Few corporations grow at above-practical rates for more than a 365 days or two. Or, as the gradual British economist and thinker John Maynard Keynes famously keep it, timber don’t grow to the sky.

That is terribly critical to undergo in suggestions now, with exuberant patrons giving great valuations to particular tech stocks. The poster child of such valuations is Nvidia

NVDA,

which no longer too prolonged in the past sported a trailing 12-month P/E of 212 (when put next to twenty for the S&P 500

SPX,

), a mark-to-book ratio of 41 (versus 4.3 for the S&P 500) and a mark-to-gross sales ratio of 39 (versus 2.5 for the S&P 500).

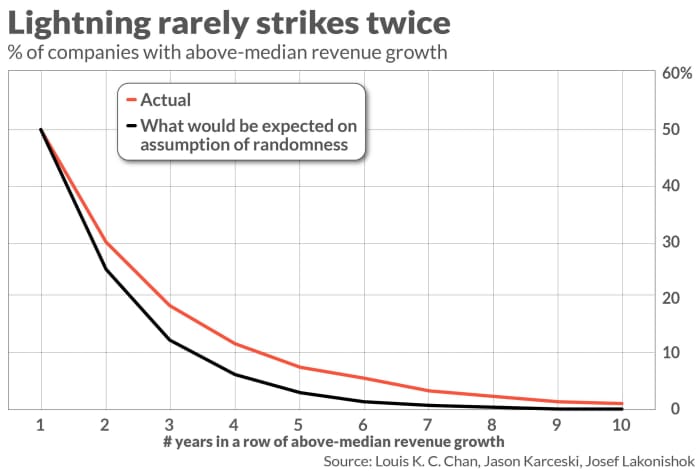

It’s impossible that Nvidia can live as a lot as the enhance assumptions embedded in these ratios. Keep in mind a seminal peek from two a few years in the past entitled “The Level and Persistence of Development Charges,” conducted by Louis Adequate. C. Chan and Josef Lakonishok of the University of Illinois at Urbana-Champaign and Jason Karceski of LSV Asset Administration. The researchers analyzed all publicly traded U.S. stocks assist to the 1950s, procuring for parents that had above-median gross sales enhance for loads of years in a row.

Their findings are summarized in the table below. The crimson line reveals the proportion of corporations with above-median gross sales enhance for the indicated preference of years in a row, while the murky line reflects what the crimson line’s form would be on the belief of pure likelihood. Detect how shut the 2 lines are to each other.

Some have tried to brush off this two-decade-mild peek, arguing that the shift to a digital economy technique that the historic knowledge are inappropriate to this day’s markets. Nonetheless that argument will not be any longer persuasive, in step with a peek from closing plunge by Verdad Be taught. The company utilized the Chan/Lakonishok/Karceski methodology to stocks’ efficiency over the 20+ years since that peek became as soon as carried out, reaching almost identical outcomes.

Nvidia’s valuation

These outcomes elevate severe doubts about enhance stocks’ elevated P/E ratios. If we peek backwards, we of course will scrutinize that enhance stocks have been rising at a quicker tempo than worth stocks. That’s why they’re enhance stocks, in spite of the entirety. Nonetheless, taking a peek forward, their elevated P/E ratios would be justified most productive if their historically lickety-split enhance rates persevered into the prolonged dart. Nonetheless that’s exactly what this compare questions.

Keep in mind the P/Es of the Forefront Development ETF

VUG,

and Forefront Designate ETF

VTV,

The original P/E of the weak ETF is more than twice that of the latter, in step with Forefront: 34.2 vs. 15.8. That reflects a extensive wager on the fragment of patrons that enhance stocks’ above-practical enhance rates will continue. This compare suggests that’s a highly awful wager.

As an example, procedure shut into consideration Nvidia. Its mark-to-gross sales ratio (PSR) is form of 10 times the 4.7 median PSR of stocks in the ICE Semiconductor Trade Index. If we heart of attention on that Nvidia’s PSR will eventually plunge to compare that of the median stock in that index, we can calculate the income enhance that’s necessary.

Let’s converse it takes 10 years for Nvidia’s PSR to plunge to that median, and that its stock over the subsequent ten years appreciates at a 10% annualized price. Each and each are beneficiant assumptions; the half of-lifetime of a firm’s above-practical PSR would possibly perchance seemingly also additionally be loads lower than 10 years, and patrons almost undoubtedly are hoping for a closer-than-10% annualized return to compensate them for the above-practical threat of proudly owning Nvidia shares. Nevertheless, to live as a lot as these beneficiant assumptions, Nvidia’s income will have to grow at a 23% annualized price for the subsequent 10 years.

You would possibly perchance perchance seemingly well also scrutinize from the chart how unlikely that’s. Undergo in suggestions, furthermore, that the low odds plotted in the chart replicate the proportion of corporations whose annual income enhance is above the median. That’s a slightly low bar; the median in step with the 2-decade-in the past peek became as soon as around 6%. That technique that, in repeat to live as a lot as its fresh valuation, Nvidia’s income enhance over the subsequent 10 years ought to be almost four times the median annual historic price. Is that how you need to always wager?

Development at what mark?

Am I being overly pessimistic? Possibly, in step with Jay Ritter, a finance professor on the University of Florida. Nonetheless no longer by loads.

In an interview, Ritter identified that even supposing the odds of sustained above-median enhance are low, they aren’t zero. And tech corporations most continuously tend to execute such enhance than non-tech corporations, since “many tech corporations have merchandise that can’t be with out considerations replicated and/or have low marginal charges. At the opposite coarse are corporations in the restaurant exchange or other industries with excessive marginal charges and no critical boundaries to entry.”

Nevertheless, Ritter added, the odds of even a excessive-tech firm residing as a lot as its excessive valuation are level-headed low. “Almost the entirety have to dawdle apt in repeat to handbook determined of disappointing patrons.”

Designate Hulbert is a fashioned contributor to MarketWatch. His Hulbert Scores tracks investment newsletters that pay a flat price to be audited. He would possibly perchance seemingly also additionally be reached at keep@hulbertratings.com

Plus: Investors are pouring money into this modified S&P 500 stock-market technique