Entrepreneurs

Things To Remember When Deciding To Invest Your Non-Retirement Funds

Published

1 year agoon

In the past three years, we saw how life could be fleeting and brittle, just like a thread. In the wink of an eye, it may break or shred when we least expect it. Indeed, life is too short to spend on our stressful nine-to-five jobs or risky businesses.

The unprecedented events that have transpired showed nothing was wrong with exploring everything the world has to offer. Leisure travel and experiences are priceless investments in ourselves.

But let’s face it. What will happen when we can’t make a living or find a secure income stream anymore? What will happen to us when we enter our golden years? As repetitive and monotonous as it may sound, we must plan for our future. We already know it for sure. Yet, we don’t know precisely how to achieve our financial investing goals.

With the current macroeconomic conditions, we must have substantial money in our retirement or investment account to ensure a comfortable retirement life down the road. It allows us to be financially secure or independent without a job or a business. Therefore, we will not have to bother our successors when the time comes.

But that is not the sole upside of retirement planning. Investing in a retirement plan or having non-retirement investments has become more vital than ever. If we do it as early as possible, we can earn more. Our retirement accounts, savings accounts, investment accounts, and brokerage accounts can promise higher income, allowing us to retire early. It will also allow us to reap the returns of our retirement and investment strategy while we still have energy.

This article will focus on building and protecting your retirement and non-retirement funds. We will provide tips to increase and diversify your non-retirement investments in your portfolio. Also, we will help you optimize your non-retirement accounts and maximize savings.

Inflation and Retirement in the US

Retirement is almost every employee’s goal. The idea of not dragging yourself out of bed when the alarm goes off is appealing. We will not have to skip breakfasts and queue up while checking our phones to catch the bus or train. Even better, we will not have to work overtime to meet endless deadlines. We will have all the time in the world to do everything we have always wanted. Travel? Reading books all day? Watching our favorite series? Spending more time with families and friends? Put up a business where we will be our own boss? No matter how old we are, we yearn for something we can’t get or do while working.

However, the current macroeconomic indicators are not on our side. Of course, I am optimistic about the improvement in the latter part of 2023. But we must deal with the potential economic slowdown in the first half.

No law prohibits anyone from retiring before they reach the age of 66 or 67. About 50% of employees aged at least 55 have retired from work in the past three years. Also, nearly one in five employees retired before the age of 65. Others aim to retire when they turn 55. but the younger generations wish to retire at 40.

Sadly, the scar of economic crises in 2004-2008 remained evident even after a decade. Many would-be retirees were forced to use their retirement savings accounts to cover household expenses. Likewise, many seniors and retirees had to live in debt. After the crisis, we learned the importance of retirement planning.

The situation has remained bland in the last year while economic forecasts were still bleak. Although unemployment is still a far cry from the labor market scenario in 2009, older adults are still wary. They don’t mind extending their working years to meet their daily expenses or increase their retirement funds. The sharp spike in inflation is one of their motivations.

In a recent study, about half of adult workers are planning to stay out of retirement. In fact, over 30% of workers in their fifties plan to postpone their retirement. Meanwhile, about 20% of workers in their sixties will work longer. With that, the average retirement age in the US is 66 vs. 62 in 2022. Although it’s the same as the legal retirement age, the increase has been noticeable. We must also note that the retirement delay rate has doubled in the last two years.

Moreover, the impact of inflation has already extended to retirement savings. Another recent study shows that 50% of workers paused their retirement savings in 2022. Over 40% stopped putting money into retirement funds like 401 (k). Even more, almost one-third of employees withdrew some of their retirement savings. The cost-of-living hike drove all these. So, it is unsurprising that 72% of the respondents have already reassessed their retirement plans. Among them, 27% reevaluated their financial goals and strategies.

But this year, we may see an improvement as inflation continues to relax. We started 2023 with inflation landing at 6.4%, a 30% drop from the 2022 peak. Indeed, the efforts of policymakers have started to pay off. Meanwhile, the Fed stays conservative as it keeps increasing interest rates. They may peak this year, but increments may slow down while inflation decreases. The impact may materialize in the second half, which can reduce the cost of living in the US. Even better, I don’t think the potential economic slowdown will lead to a deep recession. After all, inflation was more of a demand-pull than a cost-push. As demand softens and supply chain bottlenecks clear up, the market may correct itself and bounce back.

Likewise, retirees are optimistic about the economic conditions in the US. The same study shows that 57% believe the economy will be more robust this year. Also, over 60% expect an improvement in their retirement plans. Recessionary fears are still present, but pessimism is starting to waver. In the long run, macroeconomic indicators may become more stable. Adult workers may have more excess money for retirement funds and non-retirement investments.

Growing Your Funds: The Basics of Retirement vs. Non-Retirement Investments

Many people invest most of their savings and investments in individual retirement accounts. Yes, maximizing their potential in growing your retirement funds is essential. Even so, you may look at other efficient options if you have extra income to invest.

For many, maxing out their annual contribution limits on traditional IRA or Roth IRA is enough. But we must find other investments to increase our wealth. These investments, often called non-retirement investments, do not require a special investment account. You will only have to contribute after-tax dollars to these investments. Also, you can access them whenever you want, wherever you are. That is why it is crucial to seek help from a financial advisor to get the right investment advice and strategy.

Luckily, we have different non-retirement investments to choose from. It may be easier for you if you have a background in the financial market. If not, fret not, for we are here to guide you throughout your investment journey. You can find the things you need to learn in this article. But before that, we must first differentiate retirement and non-retirement investments. We will discuss their basics to help you understand better how they work. Here are the two investment choices for you.

Retirement Investment Accounts

Retirement investment accounts are qualified investments due to their qualification for beneficial tax treatments. We can make either pre-tax or after-tax contributions. Also, investment yields are tax-deferred until you make account withdrawals.

They have annual contribution limits and early withdrawal penalties before you turn 59 ½. The typical qualified accounts are 401(k)s, 403(b)s, and other employer-sponsored retirement plans. Individual retirement accounts (IRAs)s are part of qualified investments. They also have annual contribution limits and preferential tax treatment.

Employer-sponsored retirement plans are popular because most employers match employee contributions to a maximum rate. Even more important is the familiarity of older adults with these plans, so they often invest their funds there. These are easier to manage since their contributions are automatically deducted from their paycheck. As such, convenience becomes inertia in investing.

Non-Retirement Investment Accounts

Non-retirement investments allow you to invest without investing in a tax-advantaged retirement account. You can access this type of investment anytime and anywhere. You can have numerous goals when opening an account. For instance, you can invest to increase your retirement wealth or grow your extra dollars for future use. Put simply, non-retirement investment accounts are investments aside from defined benefit and retirement plans.

This investment type can be anything from the same stocks you hold in your 401(k) to purchasing properties or investing in a private or publicly-traded business. Again, the goal is to increase wealth matching your need for capital. Of course, it comes at a greater risk due to higher reward potential than just saving money for retirement.

Moreover, non-retirement investments are non-qualified accounts, meaning you invest using after-tax dollars. Unlike employer-sponsored retirement plans, one benefit of non-retirement investments is your control over them. You are free to choose whatever investments are available in the market. It also allows you to make your own investment strategy since it doesn’t have rules and limits. You can withdraw or sell it, but yields are subject to capital gains tax.

But before venturing into non-retirement investments, you must ensure financial security. You may start by determining whether you have adequate money in your retirement account. Do you have enough funds in your retirement accounts for your retirement goals? Do you have emergency funds that will last for three to six months? What are your risk tolerance and financial goals? Doing so will help you become more organized and strategic in handling, increasing, and protecting your assets.

You must also consider investment fees, especially when opening a brokerage account. You may go solo, but letting an expert do everything on your behalf will also be helpful. Also, your risk tolerance will dictate the volatility you can tolerate. Meanwhile, your time horizon will reveal your investment preference. It works hand-in-hand with risk tolerance since financial goals in the short run are suitable for less volatile investments like bonds and time deposits.

Things To Do When Investing Your Non-Retirement Funds

A lot of non-retirement investment advice includes complex formulas and strategies. But sometimes, you only need to pause and look at the bigger picture before deciding. Non-qualified or non-retirement investments promise more returns, but risks are higher. These are the essential things to remember to make your investment journey easier and more efficient.

Check retirement investment options

There are various tax-advantaged and taxable accounts for retirement investments. While you can access it in a bank and other financial intermediaries, your employers may be better. Traditional IRAs, 401(k) plans, defined benefit plans, and Roth IRAs are typical options. But know that you can only invest in the available options per account.

Maximize the advantages of retirement funds

Before investing your non-retirement funds, you must max out all your retirement funds. With the volatile economy and recession fears, it is crucial to maximizing the advantages of retirement plans like 401 (k)s. For instance, if you avail of a plan from your company, it will match your contributions at a certain limit. Basically, that’s free money in a secure and risk-free account. Also, Roth IRAs earn tax-free until you withdraw them.

Start early, earn exponentially

The early bird, indeed, catches the worm. If you start saving and investing early, you have more time to study your investment options and grow your funds. You also have better flexibility to market volatility since you are more familiar with the market trend. As such, you can cope with it through prudent portfolio diversification in technology stocks, bonds, and funds. Aside from that, there are better reasons why saving and investing early can be helpful.

- You will have more time to optimize the potential of compounding interest. You have more time to generate and reinvest investment yields in other accounts. For instance, you invest $5,000 with a compounding interest of 5% yearly. If you invest at 25 and retire at 66, the future value will be $36,959. But if you don’t invest until you’re 45, you will only have $13,930.

- You will be more disciplined, making saving and investing a lifetime habit.

- You will have more time to cope and bounce back from investment losses. With that, you can also try other investments, especially those with high risk and reward potential.

- More years to save means more money upon retirement.

- More experience in investing means expertise in various investment types. It will allow you to go solo and avoid brokerage fees.

Assess your assets and liabilities

In the world of investing, you must spend money first before you earn more money. So before you invest, you must assess your financial capacity to do so. You can start by assessing your net worth, the difference between assets and liabilities.

Your assets include cash and cash equivalents, such as cash on hand, cash in banks, and short-term investments. Other assets are in the form of real properties like houses and personal properties like jewelry. Meanwhile, liabilities include car loans, mortgages, student loans, medical expenses, and unpaid household bills.

Once you list all assets and liabilities, subtract the total liabilities from your total assets. The net value will be your net worth. Then, you can add your net worth to your retirement goals. You can check your net worth from time to time to see if it is in line with your goals. A negative net worth means you have excessive liabilities and no room for more risks. From there, you can find ways to improve your finances before starting your investment plan. Remember that liquidity is king, so you must manage your cash well to increase and protect your wealth.

Manage your emotions well

Crests and troughs are constant in the world of investing. One of the first things to learn is to manage your emotions well. Often, investors are carried away by market sentiments. Bearish views are common during market corrections, so beware.

Typically, an investor may become overconfident when investments perform well. He tends to underestimate market risks, leading to a bad investment decision. Meanwhile, an investor becomes anxious when assets are in a downtrend. He may sell investments instantly, even at a discount, leading to investment losses. Corrections are more common in the stock market. So, investors must be keen during a breakout to avoid bull or bear traps.

As such, it is crucial to avoid becoming an emotional investor. Overconfidence and anxiety may lead to wrong investment decisions. You may lose potential gains or even incur investment losses. Aside from that, you must be realistic with your investments. Observe the actual price and financial trend instead of solely relying on market sentiments. Reading expert analyses and reviews may help, but it’s more important for you or your broker to understand the investment. Also, you may rebalance or diversify your portfolio to make it suitable for whatever market condition.

Consider investment fees

More often than not, your concern revolves around returns and taxes. But exorbitant investment fees may erode the value of your investment. Transaction, brokerage, and administration fees are typical deductions from your funds. You must check them as frequently as you can since fees can offset gains. Calculate the expense ratio to know how much your investments are used for administrative and other expenses. You can divide the fund’s operating expenses by the average dollar value of assets under management (AUM).

Doing so can help you make better investment decisions. That way, you can find more affordable but earning investments. You can choose mutual funds with lower fees or brokers with more reasonable fees.

Suppose you invest $5,000 in a mutual fund with a 2% expense ratio and 5% annualized return. If you withdraw it after 20 years, the gross value will be $13,266. But with the expense ratio, leading to fees of $4,236, you will only get $9,030. But in a fund with an expense ratio of 1%, fees will only be $2,311. The net value will be $10,956. That’s a $1,936 difference.

Avail of insurance or annuities

In general, investments are good. But there’s an unspoken rule to follow when managing your assets. Again, liquidity is king, so always prioritize having enough cash reserves. Once you have enough savings and emergency funds, you may set aside a portion of your income for investments. Then, you must ensure your assets are protected. Insurance and annuities can serve as an extra mantle of financial protection. You will not have to sell your investments at a discount or deplete your savings in emergencies. Insurance will come first before your turn to your emergency funds and savings.

Speak to an expert

You may find yourself saying retirement planning or investing is not your thing. That’s inexcusable. Many financial experts are dedicated to helping you plan for your retirement and investment. Also, you can watch video tutorials or read helpful articles for free.

Non-Retirement Investments To Consider

At this point, you already know the basics of non-retirement investing. These are the investment options you can consider.

Brokerage Accounts

Brokerage accounts are probably the most typical option for non-retirement investing. These are non-qualified accounts, so funding is done with after-tax dollars. With a brokerage account, you can choose from various investment types, depending on your risk profile. These include stocks, exchange-traded funds (ETFs), bonds, and target-date funds.

Among these, stocks are the optimal option, given their high risk and reward potential. But these may require more experience since investors and brokers have to watch price trends, company financials, and market changes. You must value the stock using different price metrics when doing fundamental analysis. Doing so will help you determine if the stock price reflects the company’s intrinsic value. Meanwhile, if you prefer technical analysis, you must observe stock price changes to know when to sell or buy.

Today, it is easy to open a brokerage account. You can do it online as online brokerages become more prolific and impose lower fees. But you have to be more careful to avoid a potential scam. Also, you can find brokerages with higher brokerage fees due to their excellent customer service. Always check their fees and match them with their expertise and quality of service.

Property

Buying properties as passive income is a traditional real estate investment method. You can buy and sell properties or buy and lease them out. Yet today, more common investments, such as real estate investment trusts (REITs) and crowd-funded real estate, are available.

However, many analysts are pessimistic about the real estate performance this year. Property sales and prices are cooling down. Despite all these, I disagree with those anticipating a real estate market crash. First, commercial and residential property shortages remain high. The year started with a 4% decrease in property inventories. We can attribute it to builders becoming more cautious since the Great Recession. With the current supply and demand, price changes may remain manageable.

Educational Plan

Educational plans are another non-tax-deductible savings plan account. Funds can be invested with non-taxable earnings. Even better, withdrawals are taxable for education-related expenses, such as tuition fees and books. It will be helpful if you plan to build a family and expect your child to attend college. But remember that non-educational expense-related withdrawals are taxable with a 10% penalty.

Certificate of Deposits

Certificates of deposit (CDs) are like bonds, but banks and credit unions issue them. It is also logical to classify them as time deposits because they have a fixed term and pay periodic interest. They mature after a certain period, often within a year. Since banks often issue them, they are FDIC-insured, which pays interest. Also, like bonds, they have low risks and lower yields, unlike the other investments on the list.

Government Bonds

There are various types of bonds, but those issued by the government yield some interests with manageable risks. Municipal bonds, treasury bonds, and federal bonds are some typical options. Even better, they are more inflation-linked than corporate and mortgage-backed bonds. Note that most bonds do not perform well in a high-inflation environment. Given the nature of government bonds, they still have decent yields amidst inflation. They also have a better hedge against valuation losses. But overall, bonds have low risk and reward potential.

Learn More About Non-Retirement Investing

Having a consistent income stream is crucial for retirement planning. A passive income can help increase and protect your wealth. As such, investing your non-retirement funds can provide more returns in your retirement years. It is more essential today, given the economic volatility. But no matter how promising they can be, you must be careful and familiar with them before venturing. You must have adequate knowledge, capacity, and patience to do so. Thankfully, various types of investments suit your finances and risk preferences. There are also experts to provide all the help you need for sound investment decisions.

The post Things To Remember When Deciding To Invest Your Non-Retirement Funds appeared first on Due.

Sahil Sachdeva is the CEO of Level Up Holdings, a Personal Branding agency. He creates elite personal brands through social media growth and top tier press features.

You may like

Entrepreneurs

From Salesperson to Fashion Entrepreneur: The Journey of Satish Tiwari and Strides Sports India

Published

13 hours agoon

July 26, 2024

Satish Tiwari, based in Surat, has carved a unique niche for himself in the competitive world of fashion and sportswear. His entrepreneurial journey is a testament to hard work, smart work, and an unwavering passion for success.

Starting his career as a salesperson in a cloth store, Satish always aspired to grow beyond the confines of his initial job. His ambition and determination led him to pursue a career in modeling, where he achieved significant success by securing second place in the Mr. Gujarat Fashion Week in 2018. This achievement was a turning point, igniting his dream of starting his own clothing line.

In 2022, Satish launched Strides Sports India, a brand specializing in high-quality t-shirts and tracksuits. The brand quickly gained recognition for its exceptional products and services, particularly in the sports sector. Strides Sports India caters to various sports tournaments, including cricket, tennis, and volleyball, providing customized sportswear that meets the specific needs of athletes and teams. The brand’s commitment to quality and affordability has set it apart from competitors, making it a preferred choice for many.

Strides Sports India has also made a mark through significant sponsorships. The brand sponsored the Indian Weightlifting Championship 2024 held in Surat and Rubaru Mr. India 2023 held in Goa. These high-profile events not only showcased the brand’s capabilities but also boosted its reputation in the industry.

One of the significant milestones for Strides Sports India was preparing t-shirts for a high-profile event in Mumbai, where the chief guest was the renowned actor and philanthropist, Mr. Sonu Sood. This event further cemented the brand’s growing influence and success. Satish’s brand has grown tremendously, receiving orders from across India and even internationally. The ability to cater to a diverse clientele and deliver top-notch products has been a key factor in the brand’s success.

His vision for Strides Sports India extends beyond just making sportswear. He is keen on leveraging technology to expand his business. He plans to take his business completely online, aiming to handle more than 3000 orders per day. This move is a strategic effort to streamline operations, enhance customer experience, and scale the business to new heights.

The journey of Satish Tiwari and Strides Sports India is inspiring for aspiring entrepreneurs. Satish believes that becoming an entrepreneur does not require substantial funds or a business background. Instead, it requires hard work, smart work, and a relentless drive to achieve one’s goals. His story underscores the importance of perseverance, innovation, and adaptability in building a successful business.

Strides Sports India not only focuses on providing excellent products but also on continuous improvement. The brand stays ahead of the curve by updating its designs, printing techniques, and materials to meet the evolving demands of the market. Despite economic challenges like recessions, Strides Sports India has managed to maintain its quality and affordability, ensuring that customers get the best value for their money.

In conclusion, Satish Tiwari’s entrepreneurial journey from a salesperson to the founder of Strides Sports India is a remarkable story of passion, resilience, and success. His vision for the future, combined with his dedication to quality and customer satisfaction, positions Strides Sports India as a leading brand in the sportswear industry. Satish’s journey is a powerful reminder that with hard work and determination, anyone can achieve their entrepreneurial dreams.

Entrepreneurs

From Small-Town Dreamer to EdTech Trailblazer: The Inspiring Journey of Satyam Mishra

Published

13 hours agoon

July 26, 2024

Satyam Mishra’s entrepreneurial journey is a compelling narrative of resilience and ingenuity. His early years were marked by a deep fascination with technology. Despite the challenges of moving to Maharashtra and facing language barriers, his passion for learning never waned. His initial struggles with English and lack of internet access did not deter him; instead, they fueled his determination to master programming languages and technology.

The turning point came during the COVID-19 pandemic, when Satyam immersed himself in artificial intelligence, developing models capable of understanding and generating responses based on internet articles. This period of intense self-learning and development was a testament to his perseverance and drive. Although he faced financial constraints and operational hurdles, including supplier negotiations and regulatory challenges, Satyam remained undeterred. His first venture, Shivaay Technovation, marked his entry into the electronics market, showcasing his ability to pivot and adapt.

XpeedUp Styora Technovation Pvt. Ltd. stands as a beacon of innovation in the edtech and startup ecosystems. Founded by Satyam Mishra, this groundbreaking platform aims to bridge the gap between traditional education and practical, real-world skills. XpeedUp Styora offers a unique blend of live mentorship sessions, virtual study rooms, and practical courses in AI, finance, tech, and business, all integrated with advanced AI technologies. The company’s mission is to provide comprehensive support for students and entrepreneurs, empowering them to achieve their full potential.

XpeedUp Styora distinguishes itself through its innovative approach to education and mentorship. Unlike traditional platforms, XpeedUp Styora integrates live mentorship sessions, virtual study rooms, and AI-driven learning tools. This unique combination addresses critical gaps in mentorship, practical learning, and startup support. The platform’s focus on real-time interaction and practical application sets it apart in the edtech landscape, providing students and entrepreneurs with invaluable resources and support.

XpeedUp Styora has achieved significant milestones since its inception. The platform has successfully launched several AI-integrated courses and practical training programs, benefiting a diverse range of students and entrepreneurs. Key achievements include the introduction of live mentorship, virtual study rooms, and AI-integrated learning interfaces, the growth and success of Shivaay Technovation, including securing international clients and developing a diverse range of services, and increased subscriber count, successful project launches, and positive feedback from educational institutions and clients.

Looking ahead, XpeedUp Styora aims to expand its course offerings and enhance its platform features. Upcoming initiatives include scaling operations to reach a broader audience and introducing new educational tools and resources. The company is committed to fostering a thriving entrepreneurial ecosystem and driving national progress by empowering innovators and nurturing creativity.

Discover the transformative potential of XpeedUp Styora. Learn more about our innovative platform, explore our courses, and connect with us on social media. Join us in revolutionizing education and entrepreneurship.

Satyam Mishra’s journey from a tech enthusiast to a successful entrepreneur is a story of resilience, innovation, and dedication. His experiences—ranging from overcoming language barriers and financial challenges to pioneering new technologies and launching successful ventures—serve as an inspiration to others. Satyam’s vision for XpeedUp Styora reflects his commitment to making a meaningful impact and supporting the next generation of leaders.

Satyam Mishra’s journey is encapsulated in this inspiring quote:

“Life won’t craft my story for me. I’m the sole architect of my journey, from the struggles of the early days to building a thriving business. If I can shape my own destiny, why not strive to make it extraordinary and luxurious?”

This quote embodies the essence of Satyam’s approach to life and business—highlighting the importance of taking charge of one’s own journey and striving for excellence.

Entrepreneurs

Saket Kumar Choudhary: Acclaimed Cyber Security Expert with 20+ Certifications, including 3+ from IIT

Published

1 day agoon

July 25, 2024

Saket Kumar Choudhary, a 20-year-old cyber security prodigy from Darbhanga, Bihar, has made remarkable strides in the realm of computer science and cyber security. With an impressive portfolio that includes over 20 skills in computer science, and strong expertise in cyber security and ethical hacking tools, Saket has positioned himself as a distinguished figure in his field. He holds 12+ certifications from various prestigious organizations and has completed three IIT certification programs focused on cyber security and ethical hacking.

His accolades include the prestigious National Pride Award from the Socially Point Foundation, highlighting his significant contributions and achievements. Saket is also the founder and CEO of CYBERFACT SECURITY, an IT service provider company offering a range of services such as website development, application development, graphic design, UI/UX design, and online courses related to computer science.

Despite the absence of detailed anecdotes about his journey, Saket emphasizes the pain and challenges he faced, which have shaped his understanding and growth. His mantra, “I’m different because I don’t care about anything, just focused on my goals,” reflects his unwavering dedication and unique approach to his career. His vision for a digitally safe and strong India drives his relentless pursuit of excellence.

Through his work and achievements, Saket hopes to inspire others, even though he admits he doesn’t know how to inspire directly. His advice to others is straightforward yet profound: trust cautiously and act decisively. His journey and success story are a testament to his determination and focus, setting him apart as a leading figure in the world of cyber security and computer science.

Entrepreneurs

Teen Entrepreneur Revolutionizes Digital Marketing with AI-Powered Agency

Published

2 days agoon

July 24, 2024

Hashim Saifi, the visionary founder of Saifify, a leading 360-degree digital marketing and social media marketing agency, has achieved extraordinary success at the young age of 18. Based in New Delhi, Hashim’s entrepreneurial journey began in the small town of Iglas in Uttar Pradesh. With a passion for computer science and unwavering support from his parents, Hashim started freelancing at the age of 12, gaining valuable experience in the digital marketing field.

At just 15, Hashim launched Saifify, combining his technical skills with business insights learned from his father. Despite the challenges of limited resources and exposure in a small town, Hashim’s determination and creativity fueled his drive to succeed. He leveraged the storytelling skills inherited from his mother and the business acumen from his father to grow Saifify into a successful AI-powered digital marketing agency.

Saifify has achieved remarkable milestones, generating over Millions views, tons of likes, and hundreds of sales for various brands worldwide. The agency’s comprehensive offerings include branding, social media strategy, UI/UX design, photography, films, campaigns, graphics design, and app development. Saifify’s innovative approach and outstanding results have earned it several awards and recognition in the digital marketing industry.

The idea for Saifify was born from Hashim’s deep interest in digital marketing and the encouragement of his family. Overcoming the challenges of starting from a small town, Hashim’s father’s teachings on business and marketing, coupled with his mother’s storytelling skills, provided the foundation for his dreams. Freelancing at a young age gave Hashim firsthand experience and insight into the potential of a comprehensive digital marketing agency. His passion for helping brands grow online kept him motivated, even in the face of obstacles.

Hashim hopes to inspire others by demonstrating that age and background are not barriers to success. His journey from a small town to founding a successful digital marketing agency at 15 exemplifies the power of passion, perseverance, and family support. By leveraging his skills and constantly innovating, Hashim aims to motivate young entrepreneurs to pursue their dreams despite challenges. Through Saifify, he also demonstrates the impact of embracing technology and AI in business. Hashim’s story emphasizes the importance of learning, adapting, and staying committed to one’s goals, inspiring others to make their mark in the digital world.

Saifify’s business model revolves around providing comprehensive digital solutions that enhance clients’ online presence and drive business growth. Leveraging AI technology, the agency delivers personalized and efficient marketing strategies. The team of experts at Saifify is dedicated to maximizing digital potential, generating millions of views, likes, and sales for clients, and ensuring 100% satisfaction with every project.

A quote that embodies Saifify’s ethos is, “Innovation distinguishes between a leader and a follower.” This reflects the agency’s commitment to staying ahead in the digital marketing landscape by continuously integrating cutting-edge technologies and creative strategies. Another fitting quote is, “Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful.” This resonates with Saifify’s passion-driven approach to helping brands grow and thrive online.

What sets Saifify apart is its innovative use of AI in digital marketing and its holistic 360-degree approach. The agency integrates advanced technology to deliver personalized, efficient, and effective marketing strategies. Saifify’s commitment to client satisfaction, combined with its ability to generate substantial organic growth, distinguishes it from competitors. Furthermore, Hashim’s unique journey from a small town, leveraging storytelling and business skills from his parents, adds a distinctive touch to the brand’s story and ethos, making it relatable and inspiring to many.

One vital life lesson Hashim has learned is the power of resilience and adaptability. Challenges and setbacks are inevitable, but how one responds to them defines the path to success. Embracing a growth mindset, continuously learning, and adapting to changes are crucial for success. Additionally, the support and wisdom from family and mentors are invaluable. These elements combined can turn obstacles into opportunities, as demonstrated in Hashim’s journey from a small town to founding a successful digital marketing agency.

Looking to the future, Hashim envisions Saifify expanding into a global leader in digital marketing, continuously pushing the boundaries of innovation with AI and emerging technologies. He aims to empower small and medium-sized businesses worldwide by providing accessible and effective digital marketing solutions. Hashim aspires to inspire young entrepreneurs to pursue their passions and leverage technology to create impactful businesses. Ultimately, he envisions Saifify as a hub for creativity, technology, and excellence, driving digital transformation and growth for brands globally.

Entrepreneurs

Bestselling Author Isha Gangrade Transforms Ancient Myths into Modern Lessons in New Book

Published

3 days agoon

July 24, 2024

Isha Gangrade, an accomplished author based in Chennai, has captivated readers with her profound exploration of Indian mythology and historical fiction. Her debut book, “King Raavan: Beyond the Myths, Unveiling a Noble Legacy,” quickly rose to prominence, becoming an Amazon bestseller in all three categories it was listed under. This success marked the beginning of an inspiring literary journey.

Isha’s latest release, “10 Arrows of Wisdom: Transform Your Struggles into Strengths,” continues her tradition of weaving ancient tales with contemporary insights. Drawing on the life lessons of Karna from the Mahabharata, this book offers readers practical guidance for overcoming personal challenges and fostering resilience. The early reception has been overwhelmingly positive, with many praising its actionable wisdom and profound impact.

In addition to her literary achievements, Isha has been a featured guest speaker on the popular YouTube show “Meri Kitab Meri Kahani,” where she shared her insights and experiences with a broader audience. Her contributions to literature have not gone unnoticed; she has received several prestigious awards, highlighting her significant impact on the genre of Indian mythology and historical fiction.

Isha’s professional background as a Quality Analyst uniquely influences her writing style. This meticulous and analytical approach ensures her narratives are not only engaging but also thoroughly researched and insightful. Her academic credentials further bolster her expertise, providing a solid foundation for her storytelling.

Beyond writing, Isha is deeply committed to nurturing the literary community. She conducts writing workshops and webinars, offering guidance and mentorship to aspiring authors. Her dedication to sharing her knowledge and skills has made her a respected figure in the literary world, and her work has been featured in various media outlets and publications.

Reflecting on her journey, Isha describes it as transformative and rewarding, filled with significant milestones and personal growth. Her passion for storytelling, particularly within the realms of Indian mythology and historical fiction, has been the driving force behind her success. The creation of her brand as an author was not without challenges. Extensive research, late-night editing sessions, and moments of self-doubt were part of the process. However, her perseverance and belief in the transformative power of stories helped her overcome these obstacles.

Isha’s vision for the future is to continue exploring new narratives that inspire and empower readers. She hopes to provide insights that help individuals overcome their struggles, find purpose in their lives, and believe in the transformative power of stories. By embracing themes of resilience, redemption, and personal growth, she aims to encourage readers to tap into their inner strength and rewrite their own narratives.

Through her books, Isha offers a unique blend of ancient Indian mythology and modern self-improvement strategies. Her storytelling resonates with contemporary readers seeking practical wisdom and personal growth. Her meticulous approach, influenced by her background as a Quality Analyst, sets her apart from her peers, making her work not only engaging but also profoundly insightful.

In her own words, Isha shares a powerful life lesson: “Embrace your struggles as opportunities for growth. Every challenge you face holds a lesson, and by confronting adversity with resilience and a positive mindset, you can transform your weaknesses into strengths. Remember, it’s not the obstacles that define you, but how you overcome them. Your inner warrior is always ready to rise, so trust in your journey and use every experience to rewrite your story with courage and wisdom.”

As Isha continues to write and share her wisdom, her vision remains clear. She aims to inspire others through her powerful stories and timeless wisdom, offering modern solutions to life’s greatest obstacles. With each new book, she hopes to make a meaningful contribution to the world of literature, encouraging readers to face their challenges with courage and transform their struggles into strengths.

Entrepreneurs

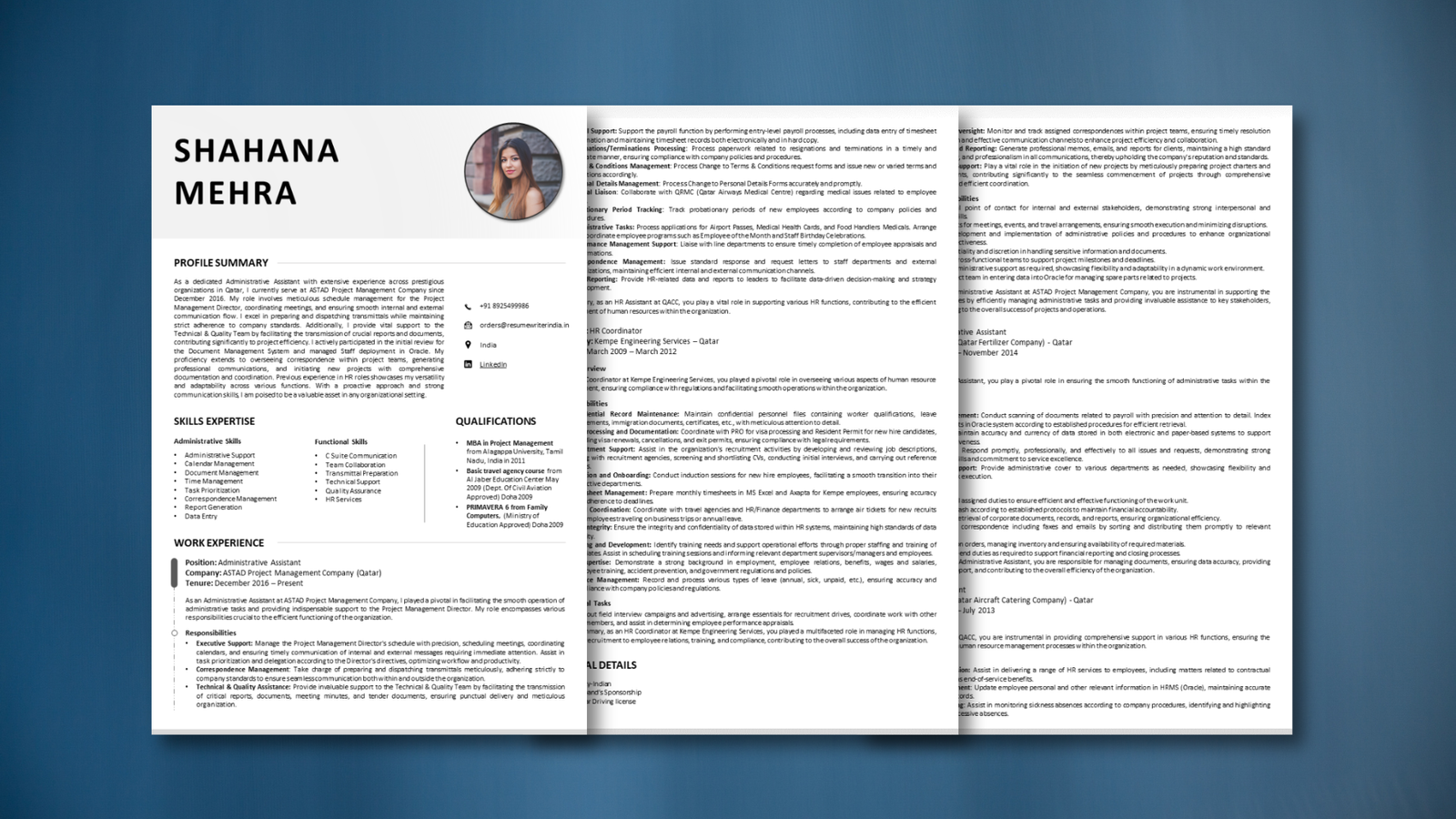

Resume Writer: Transforming Careers and Securing Your Future with a Proven Track Record in Big Four Placements

Published

3 days agoon

July 23, 2024

In today’s competitive job market, a standout resume is not just a necessity—it’s a game-changer. Leading the charge in transforming careers through expertly crafted portfolios is Resume Writer, a premium content creation brand with over 15 years of industry excellence. Founded and led by Samona Sarin, a visionary with a decade of experience in the HR industry, Resume Writer specializes in creating high-impact resumes, cover letters, and LinkedIn profiles tailored specifically for the C-suite demographic. Based in Delhi, Resume Writer has made a significant impact on the career trajectories of professionals worldwide. This article explores the remarkable growth and success of Resume Writer, highlighting its dedication to quality, client rapport, and its pivotal role in shaping career paths.

The inception of Resume Writer was born from Samona Sarin’s keen observation during her tenure as an HR Generalist. Witnessing firsthand how a resume could make or break a career, Samona recognized a significant gap in the market—many job seekers struggled to present their experiences and aspirations effectively. This realization sparked her journey from teaching to HR and ultimately to launching Resume Writer.

What began as a modest endeavor has now evolved into a leading agency with a 10x expansion over the years. Resume Writer’s success is not just a product of time but a testament to its unwavering commitment to quality and client satisfaction. A key component of this success is Resume Writer’s focus on building strong, personalized rapport with each client. By engaging in detailed consultations, the team ensures that each document reflects the unique voice and career goals of the client, making the final product resonate with hiring managers.

Resume Writer’s approach goes beyond simply creating documents; it’s about crafting business communications that speak the language of hiring managers. Understanding the nuances of what recruiters and decision-makers are looking for, Resume Writer produces resumes, cover letters, and LinkedIn profiles that effectively highlight the client’s achievements and potential in a way that is both compelling and easy to understand. This focus on clarity and relevance enhances the chances of clients making a strong impression and securing interviews.

One of Resume Writer’s most notable achievements is its impressive 93% success rate in delivering results. This track record underscores the brand’s proficiency in crafting resumes that lead to tangible career advancements. Clients of Resume Writer have landed positions in prestigious firms such as Deloitte, PwC, Ernst & Young, KPMG, Amazon, Goldman Sachs, JPMorgan Chase, IBM, Cisco, Intel, and McKinsey & Company, showcasing the effectiveness of their meticulously designed resumes.

With over 15,000 resumes written, Resume Writer’s experience spans diverse industries and career stages, from entry-level professionals to senior executives. The brand’s expertise is further highlighted by its connections with leading tech giants like Tesla, Google, Microsoft, Apple, and Facebook, reflecting its ability to craft resumes that stand out in competitive tech sectors.

Resume Writer’s dedication to quality is evident in its 100% ATS-clearing resumes, ensuring that clients’ applications are seen by human recruiters rather than being filtered out by automated systems. The brand also prides itself on offering high-quality, customized designs that enhance visual appeal while aligning with the latest trends in professional branding.

Through perseverance, a deep understanding of hiring practices, and a commitment to client success, Resume Writer has become a trusted name in the industry. Its role in helping professionals achieve their career aspirations through meticulously crafted portfolios is a testament to its excellence and dedication.

Entrepreneurs

Sunil Satyanarayan Gowda: The Creative Architect Behind GSS Animation & Multimedia LLP

Published

3 days agoon

July 23, 2024

Sunil Satyanarayan Gowda, the visionary founder and managing director of GSS Animation & Multimedia LLP, has emerged as a prominent figure in the animation and multimedia industry. Based in Ghatkopar West, Mumbai, Sunil’s journey from a small town in Karnataka to leading a successful multimedia company is nothing short of inspirational.

Sunil’s early years were marked by significant challenges. He moved to Mumbai and completed his schooling at Sakinaka Perirawadi (All India Education Society High School). After finishing his 10th grade in 2015, Sunil pursued a mechanical engineering diploma at Rajeev Polytechnic in Hassan, Karnataka. However, the first year proved to be a hurdle, and he failed. During this period, he worked as a mechanic helper at Toyota Kirloskar Garage, gaining practical experience and resilience.

Upon returning to Mumbai, Sunil assisted his father at a dosa stall while nurturing a growing interest in animation. This passion led him to enroll at Arena Animation in Ghatkopar, where his dedication and talent quickly earned him a job offer within three months. However, Sunil’s quest for knowledge and excellence drove him to pursue further education, completing his 12th grade privately and enrolling in a BA in Psychology while attending animation classes in the afternoon.

During the COVID-19 pandemic, he worked at Arihant Colour Lab, where he gained insights into the business world. This experience sparked the idea of starting his own venture, combining his skills in animation and business acumen. Thus, GSS Animation & Multimedia LLP was born, named after his initials, and standing for Global Smart Solutions LLP.

GSS Animation & Multimedia LLP offers a comprehensive suite of services, including graphic designing, video editing, wedding album designing and printing, 2D and 3D animation services, storyboarding, 3D walkthrough services, 3D rendering services, social media services, interior designing, infrastructure designing, and various multimedia solutions such as TV, social media live streaming, videography, VFX, and product shoots.

Sunil’s company has achieved remarkable success, completing over 1000 projects and earning a 4.5-star rating on Google. GSS Animation & Multimedia LLP has also been recognized with numerous awards for its outstanding animation services. Sunil’s innovative approach and dedication have positioned the company as a leading service provider in the industry.

Reflecting on his journey, he emphasizes the importance of resilience, kindness, and pursuing dreams fearlessly. His story is a testament to overcoming adversity and achieving greatness through hard work and perseverance. Sunil hopes to inspire others to follow their passions and remain focused despite challenges, believing that resilience and dedication are key to success.

Looking to the future, Sunil envisions GSS Animation & Multimedia LLP becoming the premier provider of animation and multimedia services globally, reaching new milestones with the support of his talented team. His life lessons and journey provide hope and motivation for aspiring entrepreneurs and creatives worldwide.

Entrepreneurs

Revolutionizing Urban Living: THC Pioneers a New Era in Rental Housing

Published

1 week agoon

July 16, 2024

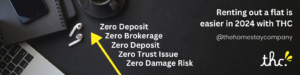

In the vibrant cities of Pune and Bangalore, a transformative force in rental housing has emerged, driven by Aditya Mahajan and his visionary venture, The Homestay Company (THC). Originating from the serene landscapes of Dharamshala in Himachal Pradesh, THC stands as a testament to Aditya’s entrepreneurial spirit and innovative drive.

Aditya’s journey to founding THC was marked by perseverance and innovation. Starting as a young entrepreneur at 17, he ventured into various businesses before finally launching THC in 2024. This venture aimed to address the complexities and financial burdens associated with urban renting.

THC distinguishes itself with a pioneering approach: zero security deposits, zero brokerage fees, zero damage risk policy, and flexible tenures. These innovations streamline the renting process, making it accessible and stress-free. From cozy Studio Apartments to luxurious Penthouse suites, THC offers a diverse range of properties, ensuring every tenant finds their ideal home.

Operating on a “Low Margins and High Volume” strategy, THC prioritizes customer satisfaction and operational efficiency. Their comprehensive online platform simplifies property search, application processes, and tenant management, setting a new standard in rental services.

With a waitlist exceeding 1000+ eager individuals, THC has quickly become a trusted name in Pune’s rental market. Their unique tenant testimonials highlight a commitment to transparency and exceptional service, cementing THC’s reputation as a customer-centric organization.

Looking forward, Aditya envisions THC expanding its presence nationwide, aiming to revolutionize the rental market in major cities like Chennai, Mumbai, Delhi, and beyond. With a focus on innovation and customer satisfaction, THC aims to redefine urban living and become India’s leading property management company

.

His journey with THC embodies resilience, innovation, and a relentless pursuit of excellence in the rental housing sector. His entrepreneurial spirit, forged through earlier ventures and honed by challenges, has culminated in THC’s success story—a testament to his vision and determination.

As THC continues to expand its footprint across India’s urban landscape, Aditya remains committed to pioneering new standards in customer experience and operational efficiency. By leveraging technology and a deep understanding of market needs, THC aims not only to meet but exceed expectations in the competitive rental market.

Looking ahead, Aditya Mahajan’s vision for THC extends beyond geographical expansion. It encompasses a future where urban dwellers experience renting as seamless and stress-free, where homes are more than mere spaces but integral parts of a vibrant, community-driven lifestyle. With each milestone, THC reaffirms its commitment to revolutionizing urban living, one innovative solution at a time.

The United Arab Emirates (UAE) has long been a beacon of innovation and growth, especially in sectors like real estate and construction. In recent years, amidst global economic shifts, these industries have not only weathered storms but have also thrived with new developments and trends shaping the market. One notable player in this dynamic landscape is Reinhardt Miller, recently featured in Gulf News, making waves with its unique approach to real estate and construction services.

Reinhardt Miller, an industry veteran with over 8 years of experience in the UAE market, Reinhardt Miller stands out for his commitment to luxury real estate solutions. Specializing in the sale of exclusive apartments and penthouses, Reinhardt Miller has carved a niche for Himself by understanding and meeting the sophisticated demands of Abu Dhabi’s discerning investors.

Miller’s journey into entrepreneurship stemmed from a clear market demand for premium real estate offerings. Despite initial challenges, including navigating economic downturns, the vision for Reinhardt Miller was driven by the goal to inspire others to maximize earnings through strategic real estate investments. “Money never sleeps,” reflects Miller’s ethos, emphasizing the potential for passive income through smart property investments.

During economic downturns, Reinhardt Miller adapted swiftly by leveraging social media and digital marketing strategies. This proactive approach not only sustained business operations but also expanded their reach, demonstrating resilience in a competitive market. Miller notes, “Innovation is key to staying ahead,” underscoring the importance of adapting to market conditions while maintaining service excellence.

Looking forward, Reinhardt Miller aims to consolidate his position as the leading agent for luxury properties in Abu Dhabi. With a focus on continuous growth and client satisfaction, Miller envisions expanding their portfolio while maintaining the highest standards of service and integrity.

As the UAE continues to evolve as a global hub for real estate and construction, Reinhardt Miller exemplify’s innovation and resilience. By focusing on luxury offerings and embracing digital strategies, they not only navigate challenges but also set new benchmarks for success in the industry.

In addition to its strategic adaptations during economic downturns, Reinhardt Miller has also capitalized on its strong network and partnerships within the UAE’s real estate ecosystem. By forging alliances with developers and investors alike, the company has not only expanded its market presence but also enhanced its ability to offer exclusive properties that cater to diverse client needs. This collaborative approach not only bolsters Reinhardt Miller’s credibility but also reinforces his reputation as a trusted advisor in luxury real estate transactions.

Moreover, Reinhardt Miller’s commitment to innovation extends beyond operational strategies to include a keen focus on sustainability and technological integration. Recognizing the growing importance of eco-friendly solutions and smart home technologies, Reinhardt Miller incorporates these elements into its property offerings, appealing to environmentally conscious investors seeking both luxury and sustainability. By staying ahead of trends and aligning with global standards, Reinhardt Miller continues to set benchmarks in the UAE’s real estate sector, paving the way for a more sustainable and technologically advanced future.

Entrepreneurs

Monica Negi: Empowering Women Entrepreneurs with Daksh Hello Travel

Published

3 weeks agoon

July 8, 2024

Monica Negi, a dynamic force in the entrepreneurial world, has emerged as a significant leader with her venture, Daksh Hello Travel. Based in the picturesque region of Uttarakhand, Monica’s story is one of resilience, determination, and the relentless pursuit of balance between personal and professional life. After marriage, she faced the formidable challenge of establishing a business while managing family responsibilities. Recognizing the difficulty many women encounter in balancing work and family life, Monica opted to start her business as a freelancer. This allowed her to maintain a harmonious balance between her personal and professional life.

Her vast experience in consultancy before marriage provided her with the necessary skills and confidence to venture into the travel industry. Monica is also an Insurance Consultant at Bajaj Allianz Life Insurance Pvt Ltd. Balancing the demands of being a housewife, a mother to a five-month-old baby, and managing client needs required immense dedication and perseverance. However, with the unwavering support of her husband, she managed to overcome these obstacles and build a successful travel company.

Monica’s entrepreneurial spirit was ignited while working from home for a travel company. This experience inspired her to start her own venture, leading to the birth of Daksh Hello Travel. Her company has garnered positive feedback from customers, earning a five-star rating for its exceptional service. Monica attributes her success to hard work, patience, and the ability to balance personal and professional life.

Throughout her journey, Monica has received numerous accolades and recognition. She was awarded by Femmetimes as the “Queen of Success’ ‘ and featured in their magazine. She was also recognized as an entrepreneur by Perfect U and featured in Perfect Woman Magazine with the title “Substance of Women ” in the top 30 future women entrepreneurs. Additionally, she received the “Emerging Business Warrior” award from the WAOW World Association of Warriors and was acknowledged by Wecare for her entrepreneurial achievements.

Monica’s vision extends beyond her business. She aims to inspire other women to embrace entrepreneurship, emphasizing that it offers freedom, wealth, and the ability to build an ideal lifestyle. She believes that every woman has the strength to succeed, and the world needs to recognize and celebrate this strength. Her advice to aspiring entrepreneurs is to never apologize for being powerful, to follow their hearts and intuition, and to keep moving forward regardless of the challenges they face.

Daksh Hello Travel operates with a focus on providing top-notch customer service. The company specializes in offering personalized travel experiences, ensuring customer satisfaction remains a top priority. Despite the challenges posed by economic fluctuations, Monica’s company has continued to thrive, thanks to its commitment to excellence and customer-centric approach.

Monica’s favorite quote, “If you can’t fly then run, if you can’t run then walk, if you can’t walk then crawl, but whatever you do you have to keep moving forward,” encapsulates her journey and philosophy. She firmly believes in the power of perseverance and hard work. Her story is a beacon of hope and inspiration for women everywhere, demonstrating that with determination and the right support, they can achieve their entrepreneurial dreams.

Looking to the future, Monica envisions Daksh Hello Travel as a leading name in the travel industry, known for its exceptional customer service and innovative travel solutions. She aims to continue inspiring and empowering women, proving that with vision and dedication, the sky is the limit.

Trending

-

Entertainment3 years ago

Entertainment3 years agoEva Savagiou Finally Breaks Her Silence About Online Bullying On TikTok

-

Entertainment2 years ago

Entertainment2 years agoTraumatone Returns With A New EP – Hereafter

-

Entertainment2 years ago

Entertainment2 years agoTop 5 Influencers Accounts To Watch In 2022

-

Fashion3 years ago

Fashion3 years agoNatalie Schramboeck – Influencing People Through A Cultural Touch

-

Fashion3 years ago

Fashion3 years agoThe Tattoo Heretic: Kirby van Beek’s Idea Of Shadow And Bone

-

Entertainment3 years ago

Entertainment3 years agoTop 12 Rising Artists To Watch In 2021

-

Entertainment3 years ago

Entertainment3 years agoMadison Morton Is Swooning The World Through Her Soul-stirring Music

-

Entertainment3 years ago

Entertainment3 years agoTop 10 Influencers To Follow This 2021

-

Entertainment3 years ago

Entertainment3 years agoBrooke Casey Inspiring People Through Her Message With Music

-

Entertainment3 years ago

Entertainment3 years agoFiery, Electric, And Tenacious. Leah Martin-Brown’s All That