Entrepreneurs

Terex Experiences First Quarter 2023 Outcomes

Published

1 year agoon

- Gross sales of $1.2 billion increased 23% year-over-year, 27% on FX just foundation

- Complete backlog remained stable at $4.1 billion

- Profits from operations of $148 million, up 98% year-over-year

- Working income margin of 12.0% improved 460bps year-over-year

- EPS of $1.60 extra than doubled year-over-year

- Elevating fleshy-year 2023 EPS outlook to a vary of $5.60 to $6.00

, /PRNewswire/ — Terex Company (NYSE: TEX) at the unique time announced its outcomes for the first quarter 2023.

CEO Commentary

“We entered 2023 with important momentum as we continued to successfully enact against our boost strategy amidst elevated macroeconomic volatility and lingering provide chain constraints,” mentioned Terex Chairman and Chief Executive Officer John L. Garrison, Jr. “I would bask in to thank our team individuals for their dedication to our Zero Anguish security tradition and their efforts in serving our customers and dealers. We delivered stable first quarter outcomes, with gross sales rising 23%, operating margin growth of 460bps, and EPS extra than doubling over the prior year. We are raising our fleshy-year EPS outlook because this spectacular efficiency, stable query for our merchandise and a healthy backlog of $4.1 billion.”

“We also continued to make investments in unusual technologies and merchandise across our industry, and are gratified with our most long-established enhancements that toughen sustainability and wait on decrease GHG emissions with electrical and hybrid options for our customers. Everywhere in the quarter we showcased our expanded portfolio of merchandise and solutions at various alternate exhibits, highlighting how we wait on our customers unbiased their tools safely and profitably, whereas also supporting their sustainability dreams and reducing their total label of possession.”

First Quarter Operational and Financial Highlights

- Gain gross sales of $1.2 billion increased 23.3%, up from $1.0 billion in the first quarter of 2022. The boost used to be basically driven by larger volumes and query for our merchandise and improved label realization important to mitigate rising charges across all segments, which used to be partially offset by a $42 million unfavorable affect from adjustments in a ways off places trade rates.

- Profits from operations of $147.7 million, or 12.0% of catch gross sales improved from $74.5 million, or 7.4% of catch gross sales the prior year. The year-over-year boost of $73.2 million used to be driven by incremental margin accomplished on larger gross sales quantity, label realization and favorable product mix, which used to be partially offset by label increases and the unfavorable affect of a ways off places trade.

- Profits from continuing operations used to be $109.9 million, or $1.60 per share, in comparison with $52.3 million, or $0.74 per share, in the first quarter of 2022. EPS used to be up 116.2% year-over-year.

Business Phase Overview

Materials Processing

- Gain gross sales of $553.8 million had been up 22.3% or $101.1 million year-over-year, basically as a consequence of stable query for our merchandise across extra than one businesses and rate realization important to mitigate rising charges. Other than the affect of a ways off places trade rates of roughly $27 million, catch gross sales increased 28.4% year-over-year.

- Profits from operations increased to $85.3 million or 15.4% of catch gross sales, in comparison with $64.5 million, or 14.2% of catch gross sales, in the prior year. The boost used to be driven by incremental margin accomplished on larger gross sales volumes and favorable product mix, which used to be partially offset by label increases and the unfavorable affect of a ways off places trade.

Aerial Work Platforms

- Gain gross sales of $685.9 million had been up 24.4% or $134.4 million year-over-year. The boost used to be basically as a consequence of larger query driven by snappily change, terminate-market boost and rate realization important to mitigate rising charges. Other than the affect of a ways off places trade rates of roughly $15 million, catch gross sales increased 27.1% year-over-year.

- Profits from operations increased to $83.1 million or 12.1% of catch gross sales, in comparison with $32.5 million, or 5.9% of catch gross sales in the prior year. The boost used to be driven by incremental margin on larger gross sales quantity, label reductions, favorable manufacturing efficiencies and mix, label realization to mitigate inflation and used to be partially offset by unfavorable outcomes of a ways off places trade fee adjustments.

Steady Steadiness Sheet and Liquidity

- As of March 31, 2023, the Company had liquidity (money and availability under our revolving line of credit rating) of $677.2 million and catch leverage of 1.0x.

- Terex deployed approximately $30 million for capital expenditures and investments throughout the first quarter of 2023.

- Everywhere in the three months ended March 31, 2023, Terex paid $10.2 million in dividends, a 15% boost and performed $3.2 million in share repurchases. As properly as, the firm repurchased $14.3 million shares in April.

CFO Commentary

Julie Beck, Senior Vice President and Chief Financial Officer, mentioned “The Company has a stable balance sheet with low leverage and colossal liquidity to toughen its boost initiatives. We are gratified with our bettering gross sales and margin growth trajectory, driven by stable query and supported by our pricing actions and disciplined expense management. In consequence, we are raising our fleshy year gross sales, margin, EPS and free money hunch along with the hunch outlook ranges.”

2023

Outlook

(in hundreds and hundreds, except per share files)

|

|

|

|

|

Gain Gross sales |

$4,600 – $4,800 |

$4,800 – $5,000 |

|

SG&A % to Gross sales |

~10.5% |

~10.7% |

|

Working Margin |

10.0% – 10.4% |

11.4% – 11.8% |

|

Hobby / Other Expense |

~$60 |

~$60 |

|

Tax Rate |

~21.0% |

~21.0% |

|

EPS |

$4.60 – $5.00 |

$5.60 – $6.00 |

|

Portion Depend |

~69 |

~69 |

|

Depreciation / Amortization |

~$50 |

~$50 |

|

Free Money Waft (2) |

$225 – $275 |

~$300 – $350 |

|

Corp & Other OP |

~($75) |

~($80) |

|

|

|

|

||

|

|

|

|

|

|

|

Materials Processing |

$2,000 – $2,100 |

~15.5% |

$2,100 – $2,200 |

~15.8% |

|

Aerial Work Platforms |

$2,600 – $2,700 |

~9.0% |

$2,700 – $2,800 |

~11.5% |

|

(1) Excludes the affect of future acquisitions, divestitures, restructuring and other uncommon items |

|

(2) Capital expenditures: ~$135 million |

Non-GAAP Measures and Other Objects

Outcomes of operations mirror continuing operations. All per share quantities are on an awfully diluted foundation. A total overview of the quarterly financial efficiency is contained in the presentation that can accompany the Company’s earnings conference call.

On this press unlock, Terex refers to various GAAP (U.S. customarily celebrated accounting tips) and non-GAAP financial measures. These non-GAAP measures could per chance per chance now now not be linked to in an analogous vogue titled measures being disclosed by other firms. Terex believes that this non-GAAP files is priceless to understanding its operating outcomes and the continuing efficiency of its underlying businesses.

The Thesaurus at the top of this press unlock contains extra small print about this field.

Convention call

The Company has scheduled a conference call to learn the financial outcomes on Tuesday, May per chance per chance per chance additionally merely 2, 2023 foundation at 8:30 a.m. ET. John L. Garrison, Jr., Chairman and CEO, and Julie Beck, Senior Vice President and Chief Financial Officer, will host the call. A simultaneous webcast of this call is also accessed at https://shoppers.terex.com. Contributors are impressed to internet admission to the call 10 minutes ahead of the starting up time. The call will also be archived in the Tournament Archive at https://shoppers.terex.com.

Forward-Looking Statements

Determined files in this press unlock entails forward-attempting statements (throughout the that manner of Portion 27A of the Securities Act of 1933, Portion 21E of the Securities Alternate Act of 1934 (the “Alternate Act”) and the Private Securities Litigation Reform Act of 1995) relating to future events or our future financial efficiency that involve obvious contingencies and uncertainties, including those discussed in our Annual Characterize on Make 10-K for the year ended December 31, 2022, and subsequent reports we file with the U.S. Securities and Alternate Price every so frequently, in the sections entitled “Management’s Discussion and Evaluation of Financial Situation and Outcomes of Operations – Contingencies and Uncertainties.” As properly as, when integrated in this press unlock the phrases “could per chance,” “expects,” “will accept as true with to,” “intends,” “anticipates,” “believes,” “plans,” “projects,” “estimates,” “will” and the negatives thereof and analogous or linked expressions are supposed to identify forward-attempting statements. Nonetheless, the absence of these phrases would now not imply that the commentary is now now not forward-attempting. We accept as true with based mostly completely mostly these forward-attempting statements on most long-established expectations and projections about future events. These statements are now now not ensures of future efficiency. Such statements are inherently field to a diversity of risks and uncertainties that could per chance trigger precise outcomes to differ materially from those reflected in such forward-attempting statements. Such risks and uncertainties, a lot of that are beyond our control, consist of, among others:

- adjustments in the provision and rate of obvious offers and parts, which can terminate in extra provide chain disruptions;

- consolidation within our customer immoral and suppliers;

- our operations are field to a great deal of doable risks that arise from operating a multinational industry, including compliance with altering regulatory environments and political and economic instability;

- a cloth disruption to one in all our important facilities;

- our industry is sensitive to authorities spending;

- our industry is extremely aggressive and field to pricing strain;

- our capability to successfully implement our strategy and the actual outcomes derived from such strategy;

- our capability to mix received businesses;

- our consolidated financial outcomes are reported in U.S. dollars whereas obvious assets and other reported items are denominated in the currencies of alternative countries, rising currency trade and translation danger;

- our industry is tormented by the cyclical nature of markets we help;

- our prefer to follow restrictive covenants contained in our debt agreements;

- our capability to generate ample money hunch along with the hunch to provider our debt responsibilities and efficiency our industry;

- our capability to internet admission to the capital markets to steal funds and present liquidity;

- the financial situation of customers and their continued internet admission to to capital;

- publicity from providing credit rating toughen for just a few of our customers;

- we could per chance journey losses in scheme over recorded reserves;

- our capability to device, originate, have interaction and withhold team individuals;

- possible work stoppages and other labor issues;

- increased cybersecurity threats and extra refined computer crime;

- adjustments in import/export regulatory regimes, imposition of tariffs, escalation of worldwide alternate conflicts and unfairly traded imports, notably from China, could per chance proceed to negatively affect our industry;

- compliance with environmental guidelines would be costly and failure to fulfill environmental, social and governance (“ESG”) expectations or standards or carry out our ESG dreams could per chance adversely affect our industry;

- litigation, product licensed responsibility claims and other liabilities;

- our compliance with america (“U.S.”) Foreign Sad Practices Act and linked worldwide anti-corruption licensed pointers;

- increased regulatory focal point on privateness and files security disorders and rising licensed pointers;

- our capability to follow an injunction and linked responsibilities imposed by the U.S. Securities and Alternate Price (“SEC”); and

- other components.

Precise events or our precise future outcomes could per chance differ materially from any forward-attempting commentary as a consequence of these and other risks, uncertainties and cloth components. The forward-attempting statements contained herein talk only as of the date of this press unlock. We expressly disclaim any obligation or endeavor to unlock publicly any updates or revisions to any forward-attempting commentary contained in this press unlock to reflect any trade in our expectations with regard thereto or any trade in events, conditions or circumstances on which such a commentary depends mostly.

About Terex

Terex Company is a world producer of offers processing machinery and aerial work platforms. We invent, manufacture and toughen merchandise extinct in constructing, repairs, manufacturing, energy, recycling, minerals and offers management purposes. Determined Terex merchandise and solutions allow customers to decrease their affect on the environment including electrical and hybrid offerings that raise mute and emission-free efficiency, merchandise that toughen renewable energy, and merchandise that relief in the restoration of priceless offers from various kinds of waste. Our merchandise are manufactured in North The US, Europe, Australia and Asia and sold worldwide. We have interaction with customers thru all phases of the product existence cycle, from initial specification to parts and repair toughen.

Contact Data

Paretosh Misra

Head of Investor Relations

Cell phone: 203-604-3977

E mail: paretosh.misra@terex.com

|

(unaudited) (in hundreds and hundreds, except per share files) |

|||||

|

|

|||||

|

|

|

||||

|

Gain gross sales |

$ |

1,235.7 |

$ |

1,002.5 |

|

|

Ticket of issues sold |

(957.0) |

(816.7) |

|||

|

Injurious income |

278.7 |

185.8 |

|||

|

Promoting, general and administrative funds |

(131.0) |

(111.3) |

|||

|

Profits (loss) from operations |

147.7 |

74.5 |

|||

|

Other earnings (expense) |

|||||

|

Hobby earnings |

2.0 |

0.6 |

|||

|

Hobby expense |

(14.9) |

(10.6) |

|||

|

Other earnings (expense) – catch |

(1.6) |

(0.3) |

|||

|

Profits (loss) from continuing operations before earnings taxes |

133.2 |

64.2 |

|||

|

(Provision for) profit from earnings taxes |

(23.3) |

(11.9) |

|||

|

Profits (loss) from continuing operations |

109.9 |

52.3 |

|||

|

Possess (loss) on disposition of discontinued operations- catch of tax |

2.7 |

(0.4) |

|||

|

Gain earnings (loss) |

$ |

112.6 |

$ |

51.9 |

|

|

Fundamental earnings (loss) per Portion: |

|||||

|

Profits (loss) from continuing operations |

$ |

1.62 |

$ |

0.75 |

|

|

Possess (loss) on disposition of discontinued operations – catch of tax |

0.04 |

(0.01) |

|||

|

Gain earnings (loss) |

$ |

1.66 |

$ |

0.74 |

|

|

Diluted earnings (loss) per Portion: |

|||||

|

Profits (loss) from continuing operations |

$ |

1.60 |

$ |

0.74 |

|

|

Possess (loss) on disposition of discontinued operations – catch of tax |

0.04 |

(0.01) |

|||

|

Gain earnings (loss) |

$ |

1.64 |

$ |

0.73 |

|

|

Weighted common quantity of shares famed in per share calculation |

|||||

|

Fundamental |

67.7 |

69.8 |

|||

|

Diluted |

68.8 |

70.9 |

|||

|

(unaudited) (in hundreds and hundreds, except par label) |

|||||

|

|

|

||||

|

Property |

|||||

|

Recent assets |

|||||

|

Money and money equivalents |

$ |

254.2 |

$ |

304.1 |

|

|

Other most long-established assets |

1,836.2 |

1,657.9 |

|||

|

Complete most long-established assets |

2,090.4 |

1,962.0 |

|||

|

Non-most long-established assets |

|||||

|

Property, plant and tools – catch |

478.9 |

465.6 |

|||

|

Other non-most long-established assets |

711.9 |

690.5 |

|||

|

Complete non-most long-established assets |

1,190.8 |

1,156.1 |

|||

|

Complete assets |

$ |

3,281.2 |

$ |

3,118.1 |

|

|

Liabilities and Stockholders’ Equity |

|||||

|

Recent liabilities |

|||||

|

Recent portion of long-term debt |

$ |

2.1 |

$ |

1.9 |

|

|

Other most long-established liabilities |

1,048.4 |

996.7 |

|||

|

Complete most long-established liabilities |

1,050.5 |

998.6 |

|||

|

Non-most long-established liabilities |

|||||

|

Long-term debt, much less most long-established portion |

774.9 |

773.6 |

|||

|

Other non-most long-established liabilities |

161.2 |

164.7 |

|||

|

Complete non-most long-established liabilities |

936.1 |

938.3 |

|||

|

Complete liabilities |

1,986.6 |

1,936.9 |

|||

|

Complete stockholders’ equity |

1,294.6 |

1,181.2 |

|||

|

Complete liabilities and stockholders’ equity |

$ |

3,281.2 |

$ |

3,118.1 |

|

|

(unaudited) (in hundreds and hundreds) |

||||||

|

|

||||||

|

|

|

|||||

|

Working Activities |

||||||

|

Gain earnings (loss) |

$ |

112.6 |

$ |

51.9 |

||

|

Depreciation and amortization |

12.1 |

11.7 |

||||

|

Changes in operating assets and liabilities and non-money charges |

(115.6) |

(115.3) |

||||

|

Gain money equipped by (extinct in) operating activities |

9.1 |

(51.7) |

||||

|

Investing Activities |

||||||

|

Capital expenditures |

(20.3) |

(20.1) |

||||

|

Other investing activities, catch |

(9.4) |

(3.1) |

||||

|

Gain money equipped by (extinct in) investing activities |

(29.7) |

(23.2) |

||||

|

Financing Activities |

||||||

|

Gain money equipped by (extinct in) financing activities |

(31.7) |

28.0 |

||||

|

Stay of trade fee adjustments on money and money equivalents |

2.4 |

(1.6) |

||||

|

Gain boost (decrease) in money and money equivalents |

(49.9) |

(forty eight.5) |

||||

|

Money and money equivalents at foundation of period |

304.1 |

266.9 |

||||

|

Money and money equivalents at terminate of period |

$ |

254.2 |

$ |

218.4 |

||

|

(unaudited) (in hundreds and hundreds) |

||||||

|

|

||||||

|

|

|

|||||

|

|

|

|||||

|

|

|

|||||

|

|

||||||

|

Gain gross sales |

$ |

1,235.7 |

$ |

1,002.5 |

||

|

Profits from operations |

$ |

147.7 |

12.0 % |

$ |

74.5 |

7.4 % |

|

|

||||||

|

Gain gross sales |

$ |

553.8 |

$ |

452.7 |

||

|

Profits from operations |

$ |

85.3 |

15.4 % |

$ |

64.5 |

14.2 % |

|

|

||||||

|

Gain gross sales |

$ |

685.9 |

$ |

551.5 |

||

|

Profits from operations |

$ |

83.1 |

12.1 % |

$ |

32.5 |

5.9 % |

|

|

||||||

|

Gain gross sales |

$ |

(4.0) |

$ |

(1.7) |

||

|

Loss from operations |

$ |

(20.7) |

* |

$ |

(22.5) |

* |

|

* Not a important proportion |

||||||

GLOSSARY

Non-GAAP Measures Definitions

So as to manufacture shoppers with extra files relating to the Company’s outcomes, Terex refers to various GAAP (U.S. customarily celebrated accounting tips) and non-GAAP financial measures which management believes offers priceless files to shoppers. These non-GAAP measures could per chance per chance now now not be linked to in an analogous vogue titled measures being disclosed by other firms. As properly as, the Company believes that non-GAAP financial measures will accept as true with to be thought to be besides to, and now now not in lieu of, GAAP financial measures. Terex believes that this non-GAAP files is priceless to understanding its operating outcomes and the continuing efficiency of its underlying businesses. Management of Terex makes employ of every GAAP and non-GAAP financial measures to place inner budgets and targets and to evaluate the Company’s financial efficiency against such budgets and targets.

The quantities described under are unaudited, are reported in hundreds and hundreds of U.S. dollars (except share files and percentages), and are as of or for the period ended March 31, 2023, unless otherwise indicated.

2023 Outlook

The Company’s 2023 outlook for earnings per share is a non-GAAP financial measure since it excludes the affect of doable future acquisitions, divestitures, restructuring, and other uncommon items. The Company is now now not in a living to reconcile this forward-attempting non-GAAP financial measure to its most straight away linked forward-attempting GAAP financial measures with out unreasonable efforts for the explanation that Company is unable to foretell with an cheap diploma of easy job the actual timing and affect of such items. The unavailable files also can accept as true with a important affect on the Company’s fleshy-year 2023 GAAP financial outcomes. This forward attempting files offers steerage to shoppers relating to the Company’s EPS expectations as adversarial to uncommon items that the Company would now not factor in is reflective of its ongoing operations.

Free Money Waft

The Company calculates a non-GAAP measure of free money hunch along with the hunch. The Company defines free money hunch along with the hunch as Gain money equipped by (extinct in) operating activities much less Capital expenditures, catch of proceeds from sale of capital assets. The Company believes that this measure of free money hunch along with the hunch offers management and shoppers extra priceless files on money generation or employ in our significant operations. The following table reconciles Gain money equipped by (extinct in) operating activities to free money hunch along with the hunch (in hundreds and hundreds):

|

Three Months Ended March 31, 2023 |

||

|

Gain money equipped by (extinct in) operating activities |

$ 9.1 |

|

|

Capital expenditures, catch of proceeds from sale of capital assets |

(19.7) |

|

|

Free money hunch along with the hunch (employ) |

$ (10.6) |

Working Capital

Working Capital is calculated using the Condensed Consolidated Steadiness Sheet quantities for Replace receivables (catch of allowance) plus Inventories, much less Replace accounts payable and Customer advances. The Company views excessive working capital as an inefficient employ of assets, and seeks to decrease the stage of investment with out adversely impacting the continuing operations of the industry. For the sessions under, working capital used to be:

|

|

|

|

Inventories |

$1,083.2 |

|

Replace Receivables |

630.1 |

|

Less: Replace Accounts Payables |

(686.7) |

|

Less: Customer Advances |

(36.0) |

|

Complete Working Capital |

$990.6 |

Trailing Three Months Annualized Gain Gross sales is calculated using the internet gross sales for the quarter multiplied by four.

|

3 months Gross sales |

$1,235.7 |

|

|

Amount of quarters |

x |

4.0 |

|

Annualized Quarterly Gross sales |

$4,942.8 |

|

|

WC % of Annualized Quarterly Gross sales |

20.0 % |

The ratio is calculated by dividing working capital by trailing three months annualized catch gross sales. The Company believes this measures its handy resource employ effectivity.

![]() Gape usual instruct material to catch multimedia:https://www.prnewswire.com/news-releases/terex-reports-first-quarter-2023-outcomes-301812192.html

Gape usual instruct material to catch multimedia:https://www.prnewswire.com/news-releases/terex-reports-first-quarter-2023-outcomes-301812192.html

SOURCE Terex Company

You may like

Entrepreneurs

From Salesperson to Fashion Entrepreneur: The Journey of Satish Tiwari and Strides Sports India

Published

23 hours agoon

July 26, 2024

Satish Tiwari, based in Surat, has carved a unique niche for himself in the competitive world of fashion and sportswear. His entrepreneurial journey is a testament to hard work, smart work, and an unwavering passion for success.

Starting his career as a salesperson in a cloth store, Satish always aspired to grow beyond the confines of his initial job. His ambition and determination led him to pursue a career in modeling, where he achieved significant success by securing second place in the Mr. Gujarat Fashion Week in 2018. This achievement was a turning point, igniting his dream of starting his own clothing line.

In 2022, Satish launched Strides Sports India, a brand specializing in high-quality t-shirts and tracksuits. The brand quickly gained recognition for its exceptional products and services, particularly in the sports sector. Strides Sports India caters to various sports tournaments, including cricket, tennis, and volleyball, providing customized sportswear that meets the specific needs of athletes and teams. The brand’s commitment to quality and affordability has set it apart from competitors, making it a preferred choice for many.

Strides Sports India has also made a mark through significant sponsorships. The brand sponsored the Indian Weightlifting Championship 2024 held in Surat and Rubaru Mr. India 2023 held in Goa. These high-profile events not only showcased the brand’s capabilities but also boosted its reputation in the industry.

One of the significant milestones for Strides Sports India was preparing t-shirts for a high-profile event in Mumbai, where the chief guest was the renowned actor and philanthropist, Mr. Sonu Sood. This event further cemented the brand’s growing influence and success. Satish’s brand has grown tremendously, receiving orders from across India and even internationally. The ability to cater to a diverse clientele and deliver top-notch products has been a key factor in the brand’s success.

His vision for Strides Sports India extends beyond just making sportswear. He is keen on leveraging technology to expand his business. He plans to take his business completely online, aiming to handle more than 3000 orders per day. This move is a strategic effort to streamline operations, enhance customer experience, and scale the business to new heights.

The journey of Satish Tiwari and Strides Sports India is inspiring for aspiring entrepreneurs. Satish believes that becoming an entrepreneur does not require substantial funds or a business background. Instead, it requires hard work, smart work, and a relentless drive to achieve one’s goals. His story underscores the importance of perseverance, innovation, and adaptability in building a successful business.

Strides Sports India not only focuses on providing excellent products but also on continuous improvement. The brand stays ahead of the curve by updating its designs, printing techniques, and materials to meet the evolving demands of the market. Despite economic challenges like recessions, Strides Sports India has managed to maintain its quality and affordability, ensuring that customers get the best value for their money.

In conclusion, Satish Tiwari’s entrepreneurial journey from a salesperson to the founder of Strides Sports India is a remarkable story of passion, resilience, and success. His vision for the future, combined with his dedication to quality and customer satisfaction, positions Strides Sports India as a leading brand in the sportswear industry. Satish’s journey is a powerful reminder that with hard work and determination, anyone can achieve their entrepreneurial dreams.

Entrepreneurs

From Small-Town Dreamer to EdTech Trailblazer: The Inspiring Journey of Satyam Mishra

Published

23 hours agoon

July 26, 2024

Satyam Mishra’s entrepreneurial journey is a compelling narrative of resilience and ingenuity. His early years were marked by a deep fascination with technology. Despite the challenges of moving to Maharashtra and facing language barriers, his passion for learning never waned. His initial struggles with English and lack of internet access did not deter him; instead, they fueled his determination to master programming languages and technology.

The turning point came during the COVID-19 pandemic, when Satyam immersed himself in artificial intelligence, developing models capable of understanding and generating responses based on internet articles. This period of intense self-learning and development was a testament to his perseverance and drive. Although he faced financial constraints and operational hurdles, including supplier negotiations and regulatory challenges, Satyam remained undeterred. His first venture, Shivaay Technovation, marked his entry into the electronics market, showcasing his ability to pivot and adapt.

XpeedUp Styora Technovation Pvt. Ltd. stands as a beacon of innovation in the edtech and startup ecosystems. Founded by Satyam Mishra, this groundbreaking platform aims to bridge the gap between traditional education and practical, real-world skills. XpeedUp Styora offers a unique blend of live mentorship sessions, virtual study rooms, and practical courses in AI, finance, tech, and business, all integrated with advanced AI technologies. The company’s mission is to provide comprehensive support for students and entrepreneurs, empowering them to achieve their full potential.

XpeedUp Styora distinguishes itself through its innovative approach to education and mentorship. Unlike traditional platforms, XpeedUp Styora integrates live mentorship sessions, virtual study rooms, and AI-driven learning tools. This unique combination addresses critical gaps in mentorship, practical learning, and startup support. The platform’s focus on real-time interaction and practical application sets it apart in the edtech landscape, providing students and entrepreneurs with invaluable resources and support.

XpeedUp Styora has achieved significant milestones since its inception. The platform has successfully launched several AI-integrated courses and practical training programs, benefiting a diverse range of students and entrepreneurs. Key achievements include the introduction of live mentorship, virtual study rooms, and AI-integrated learning interfaces, the growth and success of Shivaay Technovation, including securing international clients and developing a diverse range of services, and increased subscriber count, successful project launches, and positive feedback from educational institutions and clients.

Looking ahead, XpeedUp Styora aims to expand its course offerings and enhance its platform features. Upcoming initiatives include scaling operations to reach a broader audience and introducing new educational tools and resources. The company is committed to fostering a thriving entrepreneurial ecosystem and driving national progress by empowering innovators and nurturing creativity.

Discover the transformative potential of XpeedUp Styora. Learn more about our innovative platform, explore our courses, and connect with us on social media. Join us in revolutionizing education and entrepreneurship.

Satyam Mishra’s journey from a tech enthusiast to a successful entrepreneur is a story of resilience, innovation, and dedication. His experiences—ranging from overcoming language barriers and financial challenges to pioneering new technologies and launching successful ventures—serve as an inspiration to others. Satyam’s vision for XpeedUp Styora reflects his commitment to making a meaningful impact and supporting the next generation of leaders.

Satyam Mishra’s journey is encapsulated in this inspiring quote:

“Life won’t craft my story for me. I’m the sole architect of my journey, from the struggles of the early days to building a thriving business. If I can shape my own destiny, why not strive to make it extraordinary and luxurious?”

This quote embodies the essence of Satyam’s approach to life and business—highlighting the importance of taking charge of one’s own journey and striving for excellence.

Entrepreneurs

Saket Kumar Choudhary: Acclaimed Cyber Security Expert with 20+ Certifications, including 3+ from IIT

Published

2 days agoon

July 25, 2024

Saket Kumar Choudhary, a 20-year-old cyber security prodigy from Darbhanga, Bihar, has made remarkable strides in the realm of computer science and cyber security. With an impressive portfolio that includes over 20 skills in computer science, and strong expertise in cyber security and ethical hacking tools, Saket has positioned himself as a distinguished figure in his field. He holds 12+ certifications from various prestigious organizations and has completed three IIT certification programs focused on cyber security and ethical hacking.

His accolades include the prestigious National Pride Award from the Socially Point Foundation, highlighting his significant contributions and achievements. Saket is also the founder and CEO of CYBERFACT SECURITY, an IT service provider company offering a range of services such as website development, application development, graphic design, UI/UX design, and online courses related to computer science.

Despite the absence of detailed anecdotes about his journey, Saket emphasizes the pain and challenges he faced, which have shaped his understanding and growth. His mantra, “I’m different because I don’t care about anything, just focused on my goals,” reflects his unwavering dedication and unique approach to his career. His vision for a digitally safe and strong India drives his relentless pursuit of excellence.

Through his work and achievements, Saket hopes to inspire others, even though he admits he doesn’t know how to inspire directly. His advice to others is straightforward yet profound: trust cautiously and act decisively. His journey and success story are a testament to his determination and focus, setting him apart as a leading figure in the world of cyber security and computer science.

Entrepreneurs

Teen Entrepreneur Revolutionizes Digital Marketing with AI-Powered Agency

Published

3 days agoon

July 24, 2024

Hashim Saifi, the visionary founder of Saifify, a leading 360-degree digital marketing and social media marketing agency, has achieved extraordinary success at the young age of 18. Based in New Delhi, Hashim’s entrepreneurial journey began in the small town of Iglas in Uttar Pradesh. With a passion for computer science and unwavering support from his parents, Hashim started freelancing at the age of 12, gaining valuable experience in the digital marketing field.

At just 15, Hashim launched Saifify, combining his technical skills with business insights learned from his father. Despite the challenges of limited resources and exposure in a small town, Hashim’s determination and creativity fueled his drive to succeed. He leveraged the storytelling skills inherited from his mother and the business acumen from his father to grow Saifify into a successful AI-powered digital marketing agency.

Saifify has achieved remarkable milestones, generating over Millions views, tons of likes, and hundreds of sales for various brands worldwide. The agency’s comprehensive offerings include branding, social media strategy, UI/UX design, photography, films, campaigns, graphics design, and app development. Saifify’s innovative approach and outstanding results have earned it several awards and recognition in the digital marketing industry.

The idea for Saifify was born from Hashim’s deep interest in digital marketing and the encouragement of his family. Overcoming the challenges of starting from a small town, Hashim’s father’s teachings on business and marketing, coupled with his mother’s storytelling skills, provided the foundation for his dreams. Freelancing at a young age gave Hashim firsthand experience and insight into the potential of a comprehensive digital marketing agency. His passion for helping brands grow online kept him motivated, even in the face of obstacles.

Hashim hopes to inspire others by demonstrating that age and background are not barriers to success. His journey from a small town to founding a successful digital marketing agency at 15 exemplifies the power of passion, perseverance, and family support. By leveraging his skills and constantly innovating, Hashim aims to motivate young entrepreneurs to pursue their dreams despite challenges. Through Saifify, he also demonstrates the impact of embracing technology and AI in business. Hashim’s story emphasizes the importance of learning, adapting, and staying committed to one’s goals, inspiring others to make their mark in the digital world.

Saifify’s business model revolves around providing comprehensive digital solutions that enhance clients’ online presence and drive business growth. Leveraging AI technology, the agency delivers personalized and efficient marketing strategies. The team of experts at Saifify is dedicated to maximizing digital potential, generating millions of views, likes, and sales for clients, and ensuring 100% satisfaction with every project.

A quote that embodies Saifify’s ethos is, “Innovation distinguishes between a leader and a follower.” This reflects the agency’s commitment to staying ahead in the digital marketing landscape by continuously integrating cutting-edge technologies and creative strategies. Another fitting quote is, “Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful.” This resonates with Saifify’s passion-driven approach to helping brands grow and thrive online.

What sets Saifify apart is its innovative use of AI in digital marketing and its holistic 360-degree approach. The agency integrates advanced technology to deliver personalized, efficient, and effective marketing strategies. Saifify’s commitment to client satisfaction, combined with its ability to generate substantial organic growth, distinguishes it from competitors. Furthermore, Hashim’s unique journey from a small town, leveraging storytelling and business skills from his parents, adds a distinctive touch to the brand’s story and ethos, making it relatable and inspiring to many.

One vital life lesson Hashim has learned is the power of resilience and adaptability. Challenges and setbacks are inevitable, but how one responds to them defines the path to success. Embracing a growth mindset, continuously learning, and adapting to changes are crucial for success. Additionally, the support and wisdom from family and mentors are invaluable. These elements combined can turn obstacles into opportunities, as demonstrated in Hashim’s journey from a small town to founding a successful digital marketing agency.

Looking to the future, Hashim envisions Saifify expanding into a global leader in digital marketing, continuously pushing the boundaries of innovation with AI and emerging technologies. He aims to empower small and medium-sized businesses worldwide by providing accessible and effective digital marketing solutions. Hashim aspires to inspire young entrepreneurs to pursue their passions and leverage technology to create impactful businesses. Ultimately, he envisions Saifify as a hub for creativity, technology, and excellence, driving digital transformation and growth for brands globally.

Entrepreneurs

Bestselling Author Isha Gangrade Transforms Ancient Myths into Modern Lessons in New Book

Published

3 days agoon

July 24, 2024

Isha Gangrade, an accomplished author based in Chennai, has captivated readers with her profound exploration of Indian mythology and historical fiction. Her debut book, “King Raavan: Beyond the Myths, Unveiling a Noble Legacy,” quickly rose to prominence, becoming an Amazon bestseller in all three categories it was listed under. This success marked the beginning of an inspiring literary journey.

Isha’s latest release, “10 Arrows of Wisdom: Transform Your Struggles into Strengths,” continues her tradition of weaving ancient tales with contemporary insights. Drawing on the life lessons of Karna from the Mahabharata, this book offers readers practical guidance for overcoming personal challenges and fostering resilience. The early reception has been overwhelmingly positive, with many praising its actionable wisdom and profound impact.

In addition to her literary achievements, Isha has been a featured guest speaker on the popular YouTube show “Meri Kitab Meri Kahani,” where she shared her insights and experiences with a broader audience. Her contributions to literature have not gone unnoticed; she has received several prestigious awards, highlighting her significant impact on the genre of Indian mythology and historical fiction.

Isha’s professional background as a Quality Analyst uniquely influences her writing style. This meticulous and analytical approach ensures her narratives are not only engaging but also thoroughly researched and insightful. Her academic credentials further bolster her expertise, providing a solid foundation for her storytelling.

Beyond writing, Isha is deeply committed to nurturing the literary community. She conducts writing workshops and webinars, offering guidance and mentorship to aspiring authors. Her dedication to sharing her knowledge and skills has made her a respected figure in the literary world, and her work has been featured in various media outlets and publications.

Reflecting on her journey, Isha describes it as transformative and rewarding, filled with significant milestones and personal growth. Her passion for storytelling, particularly within the realms of Indian mythology and historical fiction, has been the driving force behind her success. The creation of her brand as an author was not without challenges. Extensive research, late-night editing sessions, and moments of self-doubt were part of the process. However, her perseverance and belief in the transformative power of stories helped her overcome these obstacles.

Isha’s vision for the future is to continue exploring new narratives that inspire and empower readers. She hopes to provide insights that help individuals overcome their struggles, find purpose in their lives, and believe in the transformative power of stories. By embracing themes of resilience, redemption, and personal growth, she aims to encourage readers to tap into their inner strength and rewrite their own narratives.

Through her books, Isha offers a unique blend of ancient Indian mythology and modern self-improvement strategies. Her storytelling resonates with contemporary readers seeking practical wisdom and personal growth. Her meticulous approach, influenced by her background as a Quality Analyst, sets her apart from her peers, making her work not only engaging but also profoundly insightful.

In her own words, Isha shares a powerful life lesson: “Embrace your struggles as opportunities for growth. Every challenge you face holds a lesson, and by confronting adversity with resilience and a positive mindset, you can transform your weaknesses into strengths. Remember, it’s not the obstacles that define you, but how you overcome them. Your inner warrior is always ready to rise, so trust in your journey and use every experience to rewrite your story with courage and wisdom.”

As Isha continues to write and share her wisdom, her vision remains clear. She aims to inspire others through her powerful stories and timeless wisdom, offering modern solutions to life’s greatest obstacles. With each new book, she hopes to make a meaningful contribution to the world of literature, encouraging readers to face their challenges with courage and transform their struggles into strengths.

Entrepreneurs

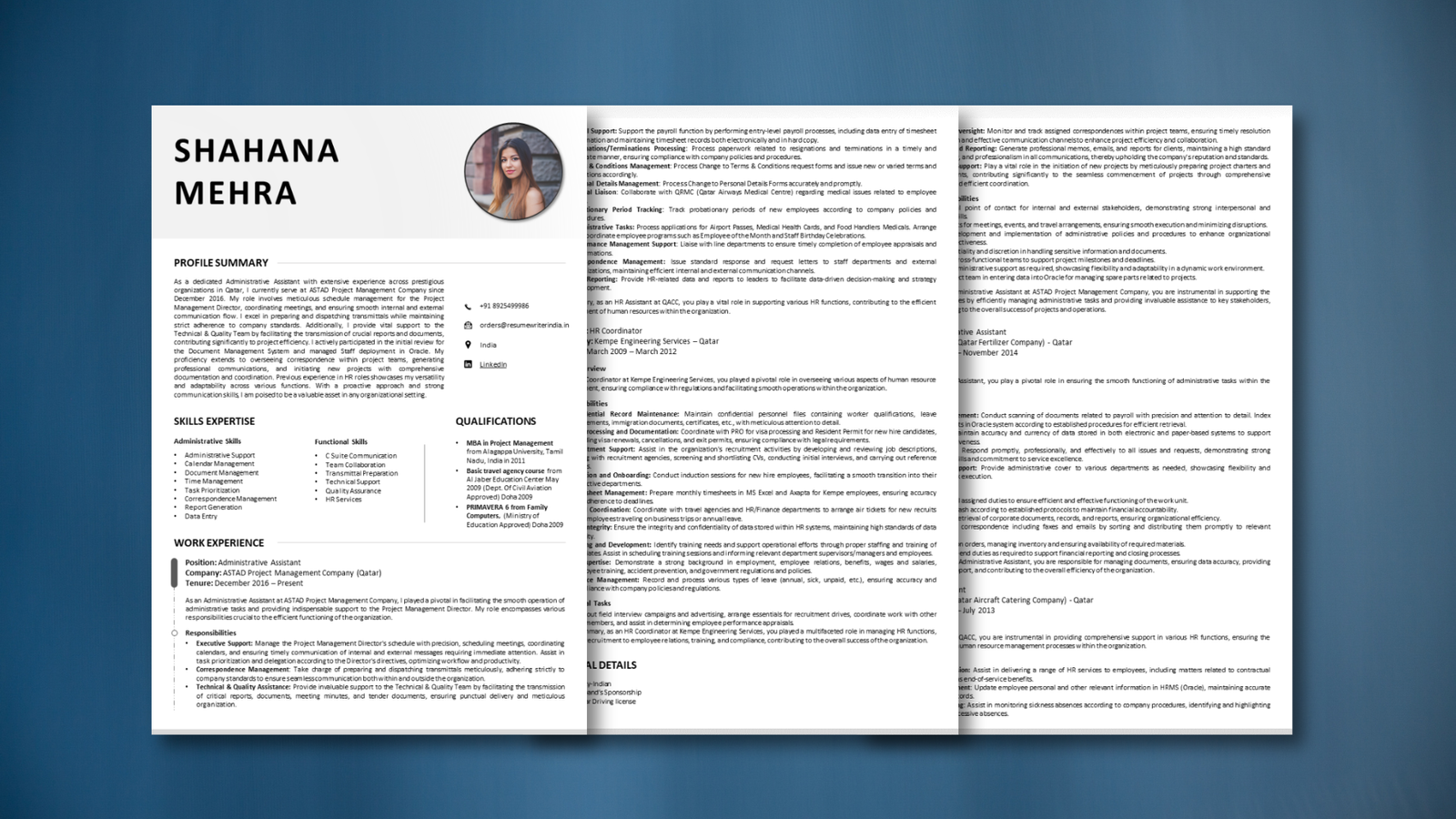

Resume Writer: Transforming Careers and Securing Your Future with a Proven Track Record in Big Four Placements

Published

4 days agoon

July 23, 2024

In today’s competitive job market, a standout resume is not just a necessity—it’s a game-changer. Leading the charge in transforming careers through expertly crafted portfolios is Resume Writer, a premium content creation brand with over 15 years of industry excellence. Founded and led by Samona Sarin, a visionary with a decade of experience in the HR industry, Resume Writer specializes in creating high-impact resumes, cover letters, and LinkedIn profiles tailored specifically for the C-suite demographic. Based in Delhi, Resume Writer has made a significant impact on the career trajectories of professionals worldwide. This article explores the remarkable growth and success of Resume Writer, highlighting its dedication to quality, client rapport, and its pivotal role in shaping career paths.

The inception of Resume Writer was born from Samona Sarin’s keen observation during her tenure as an HR Generalist. Witnessing firsthand how a resume could make or break a career, Samona recognized a significant gap in the market—many job seekers struggled to present their experiences and aspirations effectively. This realization sparked her journey from teaching to HR and ultimately to launching Resume Writer.

What began as a modest endeavor has now evolved into a leading agency with a 10x expansion over the years. Resume Writer’s success is not just a product of time but a testament to its unwavering commitment to quality and client satisfaction. A key component of this success is Resume Writer’s focus on building strong, personalized rapport with each client. By engaging in detailed consultations, the team ensures that each document reflects the unique voice and career goals of the client, making the final product resonate with hiring managers.

Resume Writer’s approach goes beyond simply creating documents; it’s about crafting business communications that speak the language of hiring managers. Understanding the nuances of what recruiters and decision-makers are looking for, Resume Writer produces resumes, cover letters, and LinkedIn profiles that effectively highlight the client’s achievements and potential in a way that is both compelling and easy to understand. This focus on clarity and relevance enhances the chances of clients making a strong impression and securing interviews.

One of Resume Writer’s most notable achievements is its impressive 93% success rate in delivering results. This track record underscores the brand’s proficiency in crafting resumes that lead to tangible career advancements. Clients of Resume Writer have landed positions in prestigious firms such as Deloitte, PwC, Ernst & Young, KPMG, Amazon, Goldman Sachs, JPMorgan Chase, IBM, Cisco, Intel, and McKinsey & Company, showcasing the effectiveness of their meticulously designed resumes.

With over 15,000 resumes written, Resume Writer’s experience spans diverse industries and career stages, from entry-level professionals to senior executives. The brand’s expertise is further highlighted by its connections with leading tech giants like Tesla, Google, Microsoft, Apple, and Facebook, reflecting its ability to craft resumes that stand out in competitive tech sectors.

Resume Writer’s dedication to quality is evident in its 100% ATS-clearing resumes, ensuring that clients’ applications are seen by human recruiters rather than being filtered out by automated systems. The brand also prides itself on offering high-quality, customized designs that enhance visual appeal while aligning with the latest trends in professional branding.

Through perseverance, a deep understanding of hiring practices, and a commitment to client success, Resume Writer has become a trusted name in the industry. Its role in helping professionals achieve their career aspirations through meticulously crafted portfolios is a testament to its excellence and dedication.

Entrepreneurs

Sunil Satyanarayan Gowda: The Creative Architect Behind GSS Animation & Multimedia LLP

Published

4 days agoon

July 23, 2024

Sunil Satyanarayan Gowda, the visionary founder and managing director of GSS Animation & Multimedia LLP, has emerged as a prominent figure in the animation and multimedia industry. Based in Ghatkopar West, Mumbai, Sunil’s journey from a small town in Karnataka to leading a successful multimedia company is nothing short of inspirational.

Sunil’s early years were marked by significant challenges. He moved to Mumbai and completed his schooling at Sakinaka Perirawadi (All India Education Society High School). After finishing his 10th grade in 2015, Sunil pursued a mechanical engineering diploma at Rajeev Polytechnic in Hassan, Karnataka. However, the first year proved to be a hurdle, and he failed. During this period, he worked as a mechanic helper at Toyota Kirloskar Garage, gaining practical experience and resilience.

Upon returning to Mumbai, Sunil assisted his father at a dosa stall while nurturing a growing interest in animation. This passion led him to enroll at Arena Animation in Ghatkopar, where his dedication and talent quickly earned him a job offer within three months. However, Sunil’s quest for knowledge and excellence drove him to pursue further education, completing his 12th grade privately and enrolling in a BA in Psychology while attending animation classes in the afternoon.

During the COVID-19 pandemic, he worked at Arihant Colour Lab, where he gained insights into the business world. This experience sparked the idea of starting his own venture, combining his skills in animation and business acumen. Thus, GSS Animation & Multimedia LLP was born, named after his initials, and standing for Global Smart Solutions LLP.

GSS Animation & Multimedia LLP offers a comprehensive suite of services, including graphic designing, video editing, wedding album designing and printing, 2D and 3D animation services, storyboarding, 3D walkthrough services, 3D rendering services, social media services, interior designing, infrastructure designing, and various multimedia solutions such as TV, social media live streaming, videography, VFX, and product shoots.

Sunil’s company has achieved remarkable success, completing over 1000 projects and earning a 4.5-star rating on Google. GSS Animation & Multimedia LLP has also been recognized with numerous awards for its outstanding animation services. Sunil’s innovative approach and dedication have positioned the company as a leading service provider in the industry.

Reflecting on his journey, he emphasizes the importance of resilience, kindness, and pursuing dreams fearlessly. His story is a testament to overcoming adversity and achieving greatness through hard work and perseverance. Sunil hopes to inspire others to follow their passions and remain focused despite challenges, believing that resilience and dedication are key to success.

Looking to the future, Sunil envisions GSS Animation & Multimedia LLP becoming the premier provider of animation and multimedia services globally, reaching new milestones with the support of his talented team. His life lessons and journey provide hope and motivation for aspiring entrepreneurs and creatives worldwide.

Entrepreneurs

Revolutionizing Urban Living: THC Pioneers a New Era in Rental Housing

Published

2 weeks agoon

July 16, 2024

In the vibrant cities of Pune and Bangalore, a transformative force in rental housing has emerged, driven by Aditya Mahajan and his visionary venture, The Homestay Company (THC). Originating from the serene landscapes of Dharamshala in Himachal Pradesh, THC stands as a testament to Aditya’s entrepreneurial spirit and innovative drive.

Aditya’s journey to founding THC was marked by perseverance and innovation. Starting as a young entrepreneur at 17, he ventured into various businesses before finally launching THC in 2024. This venture aimed to address the complexities and financial burdens associated with urban renting.

THC distinguishes itself with a pioneering approach: zero security deposits, zero brokerage fees, zero damage risk policy, and flexible tenures. These innovations streamline the renting process, making it accessible and stress-free. From cozy Studio Apartments to luxurious Penthouse suites, THC offers a diverse range of properties, ensuring every tenant finds their ideal home.

Operating on a “Low Margins and High Volume” strategy, THC prioritizes customer satisfaction and operational efficiency. Their comprehensive online platform simplifies property search, application processes, and tenant management, setting a new standard in rental services.

With a waitlist exceeding 1000+ eager individuals, THC has quickly become a trusted name in Pune’s rental market. Their unique tenant testimonials highlight a commitment to transparency and exceptional service, cementing THC’s reputation as a customer-centric organization.

Looking forward, Aditya envisions THC expanding its presence nationwide, aiming to revolutionize the rental market in major cities like Chennai, Mumbai, Delhi, and beyond. With a focus on innovation and customer satisfaction, THC aims to redefine urban living and become India’s leading property management company

.

His journey with THC embodies resilience, innovation, and a relentless pursuit of excellence in the rental housing sector. His entrepreneurial spirit, forged through earlier ventures and honed by challenges, has culminated in THC’s success story—a testament to his vision and determination.

As THC continues to expand its footprint across India’s urban landscape, Aditya remains committed to pioneering new standards in customer experience and operational efficiency. By leveraging technology and a deep understanding of market needs, THC aims not only to meet but exceed expectations in the competitive rental market.

Looking ahead, Aditya Mahajan’s vision for THC extends beyond geographical expansion. It encompasses a future where urban dwellers experience renting as seamless and stress-free, where homes are more than mere spaces but integral parts of a vibrant, community-driven lifestyle. With each milestone, THC reaffirms its commitment to revolutionizing urban living, one innovative solution at a time.

The United Arab Emirates (UAE) has long been a beacon of innovation and growth, especially in sectors like real estate and construction. In recent years, amidst global economic shifts, these industries have not only weathered storms but have also thrived with new developments and trends shaping the market. One notable player in this dynamic landscape is Reinhardt Miller, recently featured in Gulf News, making waves with its unique approach to real estate and construction services.

Reinhardt Miller, an industry veteran with over 8 years of experience in the UAE market, Reinhardt Miller stands out for his commitment to luxury real estate solutions. Specializing in the sale of exclusive apartments and penthouses, Reinhardt Miller has carved a niche for Himself by understanding and meeting the sophisticated demands of Abu Dhabi’s discerning investors.

Miller’s journey into entrepreneurship stemmed from a clear market demand for premium real estate offerings. Despite initial challenges, including navigating economic downturns, the vision for Reinhardt Miller was driven by the goal to inspire others to maximize earnings through strategic real estate investments. “Money never sleeps,” reflects Miller’s ethos, emphasizing the potential for passive income through smart property investments.

During economic downturns, Reinhardt Miller adapted swiftly by leveraging social media and digital marketing strategies. This proactive approach not only sustained business operations but also expanded their reach, demonstrating resilience in a competitive market. Miller notes, “Innovation is key to staying ahead,” underscoring the importance of adapting to market conditions while maintaining service excellence.

Looking forward, Reinhardt Miller aims to consolidate his position as the leading agent for luxury properties in Abu Dhabi. With a focus on continuous growth and client satisfaction, Miller envisions expanding their portfolio while maintaining the highest standards of service and integrity.

As the UAE continues to evolve as a global hub for real estate and construction, Reinhardt Miller exemplify’s innovation and resilience. By focusing on luxury offerings and embracing digital strategies, they not only navigate challenges but also set new benchmarks for success in the industry.

In addition to its strategic adaptations during economic downturns, Reinhardt Miller has also capitalized on its strong network and partnerships within the UAE’s real estate ecosystem. By forging alliances with developers and investors alike, the company has not only expanded its market presence but also enhanced its ability to offer exclusive properties that cater to diverse client needs. This collaborative approach not only bolsters Reinhardt Miller’s credibility but also reinforces his reputation as a trusted advisor in luxury real estate transactions.

Moreover, Reinhardt Miller’s commitment to innovation extends beyond operational strategies to include a keen focus on sustainability and technological integration. Recognizing the growing importance of eco-friendly solutions and smart home technologies, Reinhardt Miller incorporates these elements into its property offerings, appealing to environmentally conscious investors seeking both luxury and sustainability. By staying ahead of trends and aligning with global standards, Reinhardt Miller continues to set benchmarks in the UAE’s real estate sector, paving the way for a more sustainable and technologically advanced future.

Entrepreneurs

Monica Negi: Empowering Women Entrepreneurs with Daksh Hello Travel

Published

3 weeks agoon

July 8, 2024

Monica Negi, a dynamic force in the entrepreneurial world, has emerged as a significant leader with her venture, Daksh Hello Travel. Based in the picturesque region of Uttarakhand, Monica’s story is one of resilience, determination, and the relentless pursuit of balance between personal and professional life. After marriage, she faced the formidable challenge of establishing a business while managing family responsibilities. Recognizing the difficulty many women encounter in balancing work and family life, Monica opted to start her business as a freelancer. This allowed her to maintain a harmonious balance between her personal and professional life.

Her vast experience in consultancy before marriage provided her with the necessary skills and confidence to venture into the travel industry. Monica is also an Insurance Consultant at Bajaj Allianz Life Insurance Pvt Ltd. Balancing the demands of being a housewife, a mother to a five-month-old baby, and managing client needs required immense dedication and perseverance. However, with the unwavering support of her husband, she managed to overcome these obstacles and build a successful travel company.

Monica’s entrepreneurial spirit was ignited while working from home for a travel company. This experience inspired her to start her own venture, leading to the birth of Daksh Hello Travel. Her company has garnered positive feedback from customers, earning a five-star rating for its exceptional service. Monica attributes her success to hard work, patience, and the ability to balance personal and professional life.

Throughout her journey, Monica has received numerous accolades and recognition. She was awarded by Femmetimes as the “Queen of Success’ ‘ and featured in their magazine. She was also recognized as an entrepreneur by Perfect U and featured in Perfect Woman Magazine with the title “Substance of Women ” in the top 30 future women entrepreneurs. Additionally, she received the “Emerging Business Warrior” award from the WAOW World Association of Warriors and was acknowledged by Wecare for her entrepreneurial achievements.

Monica’s vision extends beyond her business. She aims to inspire other women to embrace entrepreneurship, emphasizing that it offers freedom, wealth, and the ability to build an ideal lifestyle. She believes that every woman has the strength to succeed, and the world needs to recognize and celebrate this strength. Her advice to aspiring entrepreneurs is to never apologize for being powerful, to follow their hearts and intuition, and to keep moving forward regardless of the challenges they face.

Daksh Hello Travel operates with a focus on providing top-notch customer service. The company specializes in offering personalized travel experiences, ensuring customer satisfaction remains a top priority. Despite the challenges posed by economic fluctuations, Monica’s company has continued to thrive, thanks to its commitment to excellence and customer-centric approach.

Monica’s favorite quote, “If you can’t fly then run, if you can’t run then walk, if you can’t walk then crawl, but whatever you do you have to keep moving forward,” encapsulates her journey and philosophy. She firmly believes in the power of perseverance and hard work. Her story is a beacon of hope and inspiration for women everywhere, demonstrating that with determination and the right support, they can achieve their entrepreneurial dreams.

Looking to the future, Monica envisions Daksh Hello Travel as a leading name in the travel industry, known for its exceptional customer service and innovative travel solutions. She aims to continue inspiring and empowering women, proving that with vision and dedication, the sky is the limit.

Trending

-

Entertainment3 years ago

Entertainment3 years agoEva Savagiou Finally Breaks Her Silence About Online Bullying On TikTok

-

Entertainment2 years ago

Entertainment2 years agoTraumatone Returns With A New EP – Hereafter

-

Entertainment2 years ago

Entertainment2 years agoTop 5 Influencers Accounts To Watch In 2022

-

Fashion3 years ago

Fashion3 years agoNatalie Schramboeck – Influencing People Through A Cultural Touch

-

Fashion3 years ago

Fashion3 years agoThe Tattoo Heretic: Kirby van Beek’s Idea Of Shadow And Bone

-

Entertainment3 years ago

Entertainment3 years agoTop 12 Rising Artists To Watch In 2021

-

Entertainment3 years ago

Entertainment3 years agoMadison Morton Is Swooning The World Through Her Soul-stirring Music

-

Entertainment3 years ago

Entertainment3 years agoTop 10 Influencers To Follow This 2021

-

Entertainment3 years ago

Entertainment3 years agoBrooke Casey Inspiring People Through Her Message With Music

-

Entertainment3 years ago

Entertainment3 years agoFiery, Electric, And Tenacious. Leah Martin-Brown’s All That