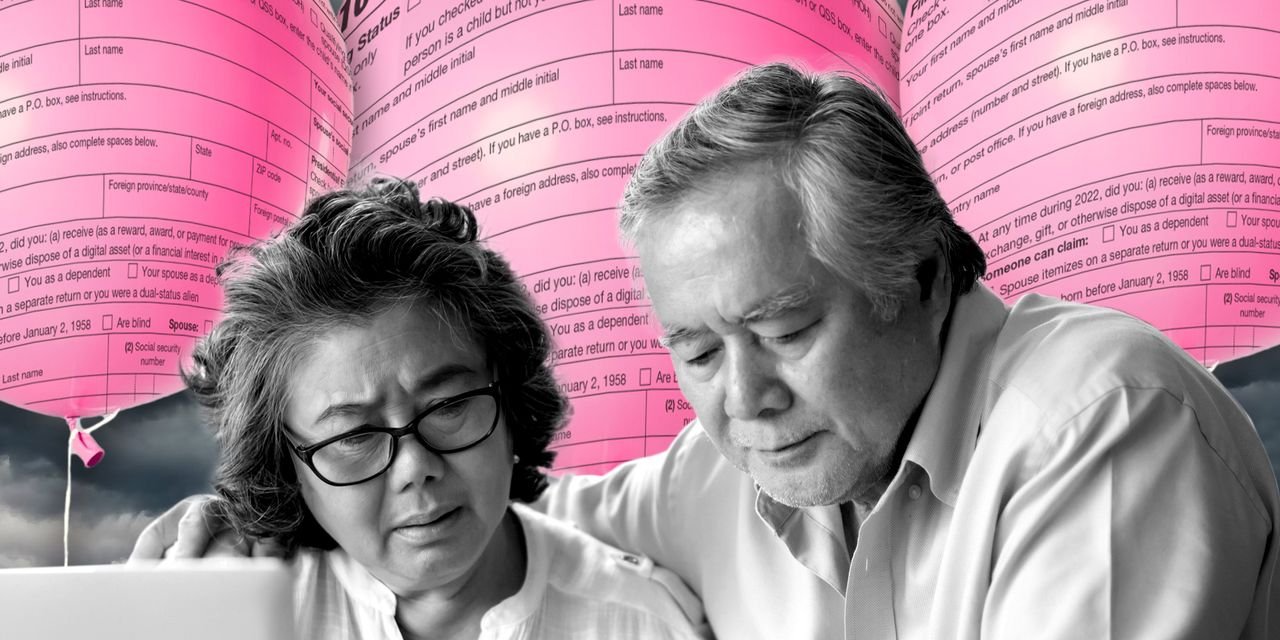

As Americans full their earnings-tax returns earlier than the April 18 submitting deadline, they are revisiting the effects of last year’s sizzling-sizzling inflation — despite the indisputable truth that they don’t know it.

When the tax code attempts to fable for rising costs, teach provisions procure pushed greater. That capabilities the long-established deduction and tax brackets, which are probably the most roughly 60 provisions the IRS updates every year for inflation. But when the tax code is tethered to teach money amounts that trail unchanged, the effects can turn into glaring over time.

Broadly speaking, the tax code does a ample job of responding to inflation, acknowledged Set Steber, senior vice president and chief tax recordsdata officer at the national tax preparer chain Jackson Hewitt. “It’s factual on the skin and it’s factual beneath the skin. But it no doubt’s now not factual for every taxpayer,” he acknowledged. It relies on an person’s financial events and on how the tax code treats these events.

Thus a long way, federal earnings-tax refunds for 2022 are averaging $2,910, which the IRS says is kind of 10% lower than last year. That’s due as a minimal in phase to the cease of pandemic-expertise boosts to obvious tax credit rating, experts maintain acknowledged.

But it no doubt’s a unfriendly time for refunds to be lower. Though inflation is inching lower, customers restful aren’t breathing straightforward, and there are restful indicators of financial stress, fancy rising credit rating-card debt and the reputation of buy now, pay later platforms for necessities fancy groceries.

Wednesday supplied the most fresh numbers on the slack retreat from four-decade high inflation charges. In March, the cost of living elevated 0.1% from February — and costs elevated 2.4% for tax preparation costs. Meanwhile, March’s year-over-year fee of inflation became 5%, down from 6% in February.

Right here’s a see at probably the most easy-to-space — and fewer straightforward-to-space — ways in which inflation is affecting tax returns.

Tax brackets

Once a year, the IRS readjusts its earnings-tax brackets to be ready to retain a long way from “bracket lunge.” If somebody’s getting paid a microscopic bit extra to retain up with inflation however the tax brackets aren’t nudged greater, that person will hit the upper tax bracket sooner with out the particular earnings to illustrate for it.

Adjusting tax-brackets for inflation goes help to the Reagan administration, when the country became emerging from a lengthy interval of inflation.

For tax year 2022, the seven brackets elevated by 3%. For tax year 2023, they maintain elevated by 7%. The IRS arrives at the bracket calculations the spend of the “chained user-heed index,” an inflation gauge that makes spend of different methodology than the regular CPI.

Gaze also: What are tax brackets for 2022 — and why enact they procure bigger over time?

It can also very smartly be laborious to detect vital changes in your tax bill in case your wages rise with inflation. If your wages don’t rise but inflation-listed brackets enact, on the assorted hand, that can also very smartly be noticeable, Steber acknowledged.

“If you happen to’re standing restful and likewise you didn’t procure any extra cash, you’re potentially going to owe less,” he acknowledged. And while minimizing taxes sounds appealing, rob demonstrate of the implication of a stagnant earnings all over a time of high costs. “You owe less tax, but are you in a more in-depth financial peril? Presumably now not,” Steber acknowledged.

The long-established deduction

The long-established deduction shall be listed for inflation the spend of the chained CPI to search out out how steep the procure bigger is every year. The long-established deduction is a widely frail approach to cleave taxable earnings, versus itemizing deductions. Roughly 90% of households last submitting season took the long-established deduction, in step with IRS recordsdata.

Retirement savings

The annual caps on 401(k) and IRA contributions also procure bigger over time. Besides to helping contributors keep for retirement, the contributions are a vogue to cleave taxable earnings. For tax year 2023, the most 401(k) contribution limit for workers beneath age 50 will seemingly be $22,500, up from $20,500 for 2022 and from the $19,500 level for 2021 and 2020. The limit for accumulate-up contributions for workers age 50 and over also elevated for 2023, to $7,500.

Inflation affects the put these contribution ranges are diagram, notorious Rita Assaf, vice president of retirement merchandise at Fidelity Investments. The amounts are instructed by a heed-of-living adjustment much like Social Security’s adjustment, Assaf acknowledged.

“Not like Social Security, contribution limits for retirement plans handiest procure bigger when the cost-of-living-adjustment is in a long way extra than a obvious quantity and subsequently [it] may maybe not trade every year,” she added.

Initiating in tax year 2024, the limit for accumulate-up IRA contributions for workers age 50 and over can even be listed for inflation, Assaf notorious. That’s attributable to provisions in SECURE 2.0, the retirement-savings regulations that Congress handed in a enormous-ranging cease-of-year bill. For now, the accumulate-up limit is $1,000. Assaf notorious, nonetheless, that the limit will “handiest procure bigger if the cost-of-living adjustment calculation is in a long way extra than $100.”

Tax provisions can enable you to mean for retirement in the face of inflation, however the vital phase is investing for the future. “A smartly-a bunch of retirement-savings portfolio may maybe abet to offset probably the most unfavorable impacts of inflation,” she notorious.

Capital positive aspects

Capital losses first offset capital positive aspects when the IRS tallies an investor’s tax bill. If losses exceed positive aspects, the taxpayer can deduct up to $3,000 and the excess losses are carried forward to future tax years. The capital-loss limitation has been at this threshold since 1978.

It’s a badly old-long-established phase of the tax code that’s a disincentive to investing, in step with U.S. Procure. Ralph Norman, a Republican from South Carolina. Closing year, he launched a bill that may maybe maybe presumably elevate the capital-loss limitation to $13,000 and index it to inflation going forward.

“Right here’s a smartly overdue, little modernization of the tax code that I imagine will maintain a enormous effect restoring investor self assurance in these unsure times,” Norman acknowledged in a observation when introducing the bill.

Any other phase of capital-positive aspects taxation also hasn’t modified: The capital-positive aspects exclusion for contributors selling their dwelling is $250,000 for single filers and $500,000 for married couples submitting collectively. It’s been that contrivance since Congress created the exclusion in 1997, in step with the Tax Foundation, a factual-leaning tax insist tank. Juxtapose that with how great home costs maintain liked in latest years — and in particular all over the pandemic.

Inflation-reduction tests

Some forms of government assistance to a household are regarded as taxable earnings. As an illustration, jobless advantages in most cases must restful be incorporated as earnings, the IRS notes.

But what referring to the array of tests that states despatched to residents in 2022 with the procedure of helping duvet growing day to day costs? Attributable to the contrivance in which that 17 of 21 states’ payments were structured, recipients in these states — California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island — didn’t have to chronicle the money on their return, the IRS acknowledged in early February. The equal goes for Alaska’s extra fee tied to vitality costs.

Most contributors in Georgia, Massachusetts, South Carolina and Virginia also don’t have to embody the payments on their returns, experts acknowledged. Without getting deep into the tax technicals, contributors in these states don’t have to embody the payments if they took the long-established deduction — which the gigantic majority of contributors enact.

The IRS made that announcement one week after telling tax filers to rapid abet off on submitting their returns while the agency sure the tax medication of the payments — a trail that triggered some criticism that the IRS must restful maintain resolved the topic earlier than submitting season.

For early filers who reported the explain payments on returns submitted earlier to the Feb. 10 announcement, the IRS now not too lengthy in the past instructed them to rob demonstrate of submitting an amended return.

Entertainment3 years ago

Entertainment3 years ago

Entertainment2 years ago

Entertainment2 years ago

Entertainment2 years ago

Entertainment2 years ago

Fashion3 years ago

Fashion3 years ago

Fashion3 years ago

Fashion3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago

Entertainment3 years ago