Business

New York Community Bancorp: From Crisis Winner to Current Setback

Published

6 months agoon

When New York Community Bancorp pounced to seize the majority of the failing Signature Bank’s assets and surged to over $100 billion in assets less than a year ago, it appeared to be among the major winners of a crisis among its peers.

The bank, which has 420 branches, announced a $252 million loss in its most recent quarter, cut its dividend, and set aside a sizable amount of reserves to cover any future losses. These actions came at a cost to the bank on Wednesday. Its stock fell 38% to a 25-year low, causing the average share price of other regional banks to fall by 6%.

Although the bank is now significantly larger than it was prior to the Signature acquisition, New York Community Bancorp attempted to put on a brave front with the news by titling the accompanying statement “Record Results for 2023.” However, analysts and investors swiftly pointed out the bank’s shortcomings.

It was a jarring reminder of the turmoil that occurred in March of last year, when issues at Silicon Valley Bank spread throughout the sector and brought down banks like Signature, which was well-known for lending bitcoin, real estate, and legal services. From federal receivership, New York Community Bancorp purchased a large portion of Signature

While some of New York Community Bancorp’s issues are directly related to its acquisition of Signature, others are the result of its own actions. Executives at the bank announced that, in part due to a deteriorating investment climate for office space, they would need to set aside additional funds to cover losses on loans in the commercial real estate sector. There was “no real property activity happening right now,” according to one executive.

When contacted for comment, the bank remained silent.

During the bank’s routinely scheduled call to assess earnings, analysts grilled the officials, and the questioning became especially pointed. J.P. Morgan’s Steven Alexopoulos questioned why the bank would not provide additional information regarding the impact on its potential future profitability.

Give us the number, please. Alexopoulos enquired. “This is a 25-year low for your stock. I doubt that you’re content with this. “I don’t understand why you wouldn’t use this chance to level-set expectations,” he continued.

Executives often refrained from providing details, attributing their problems to rules requiring banks with assets above $100 billion to maintain a higher level of reserves than smaller lenders, such as New York Community Bancorp. Thomas R. Cangemi, president of the bank, stated, “There’s no question that this was a difficult decision as a firm, but clearly necessary,” in reference to the dividend reduction.

There is a key distinction between the crisis of the previous year and the current one affecting New York Community Bancorp: Deposits at the bank seem to remain steady overall. In the fourth quarter, deposits decreased by 2% to $81.4 billion

Sahil Sachdeva is the CEO of Level Up Holdings, a Personal Branding agency. He creates elite personal brands through social media growth and top tier press features.

You may like

Business

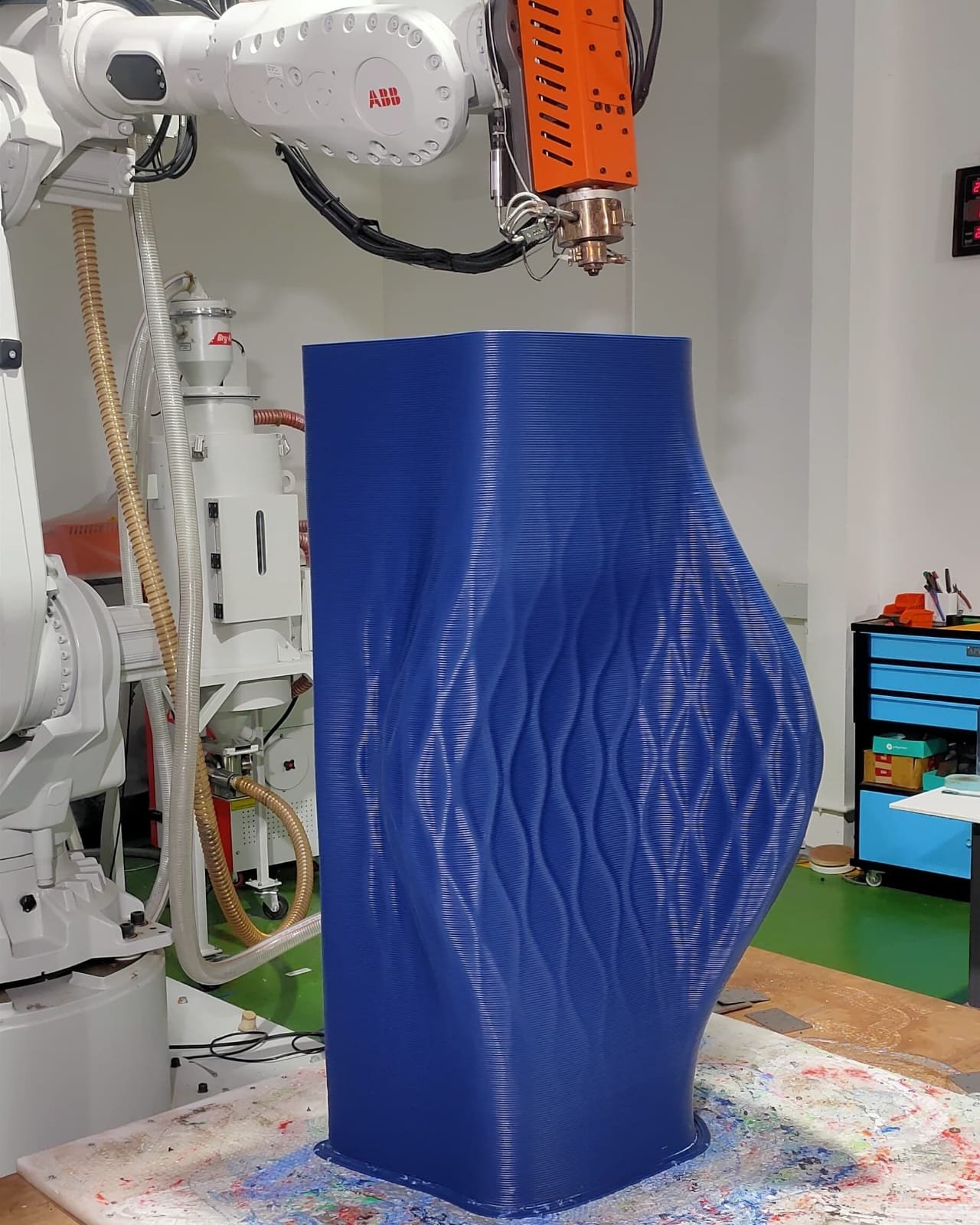

Architect Transforms Plastic Waste into Stunning Creations with Robotic 3D Printing

Published

16 hours agoon

July 26, 2024

In the vibrant city of Hyderabad, Shridhar Mamidalaa is redefining the architectural landscape with his innovative use of algorithms and advanced technology. As a modern architect with a background as a traditional artist and a degree in architecture, Shridhar’s journey has been marked by a relentless pursuit of creativity and sustainability.

His fascination with computational design began over a decade ago, driven by a desire to transcend conventional architectural practices. Faced with limited resources, he embraced the challenges of this emerging field with enthusiasm and determination. His vision was clear: to create world-class, stylish designs that are also environmentally responsible.

Under Shridhar’s leadership, his firm has achieved several significant milestones in sustainable architecture. They designed and implemented India’s first complete 3D printed interiors, setting a new benchmark in the industry. They also introduced a series of 3D printed furniture, blending cutting-edge technology with practical, elegant design. By the end of the year, Shridhar plans to unveil India’s first 3D-printed pavilion, a testament to his commitment to pushing the boundaries of architectural innovation.

The path to success was not without its hurdles. One of the primary challenges was the misconception surrounding sustainability. Many were skeptical about the feasibility of creating stylish, high-quality products while being eco-friendly. To overcome this, Shridhar’s team began with small prototypes to build trust and demonstrate their commitment to green design. This iterative approach has allowed them to scale their projects in both size and complexity.

Shridhar’s journey from lacking even a computer to becoming a leader in computational design serves as a powerful inspiration. He encourages others to take one step at a time and persist through the initial challenges of their careers. His motto, “Sustainability has never been so stylish,” reflects his dedication to merging environmental responsibility with high-quality design.

Shridhar’s firm specializes in large-scale robotic 3D printing and Fused Granular Fabrication (FGF) technology. Utilizing 80% recycled plastic and incorporating waste materials like coffee grounds and grain bran, they are advancing the use of sustainable materials in architecture. This approach not only minimizes waste but also avoids the exploitation of natural resources.

The recent economic recession provided Shridhar and his team with an opportunity to reflect and innovate. Rather than being deterred, they used this time to strategize and expand their global reach, positioning themselves as problem-solvers through their sustainable products.

His vision for the future is to continue enhancing the sustainability of his projects and to spread awareness about true environmental responsibility. He aims to reach a broader audience and inspire more people to embrace sustainable practices.

Shridhar’s journey imparts a valuable lesson: perseverance is key. Many give up too soon, but staying committed and continuing to push boundaries can lead to extraordinary outcomes.

As Shridhar Mamidalaa continues to break new ground in the field of architecture, his work stands as a testament to the power of combining passion with innovation. His achievements not only push the limits of what is possible but also pave the way for a more sustainable future in design.

Hymns Wear, a newly launched fashion brand in India, is starting to gain attention in the fast fashion landscape with its debut collection. This brand is more than just clothing; it’s a statement of style, confidence, and individuality.

Commitment to Style and Confidence

At the heart of Hymns Wear’s philosophy is a commitment to creating chic, contemporary styles designed to empower and in-still confidence in its wearers. The brand ethos is not about merely following trends but redefining them. This ensures that every piece resonates with the individuality and flair of the fashion-forward community, making the wearer feel unique and stylish.

Diverse and Trendsetting Collections

Hymns Wear offers a diverse collection that caters to various styles, ensuring that there is something for everyone. Each piece is designed to make a statement, showcasing the unique vibe of the wearer. The collections feature eye-catching graphics and phrases that stand out, emphasizing personal style over mere aesthetics.

This focus on bold and trendsetting designs helps wearers express their individuality confidently.

Quality and Craftsmanship

The brand’s dedication to quality is evident in the technical details and fabric choices of their t-shirts. Hymns Wear prides itself on using high-grade materials that elevate both the look and feel of the apparel. Comfort is a priority, reflected in the softness of the fabric against the skin and the ease of movement. The design features, such as the oversized fit, are not only a nod to contemporary fashion trends but also add an extra layer of comfort for the wearer.

Exclusive Offers and Limited Editions

To keep the shopping experience exciting, Hymns Wear frequently releases limited edition t-shirts and special deals. For instance, their current promotion offers a free Hymns Original T-shirt with the purchase of any two tees. These exclusive offers add an element of fun and anticipation, encouraging customers to return. The brand’s strategy of dropping limited editions and sweet deals ensures that there is always something new and exciting for customers.

Future Collections and Innovations

Looking ahead, Hymns Wear continues to push the boundaries of fast fashion with an exciting array of upcoming t-shirt editions and color variants. Each new release is thoughtfully crafted with the same attention to fabric quality and design detail that Hymns Wear is known for. Upcoming collections promise unique features, from the softness of the fabric to the intricacy of the prints, catering to every palette and personality. Whether it’s the nuanced shades of the ‘Serenity’ range or the vibrant tones of the ‘Young Spirit’ collection, there’s something for everyone.

Expanding Beyond T-Shirts

Hymns Wear is not stopping with oversized t-shirts. The brand is set to expand its offerings to include a wide range of Western and Indian streetwear. This extension will maintain the same commitment to quality and affordability, ensuring that every piece meets the high standards that customers have come to expect from Hymns Wear. By broadening their product range, Hymns Wear aims to cater to even more fashion enthusiasts, providing them with stylish options for every occasion.

Fashion Education and Community Engagement

In addition to expanding their product line, Hymns Wear is dedicated to educating their customers about fashion. The brand plans to launch a series of blogs covering various fashion topics, from style tips to the latest trends. This initiative aims to empower customers with knowledge, helping them make more informed fashion choices. By engaging with their community through educational content, Hymns Wear strengthens its connection with customers and fosters a deeper appreciation for fashion.

Affordable Fashion with Value

Hymns Wear ensures that their trendy fashion pieces are accessible to all without compromising on quality. The pricing details of their upcoming editions are carefully considered to ensure affordability. Special promotions and early launch offers are part of the brand’s commitment to their customers, making trendy fashion accessible and enjoyable. By maintaining a balance between affordability and high quality, Hymns Wear offers exceptional value to its customers.

Wardrobe Showcase

Hymns Wear focuses on showcasing their products through images and videos to enhance the online shopping experience for customers. They provide a variety of high-quality visuals for each t-shirt design, allowing customers to see the details and quality of the products. The collections are displayed with detailed images and meaningful phrases that reflect the brand’s values of confidence and sophistication. By

showing the t-shirts on models, customers can see how the garments look in real-life situations, helping them visualize how they would look and feel wearing the pieces.

Customer-Centric Approach

Hymns Wear’s approach to fashion is deeply customer-centric. The brand listens to its customers, understanding their needs and preferences. This feedback loop allows Hymns Wear to continually improve and innovate, ensuring that their offerings remain relevant and appealing. By staying attuned to customer desires, the brand can deliver products that truly resonate with their audience.

Conclusion

Hymns Wear is poised to make a significant impact in the fashion world with its blend of comfort, style, and affordability. As the brand redefines fast fashion, it invites fashion enthusiasts to explore its offerings and express their unique styles. Whether you’re looking for a bold statement piece or a chic everyday look, Hymns Wear provides fashionable solutions for everyone.

Ready to redefine your style? Don’t miss out on their limited edition tees and special deals. Visit Hymns Wear now to unleash your unique fashion statement. Are you ready to shop from Hymns Wear? Go visit now!

Business

Global Leaders Respond: Impact of Biden’s Withdrawal from 2024 US Presidential Race

Published

4 days agoon

July 22, 2024

Global leaders praised President Biden for exiting the 2024 race and backing Kamala Harris. This decision followed Biden’s troubled debate and amid global support for Donald Trump after an assassination attempt. Allies lauded Biden’s leadership, calling his exit a pivotal moment in US politics.

World leaders reacted with gratitude and respect to President Biden’s announcement of his withdrawal from the 2024 presidential race and endorsement of Vice President Kamala Harris. British Prime Minister Keir Starmer, who recently met with Biden in Washington, praised his decision-making rooted in the American people’s best interests. Canadian Prime Minister Justin Trudeau expressed appreciation for Biden’s friendship and commitment to bilateral relations. Australian Prime Minister Anthony Albanese commended Biden for prioritizing national interests over personal ambition. New Zealand Prime Minister Christopher Luxon recognized Biden’s extensive public service and dedication to leadership. Ukrainian President Volodymyr Zelensky thanked Biden for steadfast support during Ukraine’s conflict with Russia, noting Biden’s decisive actions amid international challenges. Collectively, these leaders acknowledged Biden’s legacy of service and leadership, emphasizing his role in fostering global partnerships and stability. Biden’s decision was seen as a testament to his statesmanship and dedication to the welfare of the United States and its allies worldwide.

In Israel, President Isaac Herzog praised Biden as a staunch ally of the Jewish people, while Defense Minister Yoav Gallant highlighted Biden’s crucial support during recent conflicts, posted on X. Biden has strongly supported Israel during the Gaza conflict since Hamas’ attacks on October 7. However, disagreements over humanitarian aid and civilian casualties have strained his relationship with Israeli Prime Minister Benjamin Netanyahu, who has not yet commented on Biden’s decision to withdraw from the race. Irish Taoiseach Simon Harris described Biden as deeply connected to his Irish heritage and thanked him for his global leadership and friendship. Other leaders acknowledged the difficulty of Biden’s decision to step back from the presidential race.

German Chancellor Olaf Scholz praised Joe Biden’s accomplishments for the US, Europe, and the world, respecting his decision not to seek re-election. Venezuelan President Nicolas Maduro supported Biden’s choice, emphasizing family and health. Polish Prime Minister Donald Tusk credited Biden for tough decisions benefiting global security and democracy. Leaders in South Korea and Japan refrained from US domestic politics commentary, highlighting continued collaboration with the White House. Japanese Prime Minister Fumio Kishida stressed the vital Japan-US alliance. South Korean President Yoon Suk Yeol pledged ongoing partnership with the US. Philippine President Ferdinand “Bongbong” Marcos JR appreciated Biden’s statesmanship and support during challenging times in Philippine-China relations.

Chinese Social Media Reacts to Biden’s Exit from 2024 Race

As of Monday morning, there was no official response from Chinese leader Xi Jinping. However, on Weibo, China’s social platform similar to X, “Biden dropping out of the election” trended as the top topic, amassing over 400 million views across related discussions on Kamala Harris and Trump’s recent assassination attempt.

Some users on Weibo speculated enthusiastically about the possibility of a female US president, while others predicted Trump’s victory regardless of the Democratic nominee. One user commented, “The assassination attempt was a good deal for Trump!” while another remarked humorously, “That one shot didn’t kill Trump but dropped Biden instead.” Overall, opinions on US politics among Chinese users varied, with some describing the situation as chaotic.

Business

Filling the Gap: How Dr. Aaditya Patakrao Went from Son of a Bus Driver to Forbes Featured Dentist

Published

1 week agoon

July 19, 2024

Dr. Aaditya Patakrao, a distinguished World Book of Records holder and the visionary owner of Dr. Aaditya’s Advance Dental Hospital, exemplifies the epitome of determination and excellence in the field of dentistry. Born in the modest village of Ambajogai in Beed, Maharashtra his father was bus driver. Dr. Patakrao’s journey from a small-town boy to a renowned dental expert in Pune is nothing short of inspirational. He completed his schooling in Ambajogai and went on to earn a Bachelor of Dental Surgery (BDS) degree from the Government Dental College and Hospital in Aurangabad. Despite facing numerous obstacles, his unwavering determination to excel in the medical field and contribute to India’s healthcare system remained steadfast.

Dr. Patakrao’s early life was marked by significant challenges. Growing up in Marathwada, an area known for its socio-economic difficulties, he faced the harsh realities of pursuing education under strenuous conditions. Despite these adversities, he emerged victorious in the medical entrance examination in 2004, securing top grades. This success was not just a personal victory but a testament to his resilience and dedication. While still a student, his sense of social responsibility led him to co-found nonprofit organizations with his siblings. Manav Parivartan and Vikas Bahuuddeshiya Sevabhavi Sanstha and the Dr. Aaditya Patakrao Youth Foundation have since become beacons of hope, providing essential nutrition and healthcare to underprivileged communities.

After earning his BDS degree, Dr. Patakrao established Dr. Aaditya’s Advance Dental Hospital in Navi Sangvi, Pune. This international-level facility aims to provide top-notch dental care to its patients, equipped with the latest technology and innovations in dentistry. The hospital’s advanced capabilities are a direct result of Dr. Patakrao’s active participation in numerous international dental conferences held in countries like Germany, Israel, the USA, Switzerland, the UK, and Italy. His relentless pursuit of knowledge and his commitment to staying abreast of the latest advancements in dentistry have made him a respected and influential figure in these global forums. Furthermore, Dr. Patakrao enhanced his dental expertise by completing an Implantology course in Boston, USA, further solidifying his reputation as a leading dental professional.

However, the path to success was not devoid of hurdles. The initial days of establishing his dental hospital were fraught with financial challenges. Dr. Patakrao’s determination to build a world-class facility saw him knocking on the doors of numerous financial institutions, only to face repeated rejections. Yet, his resolve never wavered. His perseverance and commitment eventually bore fruit, and today, he is recognized as the highest tax-paying doctor in the dental category, a record acknowledged by the Golden Book of Records by the London Book of Records. Starting with a modest 300 sq. ft rented space, Dr. Patakrao now directs a sprawling 22,000 sq. ft hospital, representing an investment worth Rs 12 crore.

Dr. Patakrao’s contributions to the field of dentistry and patient care have been honored with numerous national and international awards. These accolades include the National Dental Excellence Award (2015, 2017), Pune Professional Icon Award (2016), Indian Dental Awards (2017), International Socrates Award, Switzerland (2017), International Excellence Award (2018), Maharashtra Gaurav Puraskar (2018), Naath Puraskar (2018), British Parliamentary Award, London (2019), Global Icon of India (2019), Dr. B.R. Ambedkar International Award, Nepal (2021), Pune Health Icon (2021), National Youth Icon (2021), World Book of Records, London (2021), Al Zarooni Award, Dubai (2021), Dental Oscar, London (2022), Dr. B.R. Ambedkar National Award (2023), and Bharat Bhushan Award (2024).

His contributions were also referenced in competitive exams for UPSC and MPSC in the 37th edition of 2019.

His contributions have also earned commendation from India’s 14th President, Hon. Ramnath Kovind Ji, who lauded Dr. Aaditya’s work in both dentistry and social causes.

In addition to his professional achievements, Dr. Patakrao serves as an advisory member in the Ministry of Telecommunications and Information Technology for the Government of India and is the President of the All India Consumer Forum, Pimpri Chinchwad. His commitment to excellence, innovative approach, and dedication to patient care have earned him a reputation as one of the world’s leading dentists. Dr. Aaditya’s Advance Dental Hospital, equipped with cutting-edge technology, offers comprehensive dental care, from implants to smile makeovers. His team of experts ensures personalized attention, making the hospital a go-to destination for those seeking world-class dental treatment.

Aside from his professional achievements, Dr. Aaditya Patakrao is also involved in the entertainment industry as an actor. He has appeared in the short film and featured in T series music productions and also under his home production house, Aaditya Patakrao Production. One of his life journey Music album named as Empire Chapter 1 having more than 1.3 million views.

Dr. Aaditya Patakrao’s remarkable journey serves as a beacon of inspiration to aspiring dentists and entrepreneurs , solidifying his position as a true icon in the dental industry.

Business

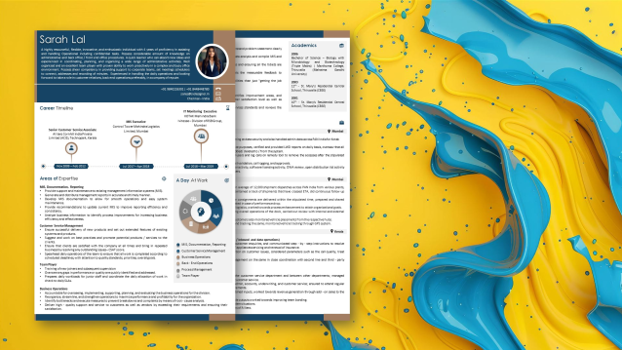

CV Designer: Creating Success Stories Through Resume Writing

Published

1 week agoon

July 18, 2024

In the bustling city of Chennai, Sushana Adurthi leads a revolutionary career consulting firm, CV Designer. Sushana’s profound expertise and vision have positioned CV Designer as a leader in comprehensive career solutions, transforming the way professionals present themselves in the competitive job market.

CV Designer’s inception was rooted in the frustration of job seekers facing repeated resume rejections and missed opportunities due to overlooked keywords. Recognizing the pivotal role keywords play in digital recruitment processes, Sushana developed a foolproof concept to optimize resumes by embedding industry-specific keywords and strategic content. This innovative strategy ensures that each document not only grabs attention but also aligns seamlessly with recruiter expectations, empowering clients to stand out in applicant tracking systems (ATS) and catch the eye of hiring managers.

The firm’s commitment to personalized solutions tailored to each client’s unique needs sets it apart. Unlike generic approaches, CV Designer prides itself on delivering customized services aligned closely with individual career aspirations, industry requirements, and professional objectives. This client-centric approach ensures that every resume, cover letter, and LinkedIn profile crafted by CV Designer strategically positions clients for success on a global scale.

CV Designer has a proven track record of helping clients secure positions in top-tier Fortune 100 and Fortune 200 companies across diverse industries. Some notable success stories include placements in companies like Microsoft, Google, Amazon, Apple, IBM, JPMorgan Chase, Goldman Sachs, Citibank, Morgan Stanley, Pfizer, Johnson & Johnson, Merck, Procter & Gamble, Coca-Cola, PepsiCo, Nestlé, Toyota, BMW, Ford, General Motors, McKinsey & Company, Bain & Company, Boston Consulting Group, Bank of America, Wells Fargo, HSBC, Barclays, American Express, Mastercard, Visa, PayPal, AIG, Allianz, Prudential Financial, and AXA. These placements underscore CV Designer’s ability to deliver results in highly competitive environments and showcase its expertise in aligning client profiles with the specific requirements of top-tier employers.

Furthermore, CV Designer places a strong emphasis on human expertise alongside advanced technological tools. While employing effective keyword strategies for ATS compatibility, the firm prioritizes human intelligence to understand and address the nuanced aspects of each client’s professional journey. This dual approach ensures that solutions authentically reflect the personality and career trajectory of every individual served, setting new standards in effective career management and development.

CV Designer operates across multiple countries, including the UAE, GCC countries, USA, Canada, UK, Europe, Germany, and Africa outside of India, serving a diverse clientele spanning various industries and career levels. The firm boasts a high success rate in securing interview calls for clients, often resulting in placements within 90 days. This achievement is attributed to the strategic use of industry-specific keywords and personalized content.

One of the innovative services introduced by CV Designer is the Visual CV, which blends infographics with textual content, revolutionizing traditional resume formats to be more visually appealing and engaging. This innovation has been well-received, further enhancing the firm’s reputation for excellence in career document preparation.

Sushana Adurthi’s leadership ensures that clients receive meticulously crafted resume solutions designed to make a significant impact. Her expertise lies at the forefront of content strategy, where she spearheads the creation of compelling resumes and executive bios that resonate globally. By leveraging her deep understanding of industry-specific nuances and strategic thinking, Sushana ensures that each document not only meets but exceeds the expectations of discerning employers and decision-makers.

Through her transformative leadership, Sushana has garnered recognition for consistently delivering high-impact career solutions. Her dedication to elevating the standards of resume writing and career consulting underscores her role as a visionary leader in the industry, driving innovation and setting new benchmarks for success. Her hope is to inspire individuals to take charge of their career paths with confidence and purpose, emphasizing the importance of content strategy, personalized solutions, and leveraging advanced techniques in professional interactions.

CV Designer’s business model focuses on offering a comprehensive array of services designed to meet the diverse needs of professionals worldwide. Specializing in crafting high-impact resumes, cover letters, and LinkedIn profiles, the firm offers two distinct product lines: Text CVs and Visual CVs.

The CV Designer caters to all levels, industries, and domains, ensuring that each client receives personalized attention and tailored solutions. Service packages are flexible and designed to accommodate various needs. Their offerings encompass crafting resumes, CVs, impactful LinkedIn profiles, and cover letters. They also specialize in adapting to clients’ needs and customizing comprehensive packages that offer complete career documentation and online profile optimization.

The recession posed challenges like shifts in hiring trends, reduced client budgets for career services, and heightened competition in the job market. CV Designer responded by enhancing its offerings to meet evolving client needs during uncertain times. The firm focused on providing more value-driven services, such as optimizing LinkedIn profiles and offering tailored resume solutions that highlighted transferable skills and resilience in job seekers. This strategic pivot helped CV Designer remain relevant and indispensable to clients facing heightened competition for fewer opportunities.

Overall, CV Designer’s journey from addressing resume rejections to becoming a leader in comprehensive career solutions highlights its innovative approach, commitment to personalized solutions, and proven track record of success. The firm continues to inspire and empower professionals worldwide, demonstrating the transformative power of strategic thinking and personalized expertise in career development.

Rajbir Kohli, the visionary behind RK Media, has been a trailblazer in the digital marketing industry. With over 18 years of experience, Rajbir began his journey at the young age of 17, freelancing for companies in the UK and USA. Through hands-on experience and constant learning, he honed his skills in SEO, social media, and web development, eventually leading to the creation of RK Media.

RK Media offers a comprehensive range of digital marketing services, including SEO, social media marketing, local SEO, and e-commerce marketing. The company’s business model revolves around delivering personalized digital strategies to boost online presence and engagement. Rajbir’s leadership, combined with the innovative contributions of his wife, Lovleen Malhotra Kohli, has propelled RK Media to new heights.

Despite the challenges of staying current with rapid industry changes and building client trust in the early days, Rajbir’s and Lovleen’s passion for digital marketing and dedication to helping businesses thrive online fueled the success of RK Media. The agency’s high client satisfaction rates and measurable results are a testament to its effective strategies and exceptional service.

The recent recession tested RK Media’s resilience, pushing the company to adapt by expanding its services and offering cost-effective solutions. This agility and client-centric approach have been key to their continued growth. Rajbir’s commitment to continuous learning and innovation sets RK Media apart from its competitors, ensuring they stay ahead of industry trends.

Rajbir’s vision for RK Media is to continue innovating in digital marketing, helping more businesses succeed online, and staying ahead of industry trends. He hopes to inspire others through webinars and mentorship, sharing his knowledge and experience to foster growth and success in the digital marketing community.

“In the world of digital marketing, adaptability is the currency of success,” says Rajbir Kohli, encapsulating his approach to business and life. His journey, marked by dedication and innovation, serves as an inspiration to aspiring digital marketers and entrepreneurs alike.

RK Media’s personalized approach to each client’s needs demonstrates their commitment to not just achieving but exceeding client expectations. By leveraging cutting-edge technologies and staying updated with the latest digital marketing trends, RK Media delivers customized solutions that drive real, measurable results. This dedication to client success has garnered them a reputation as a trusted partner in the digital marketing space.

Furthermore, the company’s emphasis on education and mentorship has created a ripple effect in the industry. Rajbir’s webinars and mentorship programs have empowered countless individuals, equipping them with the skills and knowledge needed to navigate the ever-evolving digital landscape. This commitment to giving back and fostering a community of continuous learners highlights Rajbir’s vision of creating a collaborative and progressive digital marketing ecosystem.

With a personalized approach, deep industry expertise, and a relentless drive for excellence, RK Media stands as a leader in the digital marketing revolution. As Rajbir Kohli continues to push the boundaries of what’s possible, the future of digital marketing looks brighter than ever.

Business

The Journey of a Student From Failure to Success – The Inspiring Story of Ajju Bora

Published

2 weeks agoon

July 15, 2024

Ajju Bora, hailing from the serene village of Syunani, Almora, Uttarakhand, is a young prodigy whose journey from the foothills of the Himalayas to becoming a celebrated author, game developer, and ethical hacker is as inspiring as it is remarkable. Currently residing in Rudrapur and studying in class 8 at Stone Ridge International School, Ajju’s story is a testament to the passion, perseverance, and unwavering support of his family.

Raised amidst the breathtaking beauty of Almora, Ajju’s formative years were infused with the wonders of nature and the support of his father, Mr. Ram Singh Bora. From a young age, Ajju exhibited a voracious appetite for learning and a remarkable ability to comprehend complex ideas, traits that would shape his future endeavors.

His journey into the literary world began with a deep-seated love for storytelling. Drawing inspiration from his surroundings, he penned his first works, including “The Quantum Detective” and “World of Animation,” which quickly garnered attention for their imaginative narratives and ability to merge science with storytelling. His literary prowess not only captured the imagination of readers but also earned him accolades within the literary community.

Beyond his literary pursuits, Ajju demonstrated a natural aptitude for technology. Venturing into game development, web development, and AI programming, he embarked on a journey marked by creativity and technical expertise. Starting with simple projects, Ajju’s skills blossomed, leading to the creation of interactive games and innovative AI applications that showcased his versatility and forward-thinking approach.

Ajju’s interest in cybersecurity propelled him into the realm of ethical hacking, where he utilized his skills to identify and mitigate security vulnerabilities. His commitment to ethical practices in hacking underscored his dedication to making the digital world safer. Recognized for his contributions, he participated in cybersecurity challenges and competitions, further cementing his reputation as a proactive advocate.

Ajju Bora’s journey is a testament to the power of passion, dedication, and the supportive environment that nurtures talent. As he continues to push the boundaries of literature, technology, and cybersecurity, Ajju inspires others to pursue their dreams with unwavering determination and a belief in their abilities.

His achievements have not gone unnoticed. His contributions to literature, technology, and cybersecurity have earned him admiration and recognition on national and international platforms. He was honored with the International Achievers Award in 2024, a testament to his exceptional talent and impact across multiple domains. This recognition has opened new doors for Ajju, allowing him to collaborate with global leaders and innovators, further fueling his ambitions.

Looking ahead, Ajju remains dedicated to expanding his knowledge and skills. His involvement with the All India Council for Technical Skill Development (AICTSD) highlights his commitment to fostering technological education and innovation in India. Through initiatives with AICTSD, he aims to mentor and inspire other young enthusiasts, ensuring a legacy of continuous learning and development in the field of technology.

At the heart of Ajju’s journey lies a profound belief in the power of perseverance and self-belief. He encourages aspiring young minds to embrace challenges and push beyond their comfort zones. Ajju’s story serves as a reminder that greatness knows no age or background, and with determination, passion, and a supportive community, anything is possible. As he continues to evolve as a writer, developer, and cybersecurity advocate, Ajju Bora is poised to leave an indelible mark on his industries, inspiring future generations to dream big and pursue their passions relentlessly.

Business

Trump Assassination Attempt: The Latest Developments

Published

2 weeks agoon

July 15, 2024

Current developments: An investigation is underway following an attempted assassination involving former U.S. President Donald Trump, who was shot in the ear during a campaign rally in Butler, Pennsylvania, on July 13. The incident resulted in one fatality and two individuals sustaining critical injuries.

How did the shooting occur?

On the evening of July 13, shortly after former U.S. President Trump began his speech in Butler discussing the increase in illegal border crossings, at least five gunshots were heard. In footage of the incident, Trump can be seen gripping his right ear behind the podium as Secret Service agents rushed to his side, urging him to “Get down.” As he dropped to the ground amid the chaos, he later emerged with blood on his face. Demonstrating his resilience, he raised his fist in defiance, shouting “Fight! Fight! Fight!” before being quickly escorted to a black SUV by his security team.

Who is the shooter?

The suspected shooter, identified as 20-year-old Thomas Matthew Crooks from Bethel Park, Pennsylvania, attacked Trump from an elevated position outside the rally venue and was killed at the scene. Authorities recovered an AR-style rifle at the location. The FBI has stated that no motive has been determined for the attempted assassination, and the investigation is ongoing.

According to state voter records, Crooks was a registered Republican. However, he had also donated $15 to a progressive political action committee in 2021, coinciding with President Joe Biden’s inauguration, as reported by the AP.

What was the reaction of rally attendees?

A witness described the chaos of the apparent assassination attempt on the Republican presidential candidate, recalling how a man next to him was shot and killed. “I heard several gunshots. The man beside me was hit in the head and fell to the bottom of the bleachers. Another woman appeared to be injured in the forearm or hand,” he told NBC News. He noted that the victim seemed to be “in the line of fire between the shooter and the President.”

Republican Dan Meuser, seated in the front row with other officials and candidates, stated, “It was clear after the first shot that it was gunfire. There was a lot of mayhem—a terrible tragedy, a terrible shame.”

Rico Elmore, vice-chairman of the Beaver County Republican Party, was seated in a special guest section facing President Trump when he first heard what he thought were firecrackers. “Everyone hesitated, but then it became clear these were actual gunshots. So, I yelled, ‘Get down!’” Elmore observed Secret Service agents assisting Trump off the stage and then heard someone nearby calling for a medic. He removed his tie and leaped over a barricade, only to find the victim had been shot in the head. “I held the victim’s head, but it was too late,” Elmore recalled. “It was a horror.”

Chet Jack, a member of the state Republican Party, and his wife, Beth, were in the bleachers facing Trump when they heard the gunfire. After the first round of shots, Beth ducked for cover, but then a second series of shots rang out. “I couldn’t see what was happening with President Trump because, as soon as I heard the first shot, I yelled, ‘Everybody get down!’” Beth recounted. While she sought shelter, Chet remained standing, believing the shots were coming from above and that ducking wouldn’t provide any protection.

Is Trump secure?

After the incident, Trump traveled to New Jersey to spend the night at his private golf club. He shared on his Truth Social account that he “knew immediately something was wrong” when he heard a whizzing sound and gunshots, and felt the bullet tearing through his skin. “There was significant bleeding, so I realized what was happening,” he wrote. He expressed gratitude to the Secret Service and law enforcement for their “rapid response.”

Trump also offered his condolences to the family of the individual killed at the rally, stating, “It’s incredible that such an act can occur in our country. Nothing is known at this time about the shooter, who is now deceased.”

Trump’s eldest son, Donald Trump Jr., stated that his father was “in great spirits.” He added, “He will never stop fighting to save America, regardless of what the radical left throws at him.”

What has Biden expressed?

President Joe Biden returned to Washington from Delaware ahead of schedule after the attack at the Trump rally. The White House reported that Biden also spoke with former President Donald Trump. “I’m grateful to hear that [Trump is] safe and doing well. I’m praying for him, his family, and all those who were at the rally as we await further information. There’s no place for this kind of violence in America,” he stated.

Vice President Kamala Harris expressed her relief that Trump was not seriously injured, saying, “We are praying for him, his family, and all those affected by this senseless shooting.”

She added, “Violence like this has no place in our nation. We must all condemn this abhorrent act and do our part to prevent it from leading to further violence.”

What are global reactions?

The tragic incident has sent shockwaves around the world, with leaders coming together to condemn the attack and denounce political violence. Prime Minister Narendra Modi expressed his “deep concern” for his friend, stating, “Violence has no place in politics and democracies. I wish him a speedy recovery. Our thoughts and prayers are with the family of the deceased, those injured, and the American people.”

Canadian Prime Minister Justin Trudeau shared that he was “sickened” by the shooting, while a spokesperson for British Prime Minister Keir Starmer condemned all forms of political violence. Australian Prime Minister Anthony Albanese described the incident as “concerning and confronting.” Israeli Prime Minister Benjamin Netanyahu expressed his shock, and Jordan Bardella from the French far-right National Rally party remarked, “Violence is the poison of any democracy.”

Italian Prime Minister Giorgia Meloni said she was “following updates from Pennsylvania with apprehension” and wished Trump a speedy recovery.

Business

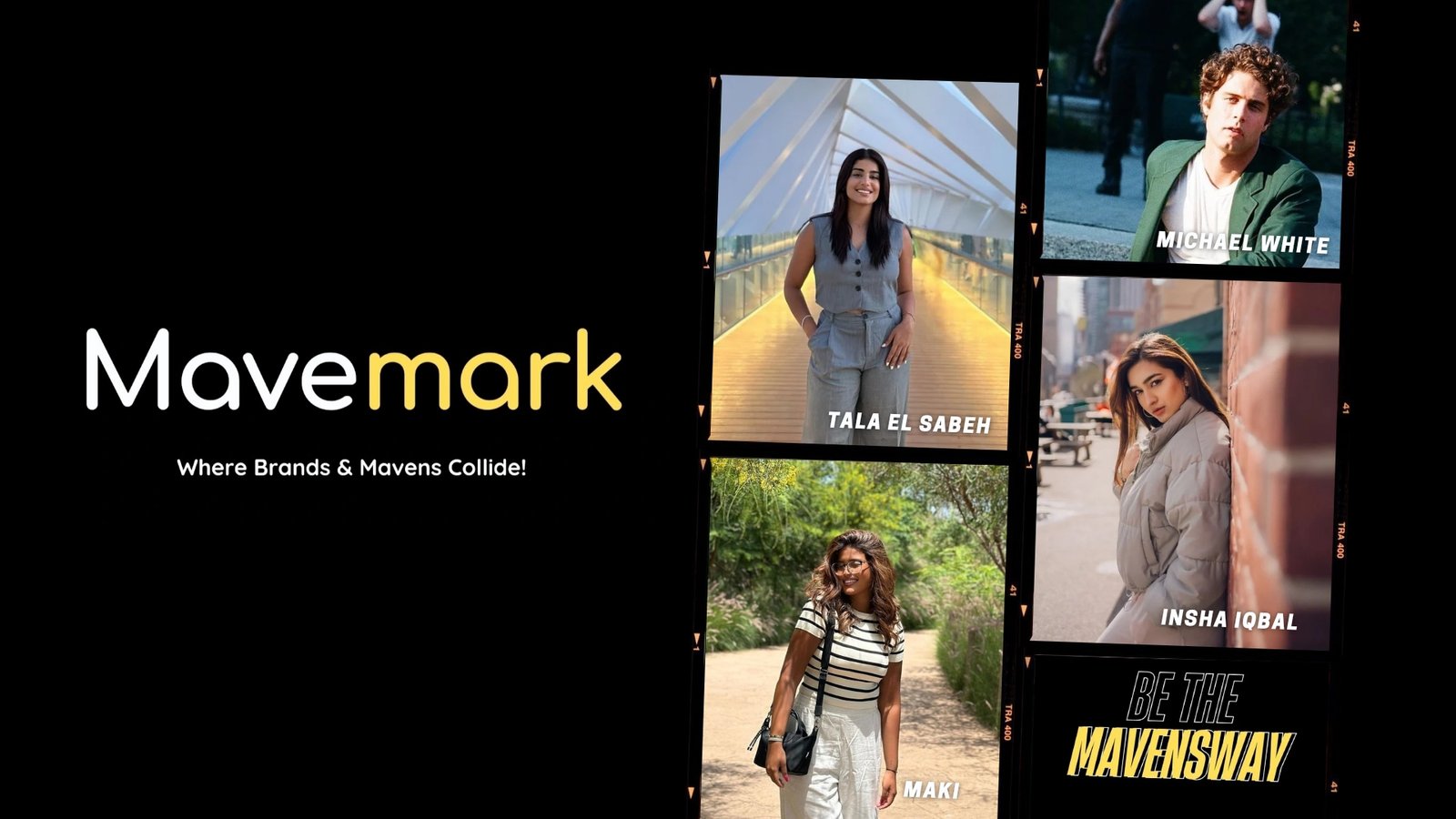

How a Gen Z Founder Launched Mavemark, a Promising Startup in Influencer Marketing

Published

2 weeks agoon

July 11, 2024

In the era of influencer marketing, a new star is on the rise: Mavemark. Founded by Mirza Ahmed in 2023, Mavemark has quickly become a promising startup in the industry. He is a Gen Z entrepreneur whose journey from an introverted grad student to the visionary behind Mavemark is as inspiring as it is impressive.

The story of Mavemark began in early 2022 when Ahmed was in his second year of grad school. What started as a Artist Manager to influencer Michael Thomas White (MTW) quickly evolved into something much bigger. The initial phase involved collaborating with high-profile brands and publications such as GQ, the New York Times, Vice Magazine, and Lululemon and 25 plus renowned brands in USA. These early successes validated Ahmed’s vision and set the stage for the official launch of Mavemark in 2023.

Building Mavemark was not without its challenges. Financial constraints and the need to build a network from scratch were significant hurdles. However, Ahmed’s determination and innovative approach helped overcome these obstacles. A significant milestone was the formation of the Mavemark Mavens community, bringing together top influencers like Tala El Sabeh and Maki, leading influencers from Saudi Arabia, Insha Iqbal, a renowned model and talent influencer from India, and Tanya, one of the most engaged influencers with a U.S. audience. Alongside the Love Twins, also hailing from the USA, these influencers collectively command a follower base totaling over 10 million. This impressive reach highlights the significant impact of Mavemark’s Mavens.”This community of influencers, known as “The Mavens,” embodies Mavemark’s commitment to authenticity and creativity.

One of the key aspects that set Mavemark apart from its competitors is its uniquely Exclusively non-exclusivity representation model. This approach ensures dedicated focus and personalized strategies for each influencer, fostering genuine connections between brands and influencers. Mavemark’s slogan, “Be the Mavensway,” symbolizes confidence, intelligence, and authenticity, encouraging influencers to embrace their unique qualities.

Ahmed’s journey from an introvert to an ambivert has been driven by his vision of making influencer marketing a transparent and effective form of marketing. His belief in the future of influencer marketing is evident in the strong community he has built and the successful collaborations Mavemark has achieved. By supporting influencers and helping them grow, Mavemark aims to inspire a new generation of content creators to pursue their passions and make a meaningful impact.

The recession posed significant challenges for Mavemark, affecting revenue streams and client budgets. In response, the company diversified its services, offered more flexible pricing models, and focused on long-term partnerships. Leveraging digital tools to enhance operational efficiency and continuously innovating in campaign strategies allowed Mavemark to navigate the tough economic landscape and emerge stronger.

Mavemark’s business model revolves around representing influencers and creating tailored marketing campaigns for brands. Services include campaign planning and execution, content creation, brand partnerships, and influencer management. The company’s commitment to authenticity and excellence is reflected in every aspect of its operations, driving genuine engagement and results for clients.

Looking ahead, Ahmed envisions Mavemark expanding its influence globally, continuing to innovate, and setting new standards in the industry. The goal is to grow the roster of influencers, explore new markets, and develop even more impactful marketing strategies. Ultimately, Mavemark aspires to become a well-respected agency in influencer marketing, known for its authenticity, creativity, and results-driven approach.

Through Mavemark, Ahmed hopes to inspire others by demonstrating that passion and perseverance can turn a vision into reality. The journey from a small talent management agency to a promising startup showcases the power of dedication and innovation. By supporting “The Mavens” and helping them succeed, Mavemark aims to inspire a new generation of influencers to pursue their dreams and make a significant impact.

In the words of Mavemark’s slogan, “Be the Mavensway” is, like, the GOAT of knowing stuff and staying extra fresh with all the trends

Mirza Ahmed journey with Mavemark exemplifies the power of vision, perseverance, and innovation. From its humble beginnings as a talent management agency to becoming a formidable player in the influencer marketing industry, Mavemark’s story is one of overcoming challenges and pushing boundaries. As Ahmed and his team look to the future, their dedication to making a meaningful impact in influencer marketing remains unwavering, encouraging others to follow the “Mavensway” and embrace their unique paths to success.

Business

Discover Atulya Rakhi Edition – August 16th at Aga Khan Hall, Mandi House, Delhi

Published

2 weeks agoon

July 11, 2024

We are thrilled to announce the Atulya Rakhi Edition, a spectacular event happening at the esteemed Aga Khan Hall in Mandi House, Delhi, on August 16th. This exclusive gathering brings together top brands in clothing, jewelry, accessories, and gifting, offering a unique opportunity to explore and shop for the perfect Raksha Bandhan essentials.

Prepare to be enchanted by a curated selection of top-tier brands showcasing their finest collections. Whether you’re looking for exquisite ethnic wear, trendy jewelry pieces, stylish accessories, or thoughtful gifts for your loved ones, Atulya Rakhi Edition promises a shopping experience like no other.

The Aga Khan Hall, Mandi House, Delhi, known for its elegance and cultural heritage, sets the stage for our celebration. Situated near Mandi House metro station, its central location ensures easy access for all guests, making your visit convenient and enjoyable.

We extend our heartfelt invitation to you and your family to join us on August 16th at Aga Khan Hall. Immerse yourself in the festive ambiance, explore a diverse range of products, and indulge in a memorable shopping spree ahead of Raksha Bandhan.

Save the Date:

– Date: August 16th, 2024

– Venue: Aga Khan Hall, Mandi House, Delhi

– Time: 11:00 AM – 7:00 PM

At Atulya Rakhi Edition, discover more than just shopping – embrace the spirit of Raksha Bandhan with us. Celebrate tradition, cherish relationships, and find the perfect expressions of love and affection for your dear ones.

For inquiries and updates, please contact 9643304708 or email: atulyafashionlifestyleexpo@gmail.com.

Join us at Atulya Rakhi Edition for a day of elegance, culture, and meaningful connections. We look forward to welcoming you!

Warm regards,

Shivani Sundriyal

Show Expert

Trending

-

Entertainment3 years ago

Entertainment3 years agoEva Savagiou Finally Breaks Her Silence About Online Bullying On TikTok

-

Entertainment2 years ago

Entertainment2 years agoTraumatone Returns With A New EP – Hereafter

-

Entertainment2 years ago

Entertainment2 years agoTop 5 Influencers Accounts To Watch In 2022

-

Fashion3 years ago

Fashion3 years agoNatalie Schramboeck – Influencing People Through A Cultural Touch

-

Fashion3 years ago

Fashion3 years agoThe Tattoo Heretic: Kirby van Beek’s Idea Of Shadow And Bone

-

Entertainment3 years ago

Entertainment3 years agoTop 12 Rising Artists To Watch In 2021

-

Entertainment3 years ago

Entertainment3 years agoMadison Morton Is Swooning The World Through Her Soul-stirring Music

-

Entertainment3 years ago

Entertainment3 years agoTop 10 Influencers To Follow This 2021

-

Entertainment3 years ago

Entertainment3 years agoBrooke Casey Inspiring People Through Her Message With Music

-

Entertainment3 years ago

Entertainment3 years agoFiery, Electric, And Tenacious. Leah Martin-Brown’s All That