The S&P 500 on Thursday closed above the brink that marked its exit from the longest uncover market since 1948.

The massive-cap benchmark

SPX,

rose 26.41 beneficial properties, or 0.6%, to shut at 4,293.93 on Thursday, marking a develop of extra than 20% from its Oct. 12 low.

Listed below are some key stats from Dow Jones Market Data:

-

The S&P 500 had been in uncover-market territory for 248 procuring and selling days; the longest uncover market since the 484 procuring and selling days ending on Might well maybe 15, 1948.

-

Rather then this most up-to-date uncover market, the life like uncover market lasts 142 procuring and selling days.

-

It took 164 procuring and selling days from the uncover-market low to exit; the longest duration from uncover-market low to exiting a uncover market since the 191 procuring and selling day duration ending July 25, 1958.

-

Rather then this uncover market, the life like uncover-market low to uncover-market exit is 61 procuring and selling days.

-

The index fell 25.43% from its recent high to its uncover-market low, on a closing basis.

-

The index is mild 10.5% off from its chronicle shut of 4796.56, arena on Jan. 3, 2022.

Below the criteria prone by Dow Jones Market Data and heaps other market watchers, a 20% upward push from a recent low indicators the birth of a bull market whereas a 20% drop indicators the birth of a uncover market. That system the market is continually in both a bull or uncover market. Also, the market doesn’t hop into and out of both a bull or uncover whenever it crosses the brink again. It takes one other 10% or 20% transfer within the reverse route to interchange the location.

See: How a hawkish Fed might murder a itsy-bitsy one bull-market rally in U.S. stocks

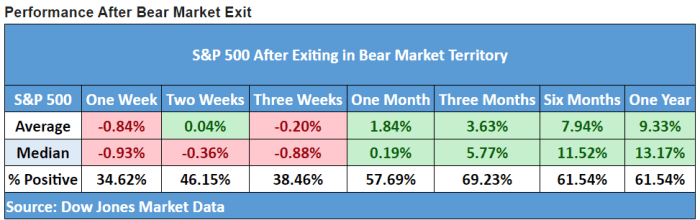

So what does history reveal about what happens next? A gaze by Dow Jones Market Data at median and life like efficiency following previous uncover-market exits, in accordance with info stretching lend a hand to 1929, is largely decided for periods from one month to a 300 and sixty five days (ogle table beneath).

Dow Jones Market Data

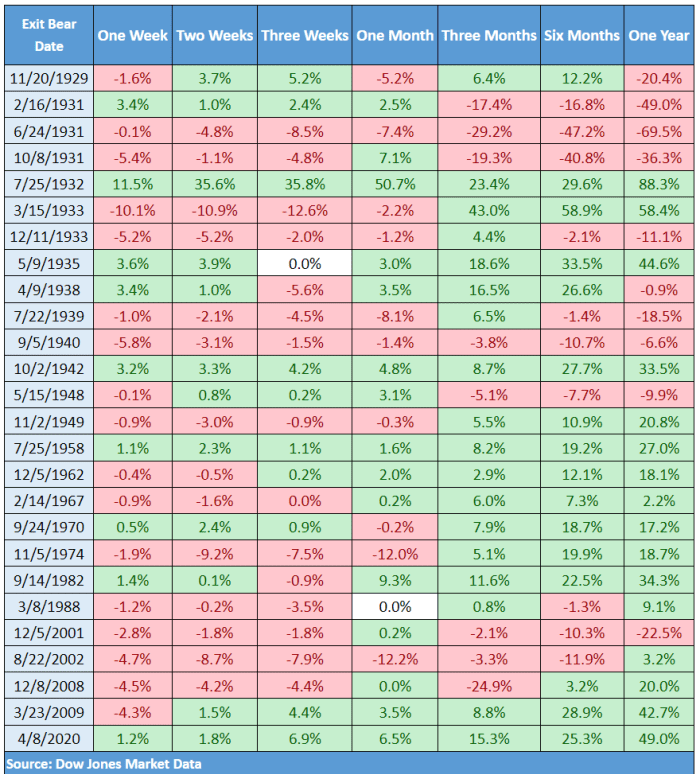

Nonetheless there’s different variability. Here’s a closer stare upon what came about after each exit:

Dow Jones Market Data

The table presentations that uncover exits most steadily — but no longer continually — result in durable bull markets.

In One Chart: Why stock-market bulls have to be cautious for ‘bogus uncover-market bottoms’

As well-known earlier by Sam Stovall, chief funding strategist at CFRA, of the 14 uncover markets since WWII, handiest two — 2000-’02 and 2007-’09 –– produced exits that saw the S&P 500 rapid scurry lend a hand accurate into a uncover market by declining extra than 20%.

See: Here’s the principle driver of the S&P 500’s bull-market rally, in defending with Fundstrat’s Tom Lee

Stocks had been boosted Thursday after a upward push in first-time jobless claims perceived to toughen expectations the Federal Reserve will leave rates unchanged when it meets next week.

Stocks eked out one other round of gains on Friday. The S&P 500 rising 4.93 beneficial properties, or 0.1%, to shut at 4,298.86, whereas the Dow Jones Industrial Common

DJIA,

gained 43.17 beneficial properties, or 0.1%, and the Nasdaq Composite

COMP,

ticked up 0.2%.

The Nasdaq exited a uncover market on Might well maybe 8, whereas the Dow exited its uncover on Nov. 30.

Label Hulbert: What the S&P 500’s new bull market tells us about what’s to reach