Uncertainty on Wall Aspect highway if truth be told looks to be off the charts.

Unquestionably, alternatively, financial uncertainty currently is never any longer any better than its ancient practical. In previous years when uncertainty became at or near most up-to-date ranges, the stock market produced middle-of-the-highway returns.

It’s fully understandable why uncertainty looks to be lots better than practical. For starters, no person has any map whether or no longer the economy is headed correct into a recession; even the Federal Reserve doesn’t know.

Likewise, none of us is aware of whether or no longer the Fed will proceed elevating rates at its subsequent meetings—or hit the dwell button. Thought about inflation is also polarized, with some insisting that inflation will tumble markedly over the next year, while others are confidently predicting that it’s headed relief up.

If that weren’t adequate uncertainty, there’s also the probability of a authorities shutdown if Congress is unable to agree on a budget for the fiscal year that begins on Oct. 1.

And then there’s the enormous geopolitical uncertainty over the probability the Ukraine battle will trip nuclear or China invades Taiwan.

Whereas this list of most up-to-date risks looks overwhelming, we would prefer to be aware of that uncertainty continuously looks to be off the charts — while we’re experiencing it. It’s a truth of existence that going via the prolonged recede continuously looks admire taking a gaze into an abyss.

What is also a truth of existence is that, as soon as the prolonged recede provides way to the previous, we right away rewrite ancient previous to originate it appear as despite the indisputable truth that what took place became apparent. Obviously, we repeat ourselves now, it became apparent that the stock market would rally after the initial COVID-19 lockdowns. We likewise order that it became apparent that 2022 might possibly possibly well be a undergo market year for each the stock and bond markets.

But, I shouldn’t occupy to remind you, none of those outcomes became clear forward of it took place.

This rewriting of ancient previous is something that age helps us to take care of, as retirees and near-retirees already know. Because the E book of Ecclesiastes famously puts it, “there might possibly be nothing contemporary below the sun.”

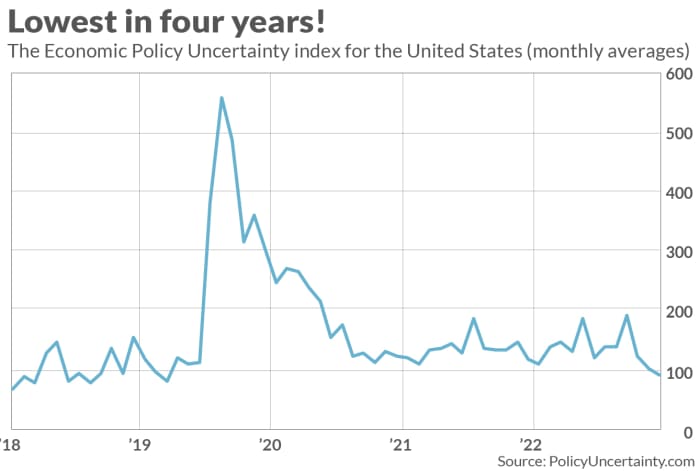

What is a quantity of referring to the most contemporary wretchedness is that we occupy quantitative measures of uncertainty, enabling us to match our most up-to-date subjective sense of uncertainty with how we felt at a quantity of times within the previous. Essentially the most prominent of such measures is the Financial Coverage Uncertainty (EPU) index, which became created several years ago by three finance professors: Scott Baker of Northwestern, Reduce Bloom of Stanford, and Steven Davis of the University of Chicago. As that you might see from the accompanying chart, which plots the EPU’s monthly practical, uncertainty currently is the lowest it has been since November 2019 — virtually four years ago.

Simply as finance theory expects, there’s a solid correlation between the EPU and the stock market’s return over the next several years. That’s attributable to, when uncertainty is better, the market’s expected return must also be better in enlighten to entice investors to threat striking their money in equities. The table summarizes this correlation, essentially based fully on the EPU since 1985 and the S&P 500’s inflation-adjusted entire return over the next 1-, 3- and 5-year sessions.

|

Subsequent 1 year |

Subsequent 3 years |

Subsequent 5 years |

|

|

25% of months with lowest practical EPU level |

6.0% |

3.0% annualized |

3.0% annualized |

|

Next very most practical 25% |

8.2% |

9.9% |

8.1% |

|

Next very most practical 25% |

7.5% |

9.4% |

10.8% |

|

25% of months with very most practical practical EPU level |

15.5% |

11.6% |

12.6% |

|

Moderate of all months |

9.2% |

8.3% |

8.2% |

The EPU currently stands at nearly the particular midpoint of its ancient distribution over the final four a long time: The forty eightth percentile, truly. Over the final four a long time, EPU ranges shut to where it stands right this moment were associated with practical market returns.

Whether you deem here’s real or sinful news is reckoning on whether or no longer you are inclined to search out the glass as half of elephantine or half of empty. For my money, practical returns can be correct fine.

Imprint Hulbert is a long-established contributor to MarketWatch. His Hulbert Rankings tracks investment newsletters that pay a flat charge to be audited. He might possibly possibly additionally be reached at imprint@hulbertratings.com.