The S&P 500 index exited a undergo market on Thursday, whereas a intently watched gauge of stock-market volatility dropped to a extra-than-three-year low. These two issues are associated, says Fundstrat World Advisors founder Tom Lee.

The Cboe Volatility Index

VIX,

every other choices-derived measure of anticipated volatility in the S&P 500 over the impending 30 days, traded as shrimp as 13.50 on Friday, its lowest since February 2020. The gauge’s lengthy-time period moderate is advance 19. A subdued studying signifies investors are feeling optimistic. The VIX averaged 25 in 2022, whereas the S&P 500 posted a decline of 19.4%.

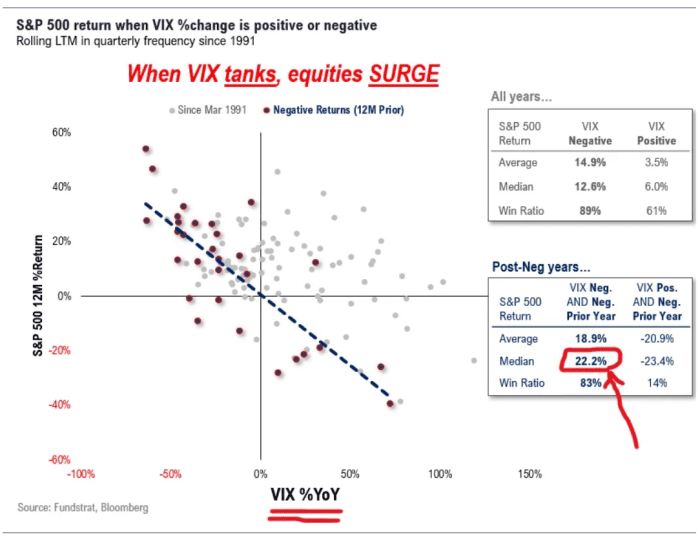

“The VIX impact is the least liked. Our work from December 2022 shows that in final 30 years, put up-detrimental fairness year (2022), when VIX is down [year-over-year], the median manufacture is 22%,” Lee said in a Friday morning demonstrate to purchasers (peek chart beneath).

Fundstrat

The VIX’s role is elevated than the impact from moves in the U.S. dollar, earnings per portion and even bond yields, Lee said.

“VIX trajectory, in a good deal of phrases, modified into the single largest determinant first and critical of 2023. This appears to be like to be enjoying out this day,” he wrote.

The S&P 500

SPX,

rose 4.93 functions, or 0.1%, Friday afternoon to shut at 4,298.86. On Thursday it closed at 4,293.93, its best possible shut since Aug. 16. Furthermore, it done extra than 20% above its Oct. 12, 2022, closing low, assembly broadly worn criteria that marks the tip of a undergo market.

Take a look at up on: S&P 500 exits longest undergo market since 1948. What stock-market historical previous says about what occurs next.

The Dow Jones Industrial Practical DJIA ended with a manufacture of 43.17 functions, or 0.1%, whereas the Nasdaq Composite

COMP,

received 0.2%.

For the S&P 500, there are loads of skeptics who peek a headfake in ought to a contemporary child bull market. The concentrated nature of the S&P 500’s rally, which has been fueled to an outrageous degree by gains for a handful of megacap, tech-associated shares, makes many investors cautious for the explanation that moderate stock has been left in the lend a hand of.

Whereas the S&P 500, which is weighted by market capitalization, is up extra than 12% to this level in 2023, the equal-weighted measure of the S&P 500 has received attractive 2.6%.

Learn: How a hawkish Fed may maybe even destroy a child bull-market rally in U.S. shares

Others apprehension an dangerous economic outlook, arguing that a extra pessimistic take hang of reflected in the bond market may maybe even snappily unravel the stock market rally if it proves genuine.

So now what? Lee said with the VIX beneath 14, it seemingly received’t be a driver of future gains.

Now, the market faces what is going to be its “most consequential” week of the year, with the Could maybe merely client-label index keep for release on Tuesday and the Federal Reserve concluding a two-day policy assembly on Wednesday.

Fed-funds futures merchants relish priced in a roughly 72% probability the central monetary institution will travel charges unchanged next week, in step with the CME FedWatch tool, pausing after a series of fee will enhance that took the benchmark fee from advance zero to doubtlessly the most contemporary fluctuate of 5% to 5.25% since March of ultimate year. However they request the Fed to articulate a hike in July.

Take a look at up on: Fed may maybe even hike interest charges again in June as an various of a ‘skip,’ some economists think

Whereas the VIX at its most contemporary stage isn’t basically a aquire signal by itself, “we silent peek upside drivers for the S&P 500 over the next 6 months. The critical driver being that inflationary pressures ease quicker than consensus expects and at a dart that will allow the Fed to unhurried its dart of hikes,” Lee said.

With the caveat that next week’s events are most fundamental, Fundstrat’s atrocious case stays that the S&P 500 will manufacture extra than 20% in 2023, with the 4,300 stage serving as a “waypoint” that will in the end give capability to fairness markets making contemporary highs this year, he said.