Business

Chevron Hess Deal : A $53 Billion Game-Changer in the Energy Industry

Published

2 years agoon

In a bold move indicative of the shifting landscape in the energy sector, Chevron, the second-largest U.S. oil giant, announced on Monday its agreement to acquire Hess, a medium-sized rival, in an all-stock deal valued at an impressive $53 billion. This landmark transaction signals yet another wave of consolidation in the energy industry, particularly within the United States, where smaller companies are capitalizing on the allure of high oil prices by merging with larger, more established players. Chevron’s endeavor follows Exxon Mobil’s recent $60 billion purchase of Pioneer Natural Resources, underlining the industry’s unwavering commitment to fossil fuels even as global policymakers push for cleaner energy alternatives.

The Chevron-Hess deal not only mirrors Exxon’s acquisition of Pioneer but also emphasizes the desire among major oil companies to focus their investments closer to home, a strategic move amid rising political risks in regions such as Asia, the Middle East, and Africa. In recent years, Chevron has been augmenting its portfolio in the Rocky Mountains and the Permian Basin, spanning the Texan and New Mexican landscapes, reinforcing its presence in the domestic market.

Peter McNally, an energy analyst at Third Bridge, a reputable research firm, noted, “Besides the United States, South America is the region where Chevron is making its bet.” He draws parallels between this recent surge of acquisitions and the wave of takeovers that occurred a quarter-century ago, culminating in the formation of industry behemoths Exxon Mobil and Chevron-Texaco. However, back then, the companies sought to reduce operational costs, while today, the acquired companies offer valuable assets and specialized expertise for unconventional resource development, such as shale.

The crown jewel of the deal is the acquisition of Hess’s stake in the offshore Guyana project. In partnership with Exxon Mobil, this venture has catapulted from producing nothing four years ago to an astounding 400,000 barrels per day, with projections indicating a tripling of output by 2027. This exponential growth positions Guyana to represent more than 1 percent of total global oil production.

Natural gas, often bubbling up alongside the oil, is not to be overlooked. It offers opportunities in the local electricity market and the potential for export to Trinidad and Tobago, where it can be converted into liquefied natural gas for European markets.

Also Read: Decoding Inflation Slowdown : Fed’s Response and Economic Implications

Exxon Mobil plays the pivotal role of operator and major investor in the Guyana project, with Hess riding the coattails of what has swiftly evolved into one of the most lucrative ventures in the oil industry. Besides West Texas, Guyana is Exxon’s most substantial investment aimed at bolstering future production.

Chevron’s well-established investment in Venezuela, which shares a border with Guyana, also hints at possible synergies should the U.S. government further ease the sanctions imposed on the neighboring country.

Beyond Guyana, Chevron’s acquisition extends to encompass Hess’s shale fields in North Dakota, offshore production in the Gulf of Mexico, where a significant oil discovery was made earlier this year, and a natural gas business in Southeast Asia. This diversification significantly bolsters Chevron’s portfolio, adding roughly 10 percent to the company’s overall oil and gas production, which stands at approximately three million barrels per day.

Mike Wirth, Chevron’s Chairman and Chief Executive, commented that this acquisition enriches the company’s operations by adding world-class assets, while Pierre Breber, Chevron’s Chief Financial Officer, highlighted that it is expected to enhance Chevron’s free cash flow growth. He added, “With greater confidence in projected long-term cash generation, Chevron intends to return more cash to shareholders in the form of dividends and higher share repurchases.”

In this momentous deal, John Hess, the CEO of Hess, is set to join Chevron’s board, marking a significant moment in his company’s nearly century-long history. He sees this merger as an opportunity to unite Hess’s growth prospects, particularly in Guyana, with Chevron’s expansive reach, financial prowess, and the capacity to deliver more substantial dividends.

On the other hand, some analysts have expressed surprise that Chevron pursued such a significant deal when Exxon, its primary rival, was seemingly out of the race due to its multi-billion-dollar Pioneer purchase. Biraj Borkhataria, an analyst at RBC Capital Markets, believed Chevron could have afforded to bide its time. He acknowledged that Hess would provide Chevron with a more robust, diversified portfolio, which could prove advantageous for shareholders in the long run, though it might exert a short-term influence on the company’s share prices.

Environmentalists have criticized the Chevron-Hess deal, mirroring their sentiments about Exxon’s acquisition of Pioneer. Cassidy DiPaola, campaign manager for Fossil Free Media, lamented, “Deals like this lock us into greater fossil fuel dependency and greenhouse gas emissions for decades to come.”

However, Chevron, much like Exxon, emphasizes its commitment to developing carbon capture and sequestration technologies to combat climate change. The Chevron-Hess deal represents the latest in a series of mergers and acquisitions reshaping the energy industry, signaling an era where established players are strategically positioning themselves for a future characterized by shifting energy landscapes and evolving environmental concerns.

Sahil Sachdeva is an International award-winning serial entrepreneur and founder of Level Up PR. With an unmatched reputation in the PR industry, Sahil builds elite personal brands by securing placements in top-tier press, podcasts, and TV to increase brand exposure, revenue growth, and talent retention. His charismatic and results-driven approach has made him a go-to expert for businesses looking to take their branding to the next level.

You may like

Business

Get Featured in Women Magazine: How to Boost Your Brand and Influence

Published

2 days agoon

March 5, 2026

In today’s competitive world, being recognized by media outlets is more than just a vanity metric—it’s a powerful way to establish authority, expand your audience, and grow your personal brand. One of the most impactful ways to achieve this is to get featured in women magazine publications, which celebrate inspiring stories, leadership, entrepreneurship, and innovation.

For women entrepreneurs, creators, and professionals, being featured in a magazine can open doors to new opportunities, from speaking engagements to collaborations and business partnerships. But getting featured is not accidental—it requires strategy, preparation, and storytelling. In this guide, we’ll break down practical ways to maximize your chances of media recognition.

Why You Should Get Featured in Women Magazine

Being featured in a women-focused publication offers numerous benefits that go far beyond visibility. Here’s why it matters:

- Credibility and Authority

When a magazine highlights your story, readers instantly see you as a trusted voice in your field. This credibility is invaluable for entrepreneurs, thought leaders, and anyone building a personal brand. - Expanded Audience Reach

Women’s magazines often have loyal readerships that span print and online platforms. Your story can reach thousands of potential clients, collaborators, or fans. - Career and Business Opportunities

Media exposure often attracts invitations for speaking engagements, networking events, and strategic partnerships. - Enhanced Digital Presence

Many magazines publish features online, creating backlinks to your website and improving SEO, which boosts your long-term online visibility. - Inspirational Impact

Sharing your journey can empower others, especially if your story focuses on overcoming challenges, innovating, or making a difference.

Getting published isn’t just a milestone—it’s a tool to accelerate growth and influence.

How to Get Featured in Women Magazine with a Compelling Story

Editors receive countless pitches, so having a strong narrative is essential. To stand out, your story must resonate with both the audience and the editorial team.

Storytelling Tips That Work:

- Overcoming Challenges: Highlight personal or professional obstacles and how you turned them into growth opportunities.

- Empowering Others: Share how your work benefits women, communities, or industries.

- Innovation and Creativity: Focus on unique solutions or entrepreneurial ventures.

- Career Transformation: Stories about pivoting or taking bold steps often captivate readers.

Magazines look for narratives that inspire, educate, or motivate. Before reaching out, ask yourself: Why would this story matter to the readers? If the answer is compelling, you’re on the right track.

Researching to Get Featured in Women Magazine

Not all magazines are the same. To increase your chances of being noticed, target publications aligned with your story and niche.

Research Checklist:

- Study recent articles and profiles

- Understand the magazine’s audience and tone

- Identify recurring story themes

- Note the type of experts or contributors featured

By tailoring your pitch to a publication’s style and audience, you show editors that you understand their platform and can provide relevant content.

Building Your Brand to Get Featured in Women Magazine

Editors are more likely to feature individuals with a clear personal brand. Establishing your expertise and credibility online can make your pitch more persuasive.

Ways to Strengthen Your Brand:

- Maintain an updated professional website or portfolio

- Be active on social media platforms relevant to your industry

- Publish blogs or articles that demonstrate your knowledge

- Share media-friendly content that positions you as an authority

A consistent online presence ensures that when journalists research you, they find credibility and professionalism.

Crafting a Pitch to Get Featured in Women Magazine

Your pitch is your first impression. A well-crafted email or message can make the difference between being ignored and being published.

Pitch Essentials:

- Brief introduction about yourself

- Story idea and why it matters to the magazine audience

- Key achievements or unique perspectives

- Links to your website, portfolio, or past media features

Keep your pitch concise, engaging, and tailored for each publication. Generic messages rarely succeed.

Networking Strategies to Get Featured in Women Magazine

Networking plays a key role in media exposure. Many opportunities come from relationships rather than cold outreach.

Effective Networking Approaches:

- Connect with editors and journalists on LinkedIn

- Attend conferences, webinars, and industry events

- Collaborate with PR professionals who have media connections

- Join professional communities and women-focused business groups

Building genuine relationships with media professionals increases the likelihood of your story being considered.

Content Ideas to Get Featured in Women Magazine

Knowing what topics resonate with magazine audiences can make your pitch stronger.

Popular Themes Include:

- Entrepreneurship and business leadership

- Career growth and professional development

- Health, wellness, and self-care

- Innovation and technology initiatives

- Social impact projects and community empowerment

Aligning your story with these themes increases your chances of being selected.

Common Mistakes to Avoid When Trying to Get Featured in Women Magazine

Even strong candidates can be rejected if their approach is flawed. Avoid these pitfalls:

- Sending generic or mass-pitch emails

- Making the story overly promotional

- Ignoring submission guidelines

- Failing to highlight audience benefits

- Giving up after a single rejection

Persistence and adaptability are key. Learn from feedback and refine your pitch to increase your chances over time.

Leveraging Your Feature After You Get Featured in Women Magazine

Once you secure a feature, it’s important to maximize its impact.

Ways to Leverage Media Coverage:

- Share the article across social media platforms

- Highlight it on your website or media kit

- Include it in email newsletters and marketing materials

- Reference it in presentations, webinars, and networking opportunities

A single feature can lead to further recognition, helping you establish long-term authority and influence.

Final Thoughts on How to Get Featured in Women Magazine

Getting media attention is a process that combines strategy, preparation, and compelling storytelling. The opportunity to get featured in women magazine is accessible to anyone with a meaningful story to share.

Focus on building a strong personal brand, crafting a pitch that resonates, and networking with media professionals. Pair this with patience and persistence, and your story could soon inspire readers, elevate your credibility, and open doors to new opportunities.

With the right approach, getting featured in a women’s magazine isn’t just about publicity—it’s a stepping stone toward greater influence, impact, and professional growth.

Business

How to Get Featured in Robb Report: The Ultimate Guide to Luxury Media Exposure

Published

4 days agoon

March 3, 2026

In the world of ultra-luxury branding, credibility is currency. A single feature in the right publication can instantly elevate your brand from premium to prestigious. That’s why so many founders, luxury PR professionals, and high-end service providers aim to Get Featured in Robb Report.

For more than four decades, Robb Report has set the gold standard for affluent lifestyle journalism. Covering everything from rare timepieces and superyachts to private aviation and elite travel experiences, the publication reaches ultra-high-net-worth individuals who actively invest in the best the world has to offer.

If your brand belongs in that category, this guide will show you exactly how to position yourself for luxury media exposure the right way.

Why Brands Want to Get Featured in Robb Report

Before building a strategy, it’s important to understand why this publication carries so much influence.

1. Access to an Elite Audience

Robb Report readers include CEOs, entrepreneurs, investors, collectors, and global tastemakers. These are decision-makers with purchasing power.

2. Immediate Brand Authority

Editorial coverage signals trust and excellence in a way advertising simply cannot. Being recognized by a respected luxury publication strengthens your positioning overnight.

3. Global Visibility

With international editions and digital reach, a feature can expand your brand’s exposure beyond one market.

4. SEO & Digital Impact

High-authority backlinks and branded search growth can significantly enhance your online visibility.

If your goal is to Get Featured in Robb Report, you’re not just chasing press—you’re building long-term prestige.

Understanding Editorial Standards to Get Featured in Robb Report

Robb Report is not interested in mainstream luxury or aspirational mid-market brands. Their editorial focus is clear:

-

True exclusivity

-

Exceptional craftsmanship

-

Heritage and legacy

-

Innovation at the highest level

-

Bespoke services

-

Limited production or rare offerings

Before pitching, evaluate your brand honestly. Ask:

-

Is this the pinnacle of its category?

-

Does it represent rarity or innovation?

-

Would affluent readers find this aspirational?

If the answer isn’t a confident yes, refine your positioning first.

Crafting a Luxury Narrative That Editors Notice

If you want to Get Featured in Robb Report, you must think like a storyteller—not a marketer.

Editors aren’t looking for: We launched a new product.

They’re looking for: A fourth-generation master craftsman has revived a lost European technique to create a limited-edition collection available to only 20 collectors worldwide.

The difference is narrative depth.

Focus on These Story Elements:

-

Heritage or origin story

-

Craftsmanship details

-

Rarity or scarcity

-

Innovation

-

Cultural relevance

-

Personalization

Luxury storytelling is about meaning, not mass appeal.

Building Credibility Before You Pitch

Major publications rarely feature brands with no established track record. If you want to successfully Get Featured in Robb Report, build momentum first.

Strengthen Your Brand Foundation:

-

Develop a refined, high-end website

-

Invest in professional photography

-

Secure smaller luxury media mentions

-

Win industry awards

-

Collaborate with respected designers or artisans

-

Establish a strong visual identity

Editors are more confident featuring brands that already demonstrate authority.

The Role of Luxury PR in Getting Featured

While it’s possible to pitch directly, many successful brands work with specialized PR agencies.

Luxury PR professionals:

-

Maintain relationships with editors

-

Understand editorial timing

-

Craft tailored, compelling pitches

-

Position brands strategically

-

Avoid common outreach mistakes

If your budget allows, working with experts can increase your chances to Get Featured in Robb Report significantly.

Creating Newsworthy Angles

Even exceptional brands need a timely hook.

You’re more likely to gain editorial attention when you tie your story to:

-

A major product launch

-

A record-breaking achievement

-

A rare collaboration

-

A limited-edition announcement

-

A global luxury event

-

A milestone anniversary

Editors need relevance. A well-timed pitch can make the difference between being ignored and being featured.

Invest in High-End Visual Assets

Robb Report is visually driven. Editorial teams expect exceptional imagery.

Make sure you provide:

-

Editorial-quality photography

-

Lifestyle shots in aspirational environments

-

Detailed craftsmanship close-ups

-

Clean, luxury branding aesthetics

Low-quality visuals are one of the fastest ways to disqualify your brand from consideration.

Developing Relationships with Editors

Cold outreach works—but relationships work better.

Research the editorial team members who cover your category. Read their articles. Understand their tone. Reference specific work in your pitch.

When you approach editors thoughtfully and respectfully, you build long-term credibility—not just a one-time opportunity to Get Featured in Robb Report.

Mistakes to Avoid When Trying to Get Featured in Robb Report

Avoid these common errors:

1. Sending Generic Press Releases

Luxury media expects personalization.

2. Overusing Promotional Language

Editorial content is not advertising.

3. Pitching Non-Exclusive Products

Mass luxury doesn’t fit.

4. Ignoring Brand Presentation

If your website or social presence looks inconsistent, it signals unpreparedness.

5. Expecting Guaranteed Coverage

Editorial placement is earned, not purchased.

Understanding what not to do is just as important as knowing what to do.

How to Leverage the Feature Once You Get Featured in Robb Report

Securing the feature is only the beginning. Strategic amplification maximizes its impact.

Use It Across:

-

Your website press page

-

Investor presentations

-

Sales decks

-

Social media

-

Email marketing campaigns

-

Retail or showroom displays

A respected media mention can become a powerful long-term trust signal when used correctly.

SEO Benefits of Luxury Media Coverage

Beyond prestige, there are measurable digital advantages:

-

Increased domain authority

-

Improved branded search visibility

-

Higher-quality backlinks

-

Referral traffic from affluent readers

-

Enhanced credibility signals for Google

Luxury buyers research before making decisions. Third-party validation influences purchasing behavior significantly.

Becoming Truly Feature-Worthy

The most sustainable way to Get Featured in Robb Report is to focus on building an undeniable brand.

Ask yourself:

-

Are we delivering excellence at the highest level?

-

Are we innovating meaningfully?

-

Is our craftsmanship exceptional?

-

Does our brand feel exclusive?

Luxury media doesn’t chase trends—it highlights leaders.

When your brand consistently demonstrates rare value and world-class quality, editorial coverage becomes a natural outcome of your positioning.

Final Thoughts on Getting Featured in Robb Report

Earning a feature in Robb Report is not about luck or aggressive promotion. It’s about alignment—aligning your brand with the standards, values, and expectations of one of the most respected luxury publications in the world.

If your brand represents the pinnacle of craftsmanship, innovation, and exclusivity, then pursuing luxury media exposure is absolutely worth it.

Build strategically. Present impeccably. Tell compelling stories.

And most importantly—create something truly exceptional.

Because in the world of high luxury, only the extraordinary gets featured.

Hayson Tasher, the United States-based founder and owner of Old Patrolman Guard Services (OLDPGS), has spent years watching the same cycle repeat. “People cheer when minimum wage rises,” he says, “but they fail to realize their bosses’ wages, food, gas, cost-of-living prices, and especially rent will climb right along with it. Shorter work hours become the norm, and rent prices jump so high that workers now need roommates just to survive. In the end they’re stuck in the same position, only worse.” As a hands-on security entrepreneur, Tasher sees this economic reality every day while running armed and unarmed uniformed security officers, alarm response teams, free consultations, and professional investigations.

His own story proves that opportunity is key. Early in his career, Tasher noticed something striking: he already held more licenses, certifications, and permits than the company paying his paycheck. “I had no other choice,” he recalls. “I observed the biggest mistake people in the security field make: working clubs and loss-prevention jobs that will never qualify them to own and operate their own firm. The state simply rejects applications from unlicensed operations. Year after year they waste time while the window closes.”

That realization became the spark for OLDPGS. During a high-level security-detail consultation, a veteran professional who once trained Tasher turned to him for a major client operation and casually called him a “mogul.” At the time Tasher brushed it off, but the label stuck. Today he proudly leads a firm whose tagline is “Security you can count on” and whose mission is “Dedicated to administrating a safe and secure environment.”

What sets Tasher apart from his peers is simple: he never left the field. While many owners sit behind desks, he still personally works and supervises security details on the ground and off. He admires the legacy of the Pinkerton Detective Agency and the original Wells Fargo before it became a bank, brands built on trust, professionalism, and results. OLDPGS follows that tradition but adds modern consultation and management services that clients repeatedly request.

From Field Supervisor to Industry Leader, Seizing Opportunity When Others Stay Stuck

Tasher’s life lesson is blunt and practical: “Reinvest your money into knowledge. Material things don’t get you more money; they take it. More permits and degrees mean more income for you. You can buy the expensive car later.” He urges every security professional to stop waiting and seize the opportunity before another year slips away. “The ones who have had enough will take it and run,” he says.

Looking ahead, Tasher’s vision is bold. He plans to open dedicated security training centers and launch retail locations carrying the OLD PATROLMAN BRAND, tactical boots, uniforms, batons, metal detectors, and more so officers can equip themselves with professional-grade gear under one trusted name. These moves will expand OLDPGS from a service provider to a full-spectrum security solution, strengthening the very industry he has helped professionalize.

Through every challenge, Tasher continues to prove that real security starts with preparation, knowledge, and the courage to act. For businesses and individuals seeking reliable protection, OLDPGS delivers consultation, management, and on-the-ground excellence that clients can count on today and tomorrow.

Business

How to Get Featured in Maxim: The Ultimate Guide to Standing Out and Getting Noticed

Published

5 days agoon

March 2, 2026

For entrepreneurs, models, influencers, and rising public figures, few media milestones feel as exciting as the chance to Get Featured in Maxim. Known for spotlighting trendsetters, innovators, and standout personalities, Maxim has built a reputation for showcasing bold stories and striking visuals that capture attention worldwide.

But landing a feature isn’t about luck. It’s about positioning, branding, and understanding exactly what editors are looking for. In this comprehensive guide, we’ll break down what it really takes, how to prepare, and the strategic moves that can significantly improve your chances.

Why Get Featured in Maxim Is a Game-Changer

Getting highlighted in a globally recognized publication does more than boost your visibility — it transforms your credibility. When you Get Featured in Maxim, you’re not just gaining exposure; you’re earning a powerful stamp of cultural relevance and authority that can elevate your entire brand.

Maxim has long been associated with influential entrepreneurs, celebrities, athletes, and emerging talents. To Get Featured in Maxim signals confidence, relevance, and mainstream appeal. Whether you’re building a personal brand, launching a product, or expanding your modeling portfolio, media validation at this level can:

-

Increase your social proof instantly

-

Strengthen brand partnerships

-

Open doors to higher-paying collaborations

-

Expand your audience internationally

-

Elevate your professional reputation

In today’s digital world, attention is currency. High-profile media placements act as trust accelerators, helping you stand out in a crowded market.

But here’s the key: editors don’t just feature anyone. They look for compelling narratives, not just attractive images or follower counts.

What Editors Look for When You Want to Get Featured in Maxim

Understanding the editorial mindset is crucial. If you want to position yourself effectively, you must think like a storyteller, not just a self-promoter.

Here’s what typically matters most:

1. A Strong Personal Brand

Editors gravitate toward individuals who have a clear identity. What do you stand for? What makes you unique? A scattered or inconsistent online presence weakens your pitch.

Your social media, website, and media kit should communicate:

-

A defined niche

-

Professional imagery

-

Consistent messaging

-

Audience engagement

Authenticity is magnetic. Generic branding is forgettable.

2. A Compelling Story

Publications thrive on narrative. Ask yourself:

-

Have you overcome significant challenges?

-

Are you disrupting an industry?

-

Do you represent a new trend or movement?

-

Do you have a powerful transformation story?

A feature isn’t just about aesthetics — it’s about impact.

3. Professional Visual Assets

High-resolution, editorial-quality photography is non-negotiable. Invest in professional shoots that align with the magazine’s tone: confident, bold, stylish, and visually striking.

Low-quality or overly filtered images can immediately disqualify you.

4. Media-Ready Positioning

If you’ve already been featured in other outlets, launched successful campaigns, or built notable partnerships, highlight those achievements. Media builds momentum — and editors prefer individuals who already show traction.

Proven Strategies to Get Featured in Maxim Without a Publicist

While hiring a PR professional can help, it’s entirely possible to make progress on your own if you’re strategic.

Here are actionable steps you can take:

Build a Newsworthy Angle

Instead of pitching yourself as “an influencer” or “a model,” craft a headline-worthy hook. For example:

-

A fitness coach redefining wellness standards

-

A tech founder reshaping digital privacy

-

A creative entrepreneur merging fashion and sustainability

The more specific your positioning, the stronger your pitch.

Create a Polished Media Kit

Your media kit should include:

-

A professional bio (short and long versions)

-

High-quality headshots and lifestyle images

-

Social media analytics

-

Notable achievements

-

Press mentions (if any)

Keep it visually clean and easy to scan.

Leverage Strategic Networking

Opportunities often come through relationships. Attend industry events, collaborate with photographers who shoot editorial-style content, and connect with creatives who understand magazine aesthetics.

Building genuine connections increases your exposure to decision-makers.

Maintain an Impressive Digital Presence

Editors will research you. Ensure:

-

Your Instagram grid looks cohesive

-

Your LinkedIn reflects professionalism

-

Your website loads quickly and showcases your best work

-

Your content reflects confidence and personality

Your digital footprint should reinforce your credibility at every touchpoint.

Pitch Professionally

When reaching out:

-

Keep your email concise

-

Personalize your message

-

Explain why your story fits their audience

-

Include a direct call-to-action

Avoid mass emails or generic templates. Thoughtful pitches stand out.

Common Mistakes to Avoid When Trying to Get Featured in Maxim

Many aspiring personalities sabotage their own chances without realizing it. Here are the most common pitfalls:

Being Too Generic

If your pitch sounds like everyone else’s, it won’t get attention. Specificity creates intrigue.

Overhyping Without Substance

Confidence is powerful. Exaggeration is not. Editors value credibility over inflated claims.

Ignoring Brand Alignment

Study the magazine’s tone, style, and previous features. Align your positioning accordingly while staying authentic.

Submitting Low-Quality Photos

Even the strongest story can be overshadowed by poor visuals. Invest in quality.

Lack of Patience

Media placement takes time. Rejection doesn’t mean you’re not qualified — it may simply mean the timing isn’t right.

Positioning Yourself for Long-Term Media Success

Rather than viewing this as a one-time goal, think bigger. Becoming media-worthy is about consistent brand building.

Focus on:

-

Growing a loyal audience

-

Creating meaningful content

-

Building industry authority

-

Maintaining professionalism in every interaction

-

Staying culturally relevant

When you develop genuine influence and a compelling narrative, features become a natural progression rather than a distant dream.

The most successful individuals don’t chase attention — they build value that attracts it.

Final Thoughts on How to Get Featured in Maxim

If your goal is to Get Featured in Maxim, approach it strategically, not emotionally. Develop a strong brand identity, craft a compelling story, invest in professional visuals, and position yourself as someone worth talking about.

Media features are earned through preparation, persistence, and clarity of purpose.

Remember: editors are always searching for the next standout personality. With the right positioning and consistent effort, that spotlight could be yours.

Business

How to Get Featured in Marie Claire and Elevate Your Brand Authority

Published

5 days agoon

March 2, 2026

If you’re building a brand in fashion, beauty, wellness, or lifestyle, one goal likely sits high on your vision board: Get Featured in Marie Claire. This globally recognized publication has long been a powerful platform for bold voices, innovative brands, and inspiring entrepreneurs. A feature isn’t just a media win — it’s a credibility badge that can dramatically expand your reach, trust, and revenue.

But landing that spotlight takes more than wishful thinking. It requires strategy, storytelling, and a clear understanding of how top-tier media works. In this guide, we’ll walk through exactly what it takes to make it happen.

Why Get Featured in Marie Claire Is a Game-Changer for Your Brand

When you Get Featured in Marie Claire, you instantly position your brand as an authority. Media coverage signals legitimacy and inspires audience trust.

The benefits are clear:

-

Credibility Boost: Media validation increases consumer confidence.

-

Expanded Reach: Tap into a global audience.

-

SEO Power: High-authority backlinks improve search rankings.

-

Partnership Opportunities: Collaborations and investor interest increase.

-

Sales Growth: Media features often drive traffic spikes and conversions.

Customers are more likely to engage with and purchase from brands recognized by top-tier publications. If your long-term plan includes scaling, speaking opportunities, or product launches, securing a feature in Marie Claire can be transformative.

How to Get Featured in Marie Claire Through Strong Story Angles

Editors aren’t looking for advertisements — they’re looking for stories. If you want media attention, you must think like a journalist.

Ask yourself:

-

What makes your brand culturally relevant?

-

Is there a timely trend you connect with?

-

Does your story challenge norms or introduce innovation?

-

Do you have data, results, or a unique perspective?

Instead of pitching “my new skincare line,” consider reframing it:

-

A sustainability breakthrough in clean beauty.

-

A founder’s story overcoming systemic barriers.

-

A product solving a common but overlooked problem.

The stronger the angle, the easier it is for an editor to envision the article. Publications thrive on narratives that empower, inform, and inspire their audience.

Timing also plays a critical role. Align your pitch with seasonal themes (holiday guides, summer fashion, New Year wellness resets) to increase relevance. Media outlets plan months ahead, so proactive outreach is key.

PR Strategies to Get Featured in Marie Claire Without a Big Budget

You don’t need a six-figure PR retainer to land press — but you do need a clear plan.

1. Build a Media-Ready Brand

Before pitching, ensure:

-

Your website is polished and professional.

-

Your social media reflects consistent branding.

-

You have high-resolution images available.

-

Your bio and brand story are compelling and concise.

Editors often research potential features quickly. If your digital presence feels incomplete, you risk losing the opportunity.

2. Create a Targeted Media List

Not every writer covers every topic. Research contributors who align with your niche. Look at bylines and recent articles to tailor your outreach specifically.

Personalization dramatically increases open and response rates.

3. Craft a Strong Pitch Email

Keep it:

-

Clear

-

Short

-

Focused on value

-

Free of fluff

A strong structure:

-

Engaging subject line

-

Brief introduction

-

Clear story angle

-

Why it matters now

-

Supporting proof (stats, testimonials, milestones)

Avoid attachments unless requested. Include links instead.

4. Leverage Expert Positioning

If you’re a founder or specialist, pitch yourself as a thought leader. Offer insights on trending topics. Media outlets frequently seek expert commentary for roundups and advice articles.

Consistency beats one-off attempts. Follow up politely after 7–10 days if you haven’t received a response.

What Editors Look for When You Want to Get Featured in Marie Claire

Understanding editorial priorities is critical. Editors are balancing audience interest, brand alignment, originality, and timeliness.

Here’s what typically stands out:

Relevance

Does your story connect to current conversations in fashion, culture, beauty, wellness, or social issues?

Authenticity

Audiences crave transparency. Brands with genuine missions resonate more than those chasing trends.

Diversity of Perspective

Unique voices and underrepresented viewpoints often receive strong editorial interest.

Visual Appeal

Strong imagery matters in lifestyle publications. High-quality visuals increase your chances of selection.

Data & Results

Numbers make stories stronger. Growth statistics, survey data, customer impact metrics — these add weight to your pitch.

Editors are constantly filtering hundreds of emails. Make their decision easy by clearly demonstrating why your story belongs in their publication.

Final Steps to Get Featured in Marie Claire Successfully

Once you’ve built your pitch and sent it out, don’t stop there.

Stay Media-Active

-

Write guest articles.

-

Appear on podcasts.

-

Contribute expert quotes to smaller outlets.

-

Build a consistent online presence.

Media momentum compounds. The more you’re featured elsewhere, the stronger your credibility becomes.

Develop Relationships, Not Transactions

Journalists remember sources who are helpful, reliable, and professional. Even if your first pitch doesn’t land, maintaining respectful communication can open future doors.

Engage with writers on social platforms. Share their articles. Provide value without always asking for something in return.

Prepare for the Spotlight

If you secure a feature:

-

Share it across all platforms.

-

Add the media logo to your website.

-

Include it in email marketing.

-

Reference it in sales materials.

Maximize the impact of the exposure. A single feature can fuel months of marketing content.

Common Mistakes to Avoid

If your goal is long-term visibility, steer clear of these pitfalls:

-

Sending generic mass emails.

-

Overhyping without proof.

-

Pitching without researching the publication.

-

Being overly aggressive in follow-ups.

-

Neglecting your online presence.

Professionalism and preparation separate successful pitches from ignored ones.

The Long-Term Mindset Behind Media Success

If you truly want to Get Featured in Marie Claire, think beyond a single pitch. Think in terms of positioning.

Ask yourself:

-

Am I building a brand worth covering?

-

Is my message clear and differentiated?

-

Do I consistently show up as an authority in my niche?

Media recognition is often the byproduct of strategic brand building. When your mission, results, and visibility align, features become a natural next step rather than a distant dream.

Patience also matters. Some brands pitch for months before landing a breakthrough placement. Persistence — combined with refinement — is often the deciding factor.

Conclusion

Choosing to Get Featured in Marie Claire isn’t about chasing vanity press. It’s about elevating your authority, expanding your reach, and positioning your brand at a higher level.

With a compelling story, strategic pitching, strong branding, and consistent visibility efforts, media features become attainable — even without a massive PR budget.

Start by refining your narrative. Build relationships. Pitch with intention. Stay consistent.

Because when preparation meets opportunity, that coveted feature isn’t just possible — it’s powerful.

Business

How to Get Featured in Glamour Magazine and Skyrocket Your Brand

Published

1 week agoon

February 27, 2026

In the ever-competitive world of public relations, standing out is more than just having a great product or service. It’s about visibility, credibility, and influence. One of the most powerful ways to elevate your brand is to Get Featured in Glamour Magazine. Known globally for its impact on fashion, lifestyle, and beauty, Glamour offers a platform that not only reaches millions of readers but also lends unmatched credibility to any brand or individual.

In this blog, we’ll dive into why getting featured matters, how you can achieve it, and actionable strategies to make your PR campaigns truly shine.

Why You Should Strive to Get Featured in Glamour Magazine

Being featured in Glamour is more than just a vanity win. It’s an opportunity to:

-

Boost Credibility: Glamour Magazine has a reputation for curating content that resonates with a sophisticated and engaged audience. A feature signals that your brand or product meets high standards.

-

Expand Reach: With millions of subscribers and a strong online presence, your story can reach new audiences beyond your existing network.

-

Increase Conversions: Readers trust the recommendations of reputable publications. A feature can drive sales, sign-ups, or bookings depending on your industry.

-

Enhance Networking Opportunities: Media exposure often opens doors to collaborations, partnerships, and speaking opportunities.

Simply put, to Get Featured in Glamour Magazine is to position yourself or your brand as an authority in your niche.

How to Strategically Get Featured in Glamour Magazine

Achieving a feature in a top-tier publication requires more than just pitching your story. It requires a calculated PR approach. Here’s how to do it:

1. Craft a Compelling Story

Editors are inundated with pitches daily. To stand out, your story must be unique, relevant, and newsworthy. Ask yourself:

-

Does it solve a problem?

-

Does it inspire or entertain?

-

Does it tie into current trends?

For example, a beauty brand could pitch an article on innovative skincare routines for winter, tapping into the seasonality of reader interest.

2. Identify the Right Contacts

Getting your pitch in front of the right editor is crucial. Research the Glamour editorial team to find contacts relevant to your niche—fashion, beauty, lifestyle, or wellness. Personalization is key; avoid sending mass emails.

3. Craft an Engaging Pitch

Your pitch should be concise, professional, and attention-grabbing. Highlight what makes your story different and why it aligns with Glamour’s audience. Include:

-

A captivating subject line

-

A clear summary of your story idea

-

Supporting visuals or samples (photos, videos, links)

-

Social proof or accolades

4. Leverage PR Agencies or Professionals

If the DIY approach seems daunting, PR agencies with media connections can accelerate the process. They know how to position your story to appeal to Glamour editors and increase the likelihood of a feature.

5. Build a Strong Online Presence

Editors often research brands online before featuring them. A professional website, active social media, and positive press mentions help validate your credibility.

Tips to Maintain Long-Term Media Relationships

Getting featured is just the beginning. Building lasting relationships with media outlets ensures continued exposure:

-

Follow Up Politely: After pitching, a courteous follow-up can make your story stand out without being pushy.

-

Engage on Social Media: Comment, share, and interact with the magazine’s content to build rapport.

-

Provide Exclusive Content: Offer editors first access to new products or stories before public release.

Consistent engagement strengthens your brand’s chances of recurring features, turning a one-time win into a long-term PR strategy.

Case Study: Brands That Successfully Got Featured

Several brands have seen tremendous growth after being featured in Glamour:

-

Beauty Startups: Small beauty brands often report a spike in sales and social media followers after a feature.

-

Lifestyle Influencers: Features have helped lifestyle influencers gain credibility, leading to partnerships with major fashion houses.

-

Health and Wellness Brands: Coverage on trending wellness topics can lead to increased newsletter sign-ups and event invitations.

These examples highlight the tangible impact of a Glamour feature on brand growth and recognition.

SEO Strategies for PR Success

When targeting media features, also consider optimizing your digital presence. Use keywords like “Get Featured in Glamour Magazine” on your website and blog to attract PR professionals and journalists searching for feature opportunities. Create high-quality content around your niche, and link back to press mentions to build domain authority.

Conclusion

To Get Featured in Glamour Magazine is a strategic move that elevates your brand, amplifies visibility, and establishes credibility in your industry. By crafting compelling stories, connecting with the right editors, and leveraging PR strategies, you can secure a feature that has long-lasting benefits.

In today’s crowded media landscape, standing out requires intention, preparation, and persistence. Whether you’re a startup, influencer, or established brand, aiming for a Glamour feature is a powerful way to level up your PR game and make your mark.

FAQ: Get Featured in Glamour Magazine

Q1: How do I pitch to Glamour Magazine?

A: Research the right editor, craft a unique and concise pitch, include visuals, and highlight why your story aligns with Glamour’s audience.

Q2: Is it possible for small brands to get featured?

A: Absolutely. Many startups and small businesses have successfully been featured by focusing on unique, newsworthy stories.

Q3: How long does it take to get a feature?

A: It varies. Some pitches get quick responses within weeks, while others may take months depending on editorial schedules.

Q4: Can PR agencies increase my chances?

A: Yes. Experienced PR professionals have established media contacts and know how to craft pitches that appeal to Glamour editors.

Q5: Should I focus only on Glamour?

A: While Glamour is a top-tier outlet, diversifying your media exposure across related publications can maximize your PR impact.

Business

How to Get Featured in Fashion Magazine: Insider Tips to Boost Your Fashion Career

Published

1 week agoon

February 25, 2026

In today’s competitive fashion industry, getting noticed by top publications can make a huge difference in your career. Whether you are a model, designer, stylist, or influencer, one golden opportunity stands out: get featured in fashion magazine. Appearing in a magazine not only boosts your credibility but also opens doors to collaborations, sponsorships, and global recognition.

In this guide, we’ll explore practical strategies to help you achieve that coveted magazine feature.

Why You Should Aim to Get Featured in Fashion Magazine

Get featured in a fashion magazine is more than just a photo in glossy pages. It is a powerful marketing tool that elevates your personal brand. Here’s why it matters:

- Credibility and Authority: Readers trust magazine features. Being recognized in a reputable publication shows that your work or style is noteworthy.

- Exposure to a Wider Audience: Fashion magazines have loyal readers who look for trends and inspiration. A feature can put you in front of thousands, sometimes millions, of potential clients or followers.

- Networking Opportunities: Editors, photographers, and industry experts often notice magazine features, leading to collaborations and career opportunities.

Steps to Get Featured in Fashion Magazine

Achieving a magazine feature requires more than just talent—it’s about strategy, presentation, and persistence. Follow these steps to increase your chances:

-

Build a Strong Portfolio

A professional and visually appealing portfolio is your first step. Include high-quality photos that highlight your unique style or designs. Remember, magazines are looking for originality and creativity.

-

Research the Right Magazines

Not every magazine aligns with your brand. Identify publications that fit your niche—luxury fashion, streetwear, sustainable designs, or modeling. Understanding their audience will help you pitch more effectively, which is a crucial part of how to get featured in fashion magazine.

-

Craft a Compelling Pitch

Your pitch should grab the editor’s attention in the first few lines. Introduce yourself, showcase your work, and explain why you would be a perfect fit for their magazine. Include links to your portfolio and social media handles.

-

Leverage Social Media

Social platforms are modern portfolios. Showcase your fashion sense, designs, and projects consistently. Tag relevant magazines and interact with their posts to increase visibility. Many editors scout talent online before deciding on features.

-

Collaborate with Photographers and Stylists

High-quality visuals make a significant difference. Work with experienced photographers and stylists to create magazine-worthy images. Professional photoshoots can dramatically improve your chances of being noticed, a critical tip for those wondering how to get featured in fashion magazine.

-

Attend Fashion Events

Fashion shows, exhibitions, and networking events allow you to meet magazine editors and industry professionals in person. Building relationships often opens doors that emails alone cannot.

-

Be Persistent and Patient

Getting a magazine feature doesn’t happen overnight. Keep refining your portfolio, pitching to magazines, and expanding your network. Persistence often pays off more than one perfect opportunity.

Tips to Make Your Feature Stand Out

Even after getting noticed, you want your magazine feature to leave an impact. Here are some tips:

- Tell Your Story: Readers love personal stories and behind-the-scenes insights. Make your feature engaging by sharing your journey or creative process.

- Highlight Your Unique Style: What makes you different from others in the fashion world? Make that the focal point of your feature.

- Promote Your Feature: Share your magazine appearance on social media and your website to maximize exposure and reach a broader audience.

Conclusion

Get featured in a fashion magazine can be a game-changer for your career. By focusing on your portfolio, pitching strategically, networking, and being consistent, you can increase your chances of landing that coveted spot. Remember, fashion is about creativity, confidence, and connection—so embrace your unique style and let it shine.

Start today, follow these steps, and soon you could be turning the pages of a top fashion magazine. Your journey to visibility and recognition begins with one goal: get featured in fashion magazine.

Business

How to Get Featured in Huffington Post: A Complete Guide for Aspiring Writers and Brands

Published

2 weeks agoon

February 24, 2026

In today’s digital age, being featured in a prestigious publication can be a game-changer for your personal brand or business. Among the most influential media outlets, Huffington Post stands out as a platform that can amplify your reach exponentially. But how do you get noticed by their editorial team? In this guide, we’ll explore actionable strategies to help you get featured in Huffington Post while maximizing your online visibility and authority.

Why You Should Aim to Get Featured in Huffington Post

The Huffington Post has built a reputation as a trusted source for news, opinion pieces, and lifestyle content. Being featured here isn’t just about bragging rights—it’s about credibility. When your content appears on HuffPost, it signals to your audience that your insights are valuable, trustworthy, and worth sharing.

Moreover, exposure on a platform with millions of monthly visitors can drive significant traffic to your website or social media channels. Whether you’re an entrepreneur, influencer, or thought leader, this kind of publicity can accelerate growth in ways that other marketing tactics may not.

Understanding the Content That Gets Featured in Huffington Post

Before you even think about pitching, it’s crucial to understand the type of content HuffPost publishes. The publication looks for articles that are:

- Newsworthy – Topics that are timely, relevant, and have a broad appeal.

- Engaging – Stories that captivate readers, spark conversation, or inspire action.

- Authentic – Personal narratives and unique perspectives often outperform generic content.

- Well-Researched – Credible sources, data, and insightful commentary make your submission stronger.

Knowing this helps you craft pitches or articles that align with HuffPost’s editorial standards, improving your chances of getting accepted.

Step-by-Step Guide to Get Featured in Huffington Post

- Identify the Right Section

HuffPost has multiple sections ranging from lifestyle and health to business and politics. Research which section aligns best with your expertise. Tailoring your pitch to a specific editor or section demonstrates that you’ve done your homework and increases your chances of being noticed.

- Build a Strong Online Presence

Editors are more likely to feature contributors who already have a professional online presence. Maintain an active blog, LinkedIn profile, or social media accounts where you showcase your knowledge. This not only demonstrates credibility but also ensures that readers can find and engage with your work beyond HuffPost.

- Craft a Compelling Pitch

When reaching out to HuffPost editors, your pitch should be concise, persuasive, and tailored to the publication’s audience. A strong pitch includes:

- A catchy subject line that grabs attention.

- A clear explanation of your article idea and why it matters.

- A brief background about yourself establishing authority on the topic.

- Links to previous work or relevant articles to showcase your writing style.

Avoid generic or mass emails. Personalized pitches show that you value the editor’s time and understand their readership.

- Leverage Guest Blogging Opportunities

HuffPost previously allowed contributors to register and submit articles directly, but in recent years, the process has become more selective. Partnering with sites that have existing relationships with HuffPost can open doors. High-quality guest posts on reputable sites can attract editor attention and pave the way to get featured in Huffington Post.

- Network with Industry Influencers

Networking is often overlooked but highly effective. Attend conferences, webinars, and industry events where editors or contributors might be present. Engaging meaningfully with professionals in your niche increases your visibility and makes it easier for your pitch to land successfully.

- Optimize Your Content for SEO

Even when your goal is to be featured on a major publication, your content should still be optimized for search engines. Using relevant keywords naturally, structuring your article with subheadings, and including meta descriptions all enhance the discoverability of your piece. Editors appreciate contributors who understand both storytelling and digital marketing.

Common Mistakes to Avoid

While aiming to get featured in Huffington Post, avoid these pitfalls:

- Being too promotional – HuffPost favors informative and insightful content over blatant marketing pitches.

- Ignoring submission guidelines – Each section has specific requirements; ignoring them reduces your chances significantly.

- Sending generic pitches – Editors are busy; a generic message is often deleted without a second glance.

- Neglecting editing – Poor grammar or lack of proofreading can overshadow even the most brilliant idea.

By steering clear of these mistakes, you position yourself as a professional contributor worth the editor’s time.

Benefits Beyond Publication

Getting published on HuffPost isn’t just a one-time win. The exposure brings long-term benefits:

- Increased credibility – Your name becomes associated with a leading media outlet.

- Higher search rankings – Backlinks from HuffPost can improve your website’s SEO.

- Networking opportunities – Connections with other writers, editors, and influencers in your field.

- Business growth – More visibility can lead to collaborations, partnerships, and client inquiries.

These advantages make the effort to get featured in Huffington Post more than worthwhile.

Final Thoughts: How to Get Featured in Huffington Post & Boost Your Reach

The journey to being featured in HuffPost is competitive but achievable. By understanding the editorial focus, crafting a compelling pitch, maintaining a professional online presence, and leveraging networking opportunities, you significantly improve your chances. Remember, persistence matters—rejection is not a failure but a learning step toward eventual success.

Publishing on HuffPost can transform your visibility and authority in your niche. Every well-prepared pitch, insightful article, or thoughtful connection brings you closer to achieving that coveted feature. With dedication, strategy, and a clear understanding of what editors are looking for, your story could soon reach millions of readers around the globe.

Your journey starts today—refine your pitch, polish your content, and take the steps necessary to get featured in Huffington Post. The opportunity to amplify your voice and grow your influence is within reach.

Business

Stop Building Features. Start Building Infrastructure.

Published

2 weeks agoon

February 24, 2026

Most founders build features.

The best founders build infrastructure.

Before Banu, we were operators. Our team closed over $600M in commercial real estate transactions and financed more than $100M in deals. We weren’t trying to build software.

We were trying to fix our workflow.

The real bottleneck wasn’t capital.

It wasn’t underwriting.

It wasn’t a competition.

It was reach.

Outbound Determines Growth

Modern sales stacks exploded into dozens of tools:

- Data vendors.

- CRMs.

- Email platforms.

- SMS systems.

- Dialers.

- AI add-ons.

Feature inflation created fragmentation.

Fragmentation created inefficiency.

Inefficiency created revenue drag.

So instead of building another feature, we built infrastructure.

Banu combines:

- 185M+ verified contact records

- Nationwide property and business owner data

- Built-in CRM

- Integrated email, SMS, phone, and direct mail

- Unified automation engine

- Zero integrations required

This is not a lead tool.

It is a system of record for outbound.

The Bigger Opportunity

More than 5 million professionals across real estate, mortgage, insurance, and financial services rely on outbound to survive and grow.

If you increase productivity per professional even marginally, the economic impact is enormous.

Infrastructure scales.

Fragmentation stalls.

When you consolidate the stack, you don’t just simplify the workflow.

You increase velocity.

Velocity compounds into revenue.

Revenue compounds into leverage.

The companies that win the next decade won’t build more tools.

They’ll rebuild the foundation.

Banu is free to try at www.banu.ai.

Business

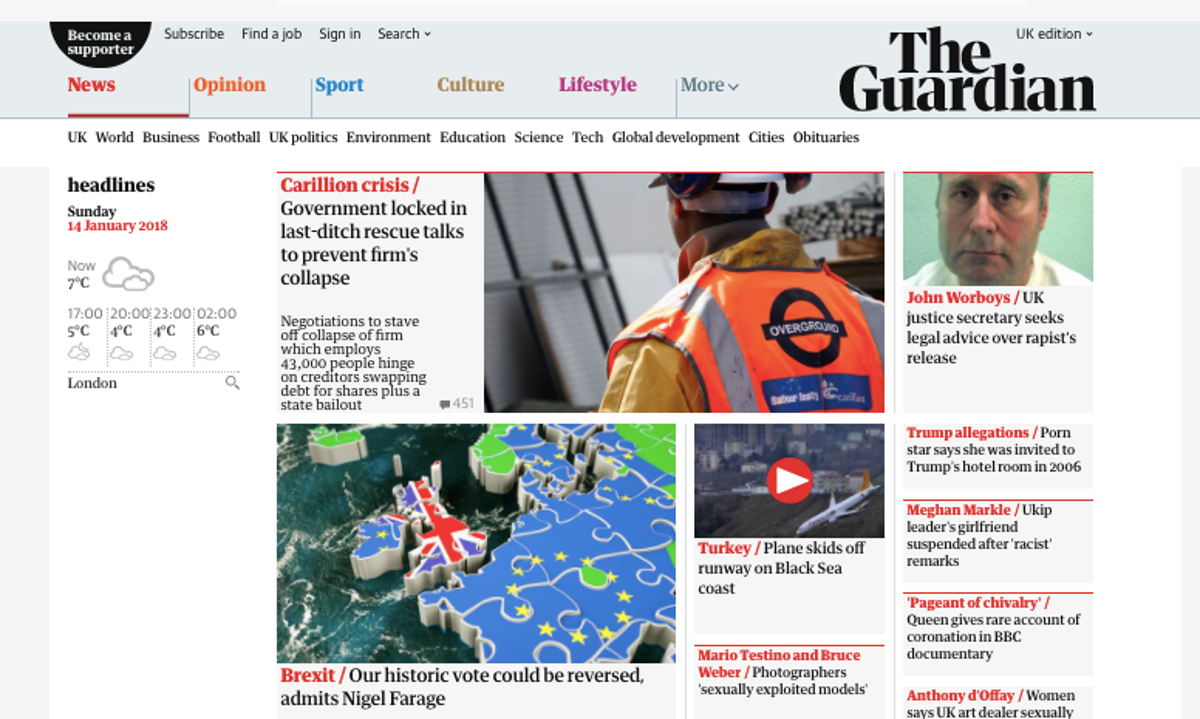

How to Get Featured in The Guardian: A Practical Guide to Earning National Media Coverage

Published

2 weeks agoon

February 23, 2026

If you’re an entrepreneur, founder, author, or marketing professional, you’ve probably wondered how to Get Featured in The Guardian and other top-tier publications. National media coverage isn’t just about vanity—it builds credibility, drives traffic, attracts partnerships, and positions you as a trusted authority in your industry.

But landing coverage in a globally respected newspaper doesn’t happen by accident. It requires strategy, timing, and a strong understanding of what journalists actually want. In this guide, you’ll learn actionable steps you can take to dramatically improve your chances of securing meaningful press coverage.

Why Get Featured in The Guardian Matters for Your Brand

Securing a feature in a major publication instantly elevates your reputation. When you get quoted or profiled in a respected outlet, your audience perceives you differently. You’re no longer just promoting yourself—you’ve been validated by an independent and credible source.

Here’s why media coverage at this level is so powerful:

- Instant Credibility and Authority

Being associated with a trusted newspaper enhances your brand image overnight. Potential clients, investors, and partners are more likely to take you seriously.

- High-Quality Traffic

Online articles can drive thousands of readers to your website. Unlike paid ads, this traffic often converts better because it comes from trust-based exposure.

- Long-Term SEO Benefits

Media backlinks from authoritative domains significantly improve your search engine rankings. Over time, this strengthens your overall digital presence.

- Social Proof That Compounds

Once you’ve been featured, you can showcase it on your website, social media, sales pages, and email signatures—amplifying its impact for years.

When done strategically, the decision to pursue media coverage becomes a long-term brand investment, not just a publicity stunt.

Proven Strategies to Get Featured in The Guardian

If you want to Get Featured in The Guardian, you need more than a good product or service. Journalists are not looking for advertisements—they’re looking for compelling stories that resonate with their readers.

Here are proven strategies that increase your chances of success:

- Develop a Strong News Angle

Reporters care about what’s new, relevant, or timely. Ask yourself:

- Is there a trend you’re tapping into?

- Do you have data or research that supports a bigger narrative?

- Are you responding to a current issue or public debate?

A strong angle connects your expertise to a broader social, economic, or cultural conversation.

- Understand the Right Section

Before pitching, research where your story fits. Is it business, technology, lifestyle, opinion, or environment? Study recent articles in that section and look at:

- Writing tone

- Story structure

- Types of sources quoted

- Headline style

If you want to Get Featured in The Guardian, your pitch must feel like a natural extension of content they already publish.

- Craft a Personalized Pitch

Avoid mass emails. Journalists can spot generic pitches immediately.

A strong pitch should include:

- A compelling subject line

- A concise explanation of why the story matters now

- Supporting data or unique insights

- A short bio establishing credibility

Keep it clear and direct. Long-winded emails often get ignored.

- Offer Real Value, Not Promotion

One of the biggest mistakes people make is pitching themselves instead of pitching a story. Your goal is not to sell—it’s to inform, educate, or inspire readers.

Provide:

- Original research

- Contrarian viewpoints

- Expert commentary

- Case studies or personal experiences

Journalists are more likely to respond when they see genuine value for their audience.

- Build Relationships Before You Pitch

Engage with journalists on social media. Share their articles. Leave thoughtful comments. Show that you understand their work.

Relationship-building increases familiarity, and familiarity increases response rates.

Common Mistakes to Avoid When Trying to Get Featured in The Guardian

Even highly successful professionals struggle with media outreach because they make avoidable errors. If you’re serious about your PR strategy, watch out for these pitfalls.

- Making It All About You

Editors are focused on readers. If your pitch centers solely on your achievements, it’s unlikely to gain traction. Shift the narrative from “Look at me” to “Here’s why this matters.”

- Ignoring Timing

Timing can make or break your story. A pitch tied to a trending topic or current event has a much higher chance of being accepted.

For example, launching a sustainability initiative is more compelling if it aligns with global climate discussions or policy updates.

- Sending Attachments Without Context

Never attach large files without explanation. Instead, summarize your story in the email and offer additional materials upon request.

- Giving Up Too Soon

Media outreach is a numbers game. One rejection doesn’t mean your story isn’t strong. Sometimes it’s about timing, editorial calendars, or competing priorities.

Persistence—without being pushy—is key.

Long-Term Benefits When You Get Featured in The Guardian

The real power of media coverage unfolds over time. When you successfully Get Featured in The Guardian, the impact extends far beyond the initial publication date.

- Speaking Opportunities

Event organizers and conference hosts often look for speakers who have credible media exposure. A feature can open doors to keynote invitations and panel discussions.

- Partnership Requests

Brands prefer collaborating with businesses that have established authority. Media recognition signals trustworthiness and influence.

- Increased Investor Confidence

For startups, press coverage can improve investor perception. It demonstrates traction, relevance, and public interest.

- Enhanced Personal Brand

Whether you’re a founder or a thought leader, being featured strengthens your positioning. It separates you from competitors and builds long-term recognition.

Over time, one strong feature can lead to additional coverage in other publications, creating a ripple effect across your industry.

How to Strengthen Your Chances Even Further

While pitching directly can work, you can also improve your success rate through:

- Hiring a PR professional with media connections

- Publishing high-quality thought leadership on your own platform

- Building a strong LinkedIn presence

- Creating original research reports journalists can reference

Consistency matters. Media visibility is often the result of sustained effort rather than a single email.

Additionally, make sure your website and social channels are polished before pitching. If a journalist researches you, your digital presence should reinforce your credibility.

Final Thoughts: Turning Media Coverage into Momentum

Many professionals dream of national press coverage, but only a few approach it strategically. If your goal is to Get Featured in The Guardian, focus on delivering timely, relevant, and reader-centered stories rather than self-promotion.

Remember:

- Lead with value.

- Support your pitch with data.

- Personalize every outreach effort.

- Be patient and persistent.

Media success is rarely instant—but when it happens, it can transform your brand authority, search visibility, and growth trajectory.

Start by refining your story today. With the right angle and approach, your next email pitch could be the one that earns you a powerful and career-defining feature.

Trending

-

Health5 years ago

Health5 years agoEva Savagiou Finally Breaks Her Silence About Online Bullying On TikTok

-

Health4 years ago

Health4 years agoTraumatone Returns With A New EP – Hereafter

-

Health4 years ago

Health4 years agoTop 5 Influencers Accounts To Watch In 2022

-

Fashion5 years ago

Fashion5 years agoThe Tattoo Heretic: Kirby van Beek’s Idea Of Shadow And Bone

-

Fashion5 years ago

Fashion5 years agoNatalie Schramboeck – Influencing People Through A Cultural Touch

-

Fashion9 years ago

Fashion9 years ago9 Celebrities who have spoken out about being photoshopped

-

Health5 years ago

Health5 years agoBrooke Casey Inspiring People Through Her Message With Music

-

Health5 years ago

Health5 years agoTop 12 Rising Artists To Watch In 2021

-

Health5 years ago

Health5 years agoMadison Morton Is Swooning The World Through Her Soul-stirring Music

-

Health4 years ago

Health4 years agoTop 10 Influencers To Follow This 2021